NOTE: This page is ordered from most recent to oldest update regarding the budget. It will be updated after each step in the Capital Budget development process has been completed.

November 7, 2024 – Special council meeting for 2025 Capital Budget

October 7, 2024 to November 4, 2024 – Survey #2 – 2025 Draft Capital Budget

Survey available here: surveymonkey.com/r/GTH625N

The Draft 2025 Capital Budget and 10-Year Capital Plan is now available to view and we want your feedback! The capital budget is the City’s plan for making large investments in infrastructure and services and the 10-year plan provides a roadmap for capital projects and investments in the long-term. Have your say, take the survey today!

surveymonkey.com/r/GTH625N

Or submit your comments on the 2025 Draft Budget Comment Card or budget process or to [email protected].

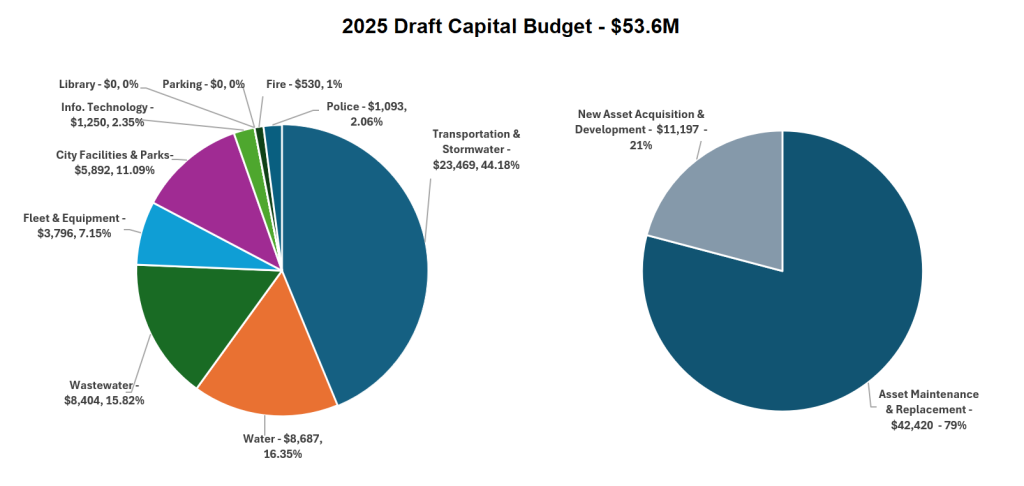

Draft Capital Budget

The 2025 Draft Capital Budget proposes $53.6M ($72M in 2024 and $60M in 2023):

It prioritizes high risk and growth-related assets and alternative funding (not tax levy or user rates) to bridge the infrastructure gap as noted in the 2022 Asset Management Plan, including the replenishment and growth of its asset management reserve funds.

Project highlights

- Police

- $1.1M ($993.6K in 2024, 1.3M in 2023)

- Facilities & parks

- $1.25M for Meyers Pier Remediation (Medium-Term)

- $300K for Security Cameras

- $150k for Victoria Harbour Security Gates

- $1.65M for Quinte Sports and Wellness Center Annual Asset Renewal

- Information Technology

- $250K for Network and Server Upgrades

- $250K for End User Device (Desktop and Laptop) Replacement Program

- $350K for Human Resource Information System (HRIS)

- $500K for Asset Management Software – Enhancement

- Bridges

- $4M for Upper Bridge Rehabilitation (arched bridge over the Moira River at the north end of the downtown)

- $2M for McWilliams Bridge (Blessington Road) Replacement – Construction

- Roads

- $5M for Bridge St East – Herchimer to Haig – Phase 1 (Herchimer to Farley)

- $5.5M for Octavia St. & Henry St. – Sewer Separation – Construction

- $480K for Bell Blvd – Replacement of Concrete Section

- Sidewalk

- $550K for Ashley Street Sidewalk – Ducette Road to Foxboro Public School – Construction

- Trails

- $1M for Multi-Use Trail – Hydro Corridor – Construction – Phase 1 from Sidney St to Moira River – within the Hydro One transmission corridor (running south of and parallel to Bell Boulevard) between West Riverside Park and Sidney Street. This path would provide an east / west cycling route south of Bell Boulevard between West Riverside Park and Sidney Street connecting to other cycling routes such as the North Park St bike lanes, multiuse path adjacent to Georges Vanier School (on Tracey St), the path at Lemoine St., and the multi-use path completed as part of the Sidney St Corridor Improvement project in 2021

- Equipment

- ~$2.5M for truck, snow blower, asphalt roller, sidewalk machine and trailer replacements

- $525K for Six (6) New Hybrid Electric Vehicles for Building Inspectors

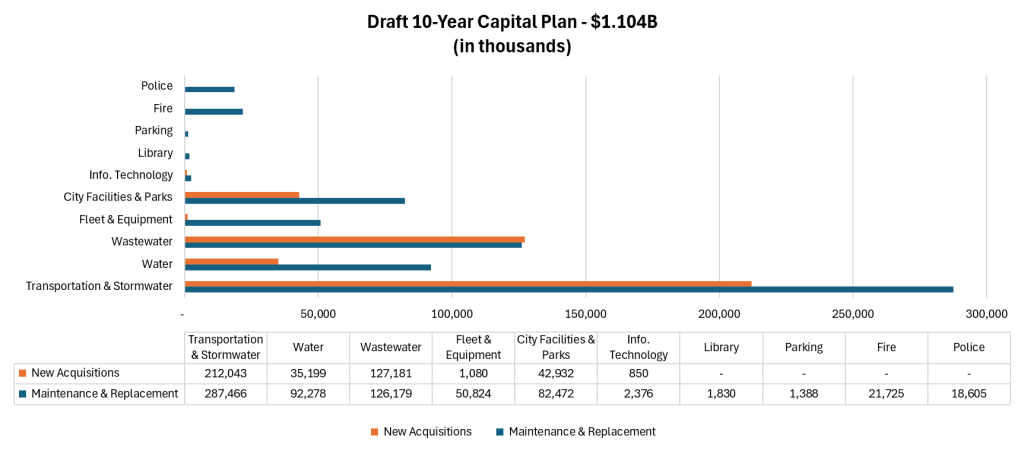

10 Year Capital Plan

Survey questions

Which tax billing area do you live in?

- Belleville Urban

- Belleville Rural

- Cannifton Urban

- Cannifton Rural

While considering the [below]-noted guidelines, are you generally satisfied with the projects included in the draft 2025 Capital Budget?

- Yes

- No

In your opinion, are there any service areas that you think require general immediate attention but may not be appropriately reflected in this budget?

- Police

- Transportation & Stormwater

- Water

- Wastewater

- Fleet & Equipment

- City Facilities & Parks

- Information Technology

- Library

- Parking

- Fire

- Other

Based on the projects listed in the 10-Year Capital Plan, are you generally satisfied with the projects and/or service areas included?

Are there any specific topics surrounding the City’s Capital Budget or 10-Year Capital Plan processes that you wish you had more information and background on?

Yes – all of them. As evidenced by the 10-Year Capital Plan, many projects stretch on for many years.

For example, plans for the West Hill Greenspace on the former Queen Mary School property are underway in 2024 and there is projected funding of $5.7M in 2032, but no details are provided in the 10 Year Capital Plan document as to what that would be for.

Few residents have the time to read through all the AMP, Master Plans, staff reports and council minutes to come to an full understanding and determine for themselves whether or not the the spending outlined in the budget aligns with City policies and past findings of staff/council/consultants.

Those who do may not be able to find all the relevant, recent documentation – since there is no central repository for these documents where you can easily track how a particular project you’re interested developed over time.

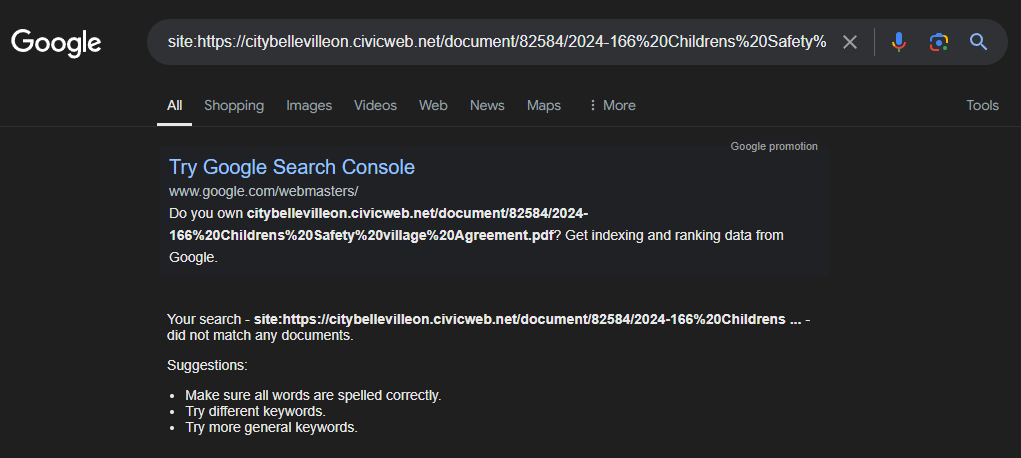

What about the CivicWeb portal? The portal and documents within are not SEO-friendly (search engines cannot access many of the documents) – so residents cannot find source documents where they would go to look for them: Google.

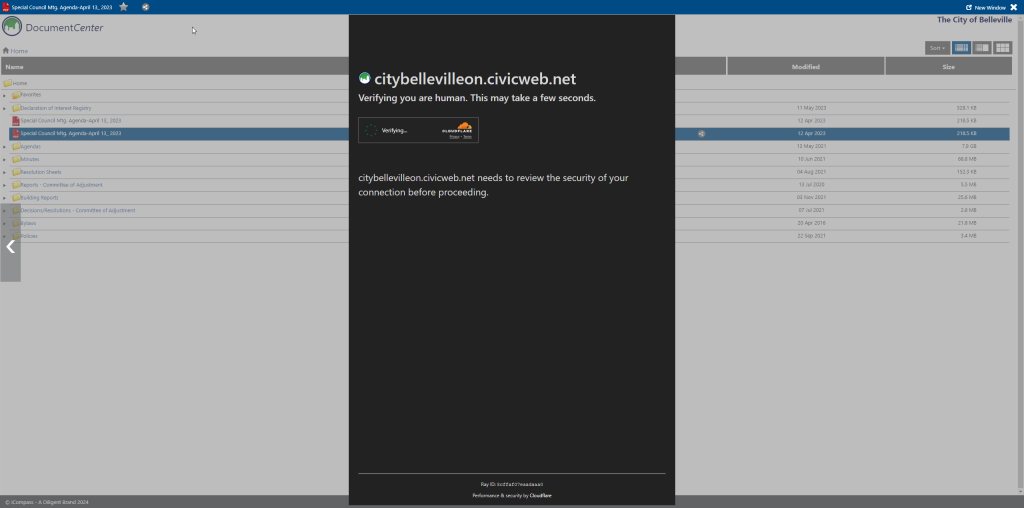

In addition, the software uses Cloudflare anti-bot protection to prevent bots from reading the files:

Currently, interested residents have to piece together an understanding of a project – often relying on limited coverage by local media.

In addition, the City’s document management/naming conventions aren’t consistent and documents are frequently moved, making them inaccessible.

For example, Belleville’s Transit Master Plan was posted to the City’s website and was available (shown on the Internet Archive) at the following web address on February 8, 2024:

https://www.belleville.ca/en/walk-ride-and-drive/resources/Transit/Transit-Master-Plan—Master.pdf

Checking that same web address later in the year (October 2024), the file is no longer accessible, with the website giving the reason:

This is most likely because we’ve launched our new website. Please try the search box below to find the information you are looking for, or go to our home page.

This file being inaccessible has nothing to do with the new website, which was launched back in August 2020. Instead, it has to do with files being moved around on the website’s back end by staff to directories that are not accessible to the public. Many links were recently broken by changes to the PDF handling requirements of the Web Accessibility Policy, but this was happening before that policy was implemented.

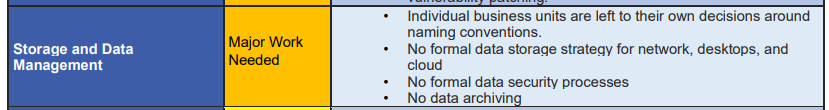

This poor document handling was classified as “Major Work Needed” in the Information Technology Service Review and Master Plan:

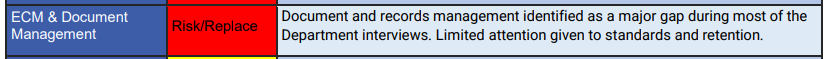

And limited attention is given to document standards and retention:

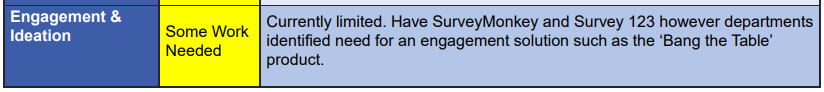

A civic engagement software such as Engagement HQ would help residents follow along and engage with these big projects, provide more timely and specific feedback to the city (these surveys are great, but only happen annually) and see the “whole picture”/vision for the City. This was recommended in the Information Technology Service Review and Master Plan:

Many other municipalities of varying sizes use online engagement software to engage their residents and make relevant documentation accessible. The software is not cost-prohibitive, ranging from $15,000 to $30,000 per year and Belleville staff have identified that such software would help them in their work (ie. not likely to create more work for them).

The City recently completed an update to its Asset Management Plan which identifies the annual capital investments required to maintain levels of service. In your opinion, how would you prioritize the following aspects of City services tied to capital infrastructure (rank from high to low):

- Services have enough capacity to support demand

- Services are reliable and responsive

- Services are inclusive and equitable

- Services are sustainable and mitigate climate impacts

- Services are affordable

The Asset Management Plan outlined the City’s overall levels of service tied to infrastructure. Please indicate whether you feel the level of service related to the infrastructure and investments of each area should be increased, maintained or decreased:

- City Facilities (e.g. community centres, arenas, pool, library, harbours, parks)

- Police (e.g. police fleet, facilities, equipment)

- Fire (e.g. fire fleet, facilities, equipment)

- Transportation & Stormwater (e.g. maintenance and general upkeep of roads, bridges & culverts, sidewalks, and stormwater, replacement of transit buses & shelters)

- Water (e.g. water meters, water treatment, distribution infrastructure)

- Wastewater (e.g. sanitary manholes, wastewater treatment, collection)

- Parking (e.g. parking lots, parking meters, lighting)

- Information Technology (e.g. security cameras)

- Library (e.g. facility, equipment)

- Fleet & Equipment (e.g. snow plows, trucks)

Please indicate how you feel the City should prioritize these actions to manage the current infrastructure gap (rank from high to low):

The City is facing a current infrastructure gap of nearly $40 million per year. This means that the annual capital investment required to maintain current levels of service exceeds what the City typically spends. Municipalities typically take three actions as a way of managing this gap:

- Increase Funding (e.g. increased tax rates and/or user fees)

- Accepting Increased Risk (e.g. conduct less frequent inspections or maintenance of less critical assets)

- Accepting Lower Level of Service (e.g. deferral of lower priority projects)

Council approves guidelines prioritizing high risk and growth-related capital projects

Staff shall prioritize capital renewal projects that are identified as high risk (i.e. high consequence and probability of asset failure) in the City’s Asset Management Plan, and that in the case of funding constraints, staff collectively defer capital projects that have a lower risk and prioritization score, and that where these scores are equal, priority be given to core infrastructure assets.

Growth-related capital projects be prioritized in line with the Asset Management Plan and approved master planning documents. Prioritization will also consider availability of alternative funding outside of the tax levy or user rates (e.g. development charges), the tax and user rate return on investment, alignment with the City’s Strategic Plan and Departmental Operating Plans.

Staff bring forth a proposed increase in contribution to reserve funds for capital projects in the 2025 draft operating budget that aligns with the financial strategy and recommendations outlined in the Asset Management Plan.

The development of the 10-Year Capital Plan considers and reports on all relevant asset data and decision-making inputs, such as condition and risk, as outlined in the Asset Management Plan.

June 12, 2024 – 2025 Preliminary Capital Budget Survey Results

The survey was available for roughly three weeks from May 14th to June 5th with a total of 781 responses received. The “2025 Preliminary Survey Results Report” highlighting the survey’s results are attached, with some high-level observations noted below.

The purpose of the survey was to obtain feedback regarding Capital and Operating spending priorities and overall approach to budget development. These results will be presented to the Finance Committee and Council to assist with the establishment of budgetary guidelines.

Majority of respondents were either homeowners (80%) or tenants (15%) living within the Belleville Urban boundary (66% of the total responses). Much better balance of responses received in terms of age group and household income.

Service levels

Majority (42%) in favor of maintaining taxes, even if it means reducing some discretionary tax-funded services. There was a relatively equal split between “increase taxes to an extent that maintains tax-funded services” and “decrease taxes by reducing discretionary tax-funded services” at 22% and 26%, respectively.

Majority of residents would like to see services maintained at existing levels.

Increased levels of service: Doctor Recruitment (58%), Long-Term Care (34%), and Road and Sidewalk Maintenance (34%).

Decreased levels of service: Heritage, Museums and Cultural Events (37%), Parking (30%), and Community Events (29%).

User Fees

Participants were asked whether they would be in favor of user fees increases, and if so, which specific fees they would support increases to. While over 17% of the responses did not support increases to any of the user fees, respondents were fairly supportive of increasing most fees, with the exception of Bag Tags. Apart from Bag Tags and Transit Fares, which received just slightly less support, potential increases to other user fees, including Dog Tags, Pools, Sports Fields and Recreation Programs, were supported by over 45% of respondents. Arenas and Museum Services were the most supported areas, receiving support from over 55% of respondents.

Key Performance Indicators (KPI)

KPIs were most relevant and beneficial for tracking performance: Efficiency and Community Impact, with a desired focus on Finance.

Asset Prioritization

Top 3 respondent priorities for capital spending: Transportation (roads) (67%), Water (61%) and Wastewater (50%).

May 14, 2024 – Survey #1 – 2025 Preliminary Capital & Operating Budget Survey

Purpose: engage stakeholders in the early stages of the budget process and allow them to provide their feedback on operational and capital spending priorities, as well as the overall approach to budget development. The results of the survey will be presented to the Finance Committee and Council to assist with the development of guidelines for budget preparation later this year.

1. Do you live and/or own a business in Belleville?

- I am a homeowner

- I am a business owner

- I am a tenant

- One or more of the above

- None of the above (please specify)

2. What is your tax billing area?

- Belleville Urban

- Belleville Rural

- Cannifton Urban

- Cannifton Rural

3. How old are you?

- 18-24

- 25-34

- 35-44

- 45-54

- 55-64

- 65+

- Prefer not to answer

4. What is your annual gross household income?

- Less than $50,000

- $50,000 to $100,000

- $100,000 to $150,000

- $150,000 to $250,000

- $250,000+

- Prefer not to answer

5. How familiar are you with how the City develops the annual Capital and Operating Budgets?

- Very familiar

- Somewhat familiar

- Not at all familiar

6. Due to the increased cost of maintaining service levels and supporting infrastructure, the City must balance property taxes with increasing demand for services. The City has a number of options when balancing the budget. Please indicate which of the following statements comes close to capturing your point of view:

- Increase taxes to an extent that maintains tax-funded services.

- Maintain taxes, even if it means reducing some discretionary tax-funded services.

- Decrease taxes by reducing discretionary tax-funded services.

- Increase taxes to expand and/or enhance tax-funded services.

7. For each of services listed below that are directly or indirectly provided by the City, please indicate whether the level of service should be increased, maintained, or decreased.

- Building, planning, and development

- Bylaw enforcement

- Community Events

- Doctor Recruitment

- Economic development

- Firefighting and fire prevention

- Greenspaces (parks and playgrounds, sports fields)

- Heritage, museums, and cultural events

- Information technology

- Library services

- Long-term care (externally contracted)

- Parking

- Policing

- Public transit

- Recreation (arenas, camps, aquatics, fitness)

- Road and sidewalk maintenance

- Social Housing (externally contracted)

- Stormwater management

- Traffic and pedestrian safety (streetlights and signs)

- Winter maintenance (snowplowing, sanding, and salting)

- Waste and recycling collection (externally contracted)

- Water and wastewater services

8. The following services are partially funded user fees.

Please identify which service(s) you would support an increase in user fees to reduce reliance on property taxes (select all that apply)

- Arenas

- Museum & Culture Services

- Recreation Programs

- Pools

- Sports Fields

- Transit (only applicable to Belleville Urban tax billing area)

- Garbage Bag Tags

- Dog Tags/Licenses/Permits

- None of the above

9. The City prepares Annual Departmental Plans each year in conjunction with the Operating budget process.

This document provides a comprehensive overview of past accomplishments, strategic objectives, operational goals, key initiatives, and budget projections for the upcoming year: City of Belleville 2024 Departmental Plans.

For the development of the 2025 Departmental Plans, staff and Council will be developing key performance indicators to be included in these plans.

Please select the types of performance metrics and departmental areas you believe are most relevant and beneficial for tracking performance. (select all that apply)

- Finance

- Fire Services

- Corporate Services

- Human Resources

- Engineering & Development Services

- Transportation & Operations Services

- Community Services

- Environmental Services

- Information Technology

- Economic Development

- Efficiency – expresses the resources used in relation to the number of units of service provided or delivered. Typically, this is expressed in terms of cost per unit of service.

- Customer services – expresses the quality of service delivered relative to service standards or the customer’s needs and expectations.

- Community impact – expresses the outcome, impact, or benefit that the City program has on the community in relation to the intended purpose or societal outcomes expected.

- Activity level – provides an indication of service/activity levels by the number of resources or the volumes of service delivered to ratepayers. Results are often expressed on a common basis, such as, the number of units of service provided per capita.

- Other (please specify)

10. The Capital Budget is the City’s plan for making large investments in infrastructure. Capital expenses include major maintenance to public buildings, construction or purchase of new buildings, purchase of major equipment, significant road resurfacing projects, water and wastewater infrastructure, and more.

In your opinion, how would you rank the following areas of the City’s capital investment?

- Adding to or expanding existing infrastructure to enhance levels of service (e.g., adding a new recreation facility or splash pad to serve existing ratepayers)

- Renewing assets that support existing levels of service (e.g., rehabilitating or reconstructing a road).

- Improving the responsiveness of City services (e.g., improving response time of ratepayer complaints regarding infrastructure).

- Facilitating residential and non-residential growth (e.g., acquiring a new snowplow to service new subdivisions that would generate tax revenue).

- Investing in other key priorities as outlined in the City’s Strategic Plan (e.g., reducing climate change impacts).

11. In accordance with the Asset Management Plan, the City must prioritize Capital projects to develop its 10-year capital plan. In your opinion, select the most important infrastructure areas.

- Transportation (e.g., roads, streetlights, bridges)

- Water (e.g., treatment plant, water pipes)

- Wastewater (e.g., treatment plant, wastewater pipes)

- Stormwater (e.g., culverts, stormwater manholes)

- City Facilities (e.g., community & recreation centres, City Hall)

- Parks (e.g., playgrounds)Fire (e.g., firetrucks, fire stations)

- Police (e.g., patrol vehicles, police station)

- Fleet & Equipment (e.g., snowplows, lawnmowers)

- Information Technology (e.g., servers, computer equipment)

- Library (i.e., facility, books)Parking (i.e., parking lots, meters)

12. Would you like to sign up to receive ongoing updates on the City’s budget?

- Yes

- No

May 13th, 2024 – 2025 Capital & Operating Budget timeline and Public Engagement Communication Plan

Leave a comment

All comments are reviewed prior to appearing on the site.

Rules: