Note: This page is in reverse chronological order – from most recent to oldest update regarding the budget. It will be updated after each step in the Operating Budget development process has been completed.

Operating issues progress reports and overages

April 15, 2024 – 2024 Property Tax Bylaw, Municipal Estimates and Property Tax Levy

February 28, 2024 – approved 2024 operating budget

February 27, 2024 – 2024 Tax Rates – Taxpayer Impact Analysis

| Area | Increase over 2023 |

|---|---|

| Belleville Urban | 5.78% |

| Cannifton Urban | 5.70% |

| Cannifton Rural | 4.91% |

| Belleville Rural | 4.16% |

Funding increases

- Police: 10.87%

- Social services: 7%

- Social housing: 7%

- Library: 3.9%

| Service Category | Actual | Proposed |

|---|---|---|

| General Government | -13.84% | -39.69% |

| Contribution to Capital Projects | 16.79% | 16.79% |

| Planning, Development and Engineering | 13.15% | 12.54% |

| Environmental Services | -2.91% | -2.91% |

| Transportation & Operational Services | 8.21% | 8.21% |

| Protective Services | 10.79% | 10.79% |

| Recreation & Cultural | 11.74% | 11.74% |

| Health Services | 6.75% | 6.75% |

| Social & Family Services | 17.22% | 7.30% |

New projects

- D2-13 The Bridge – $1M for renovations and $2M to get services up and running

- D2-2 Quinte Air Show: $25,000 to Bay of Quinte Regional Marketing Board funded by MAT

- D8-2 Removal of BDIA Welcoming Streets Program and Addition of downtown overnight security costs

- Cannifton Development Strategy (Land Use and Servicing Rationale/OP Update): $500,000

- D6-7 Lighting Display Drone Show – annualization of the Lighting Display opening ceremony drone show. Funded annually from MAT

February 27, 2024 – Draft operating budget meeting & discussions

Minutes

Meeting – Part 2

Presentation

Meeting – Part 1

Agenda and external municipal board budget submissions

February 1, 2024 – Draft operating budget

I would like to thank staff for putting together a fair and balanced budget that recognizes both the need for increased service levels and the impact on taxpayers,

Belleville City Council recognizes the critical juncture we are at as a community. We feel that this budget provides the most balanced approach possible. I would like to applaud staff on their great work on this year’s budget and thank everyone who provided their input throughout the process.

Mayor Neil Ellis

Proposed departmental changes

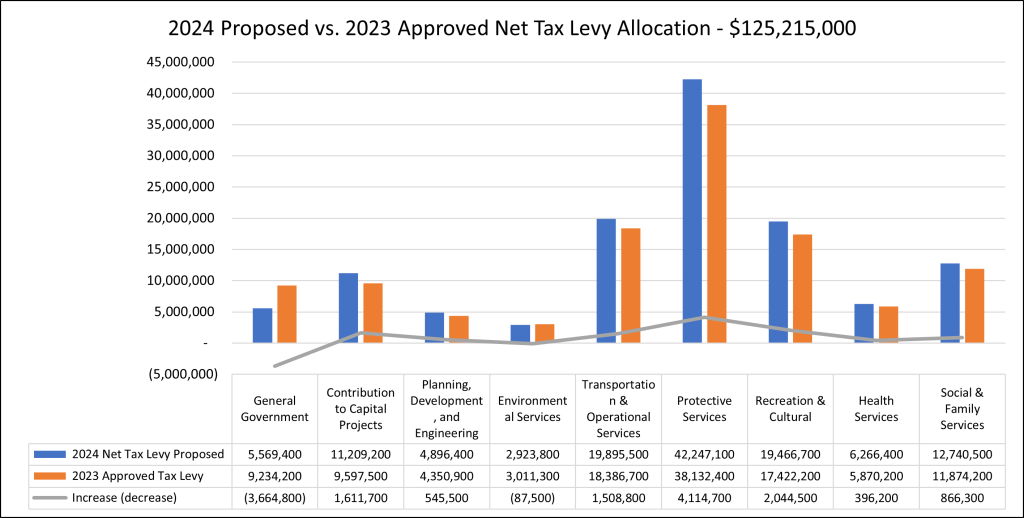

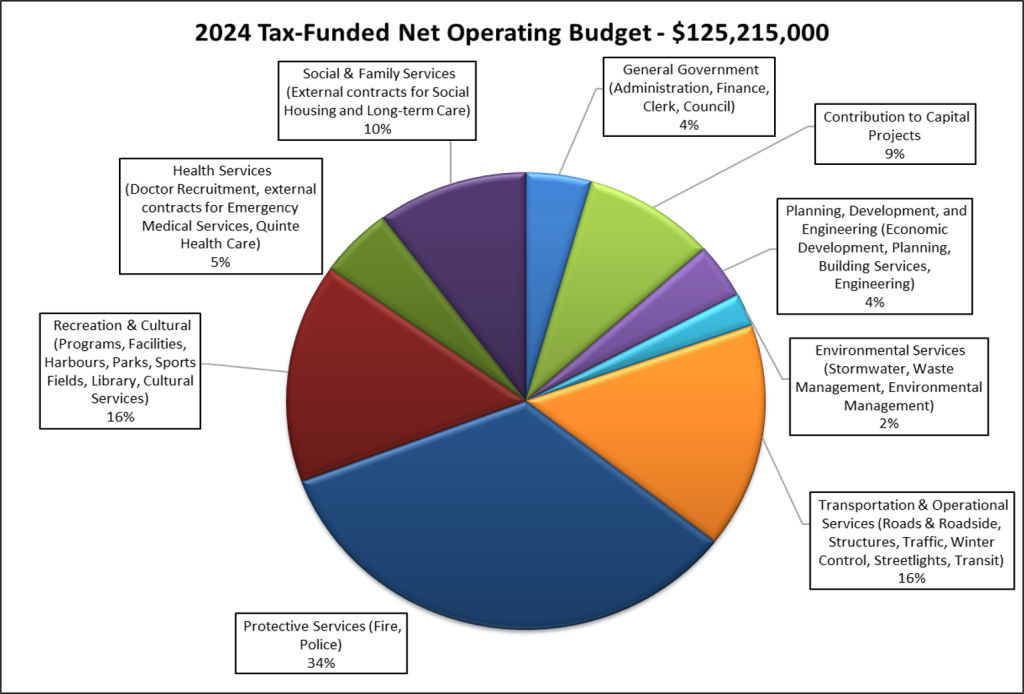

Where your property taxes will go, when compared to 2023:

| Service Category | Percentage change |

|---|---|

| General Government | -39.69% |

| Contribution to Capital Projects | 16.79% |

| Planning, Development and Engineering | 12.54% |

| Environmental Services | -2.91% |

| Transportation & Operational Services | 8.21% |

| Protective Services | 10.79% |

| Recreation & Cultural | 11.74% |

| Health Services | 6.75% |

| Social & Family Services | 7.30% |

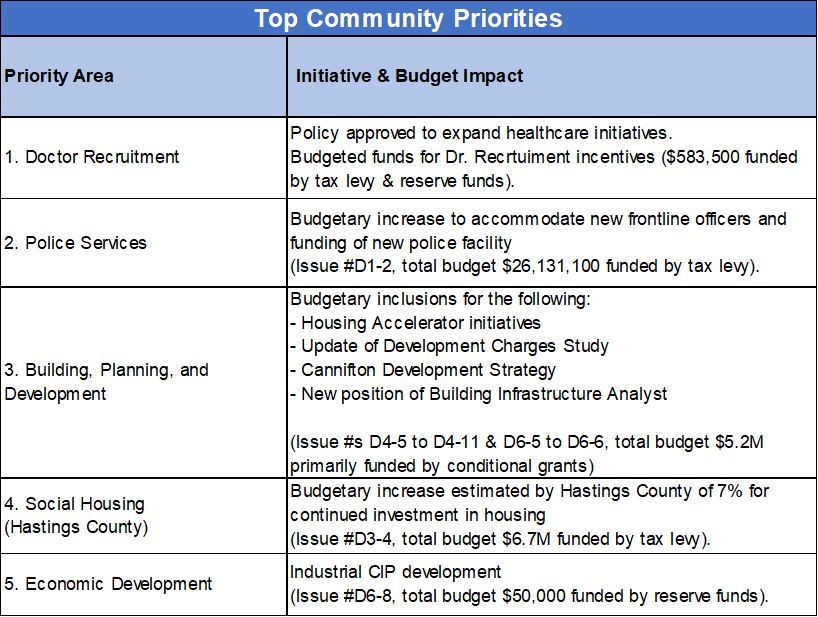

Community priorities

Based on 707 responses from residents:

Priorities

- That the 2024 Operating Budget (proposed) be presented with an overall residential property tax rates increase not to exceed 5%;

- That the 2024 Operating Budget consider the service areas prioritized through public input received;

- That City Department operating issues presented in the 2024 Operating Budget align with the strategic themes and initiatives outlined in the City’s Strategic Plan, with priority given to those categorized as Legislative, Compliance, or Health & Safety and Maintenance of Service Levels, and where any Enhancement of Service Levels are proposed, that they align with public input received; and

- That the 2024 Operating Budget incorporate a moderate increase in its tax-funded contributions to capital projects to maintain current levels of service relating to infrastructure.

February 1, 2024 – Survey 2: Draft operating budget survey results

Purpose: To obtain directed feedback on the preliminary draft operating budget by incorporating categorical results and funding plans. The survey results will be presented at the Operating Budget meetings in February 2024 for Council’s consideration.

The survey ran from Feb. 1 to 23 and received 587 total responses. Results are reported in 2024 Operating Budget – Phase 2: Public Engagement Report

1. What is your tax billing area?

- Belleville Urban

- Cannifton Rural

- Cannifton Urban

- Belleville Rural

- I don’t live in Belleville

2024 Proposed vs. 2023 Approved Net Tax Levy Allocation

They provided the following chart, lacking percentages for easy comparison:

Fixed:

| General Government | Contribution to Capital Projects | Planning, Development and Engineering | Environment al Services | Transportation & Operational Services | Protective Services | Recreation & Cultural | Health Services | Social & Family Services | |

|---|---|---|---|---|---|---|---|---|---|

| 2024 Net Tax Levy Proposed | 5,569,400 | 11,209,200 | 4,896,400 | 2,923,800 | 19,895,500 | 42,247,100 | 19,466,700 | 6,266,400 | 12,740,500 |

| 2023 Approved Tax Levy | 9,234,200 | 9,597,500 | 4,350,900 | 3,011,300 | 18,386,700 | 38,132,400 | 17,422,200 | 5,870,200 | 11,874,200 |

| Increase (decrease) | -3,664,800 | 1,611,700 | 545,500 | -87,500 | 1,508,800 | 4,114,700 | 2,044,500 | 396,200 | 866,300 |

| Percentage change | -39.69% | 16.79% | 12.54% | -2.91% | 8.21% | 10.79% | 11.74% | 6.75% | 7.30% |

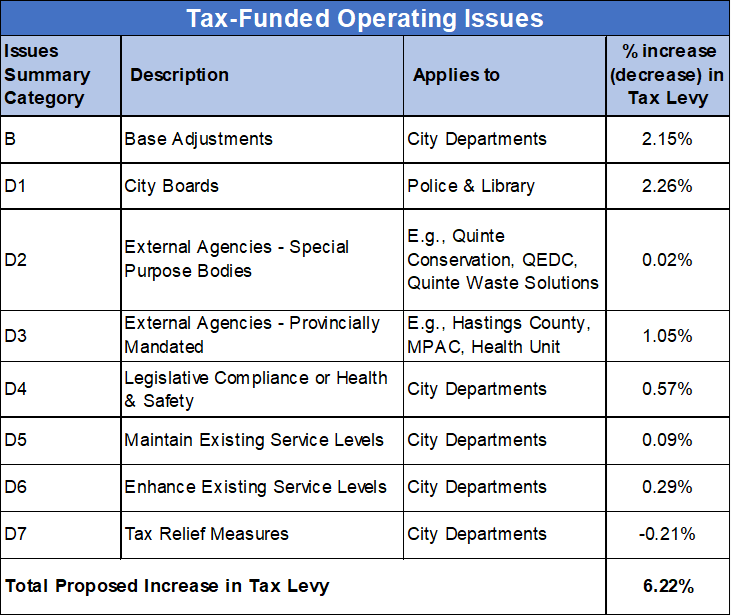

2024 Tax-Funded Net Operating Budget

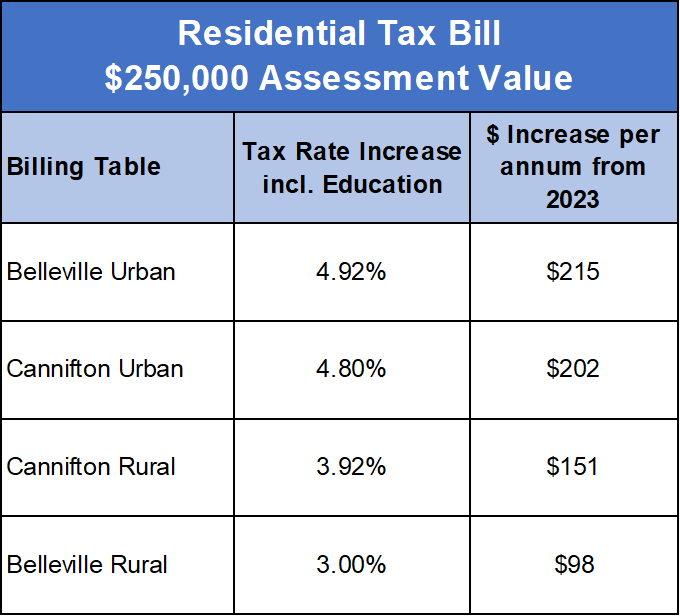

Residential Tax Bill

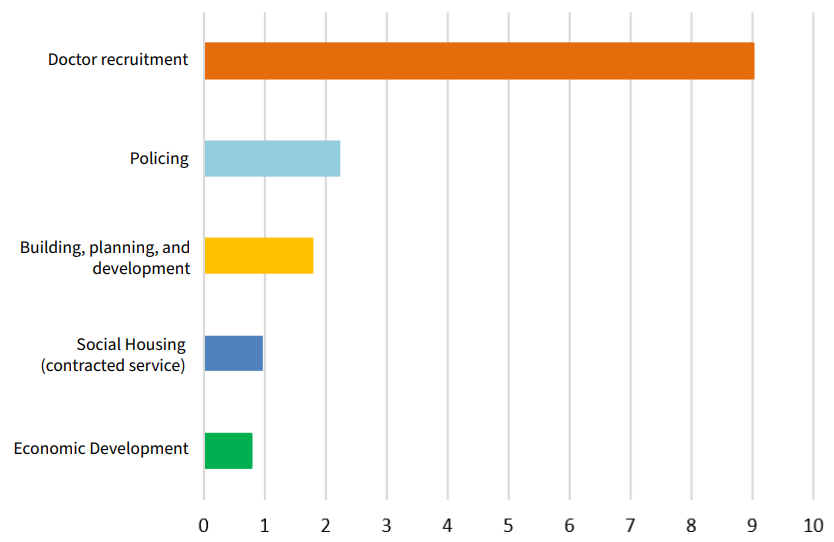

Top-Funding Operating Issues

Top Community Priorities

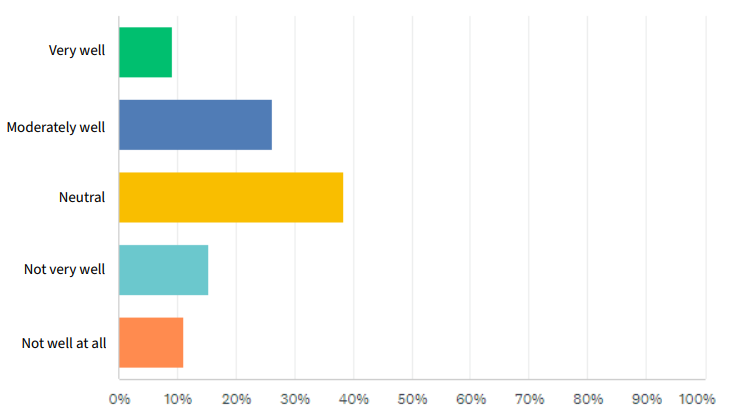

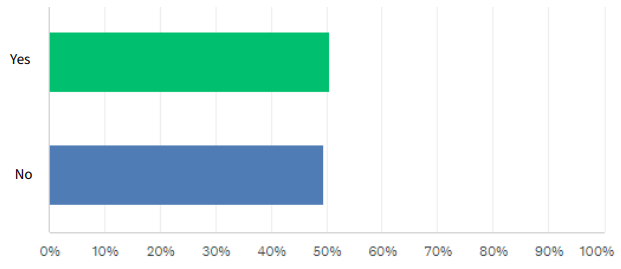

2. In your opinion, how well does the 2024 operating budget align with the budgetary guidelines established?

- Very well

- Moderately well

- Neutral

- Not very well

- Not well at all

3. Please elaborate on your opinion to the previous question:

- Tax increases per guidelines are too high and above inflation. Ratepayers are struggling.

- There is not enough allocation to housing initiatives within Social Services portfolio.

- An improved service level within Police Services is desired without increased costs/Policing budget should be reduced.

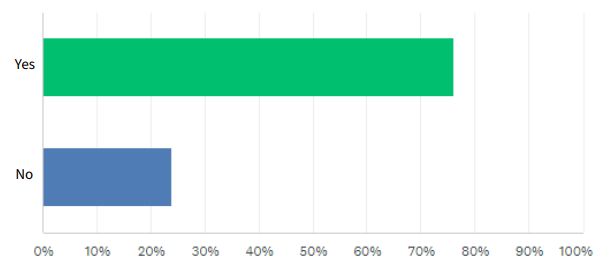

4. Included in section 8.a.13 of the operating budget are proposed operating issues that reflect an incremental increase from the 2023 operating budget. Are you generally satisfied with these new initiatives?

5. You responded, “No” the previous question. Please share your comments.

While there was an array of comments, below are some of the highlights. See Appendix A for detailed responses.

- Tax increases are too high.

- An improved service level within Police Services is desired without increased costs/Policing budget should be reduced.

- Operating issues are excessive. A complete service level review is needed.

- There are not enough new funds allocated to housing initiatives under Social Services portfolio.

- City wages/hiring should be reduced or frozen.

6. In your opinion, what changes or improvements would you suggest for the 2024 operating budget to better meet the needs of the community?

While there was an array of comments, below are some of the highlights. See Appendix A for detailed responses.

- Taxes are too high and costs should be cut.

- Increase in Doctor Recruitment and Health Services initiatives.

- Increase in affordable housing initiatives.

- Increase in road maintenance activities.

- Increase in Social Services (homelessness & housing)

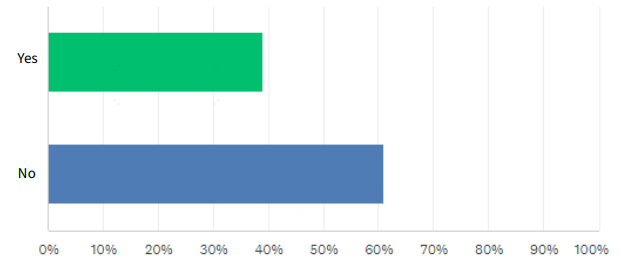

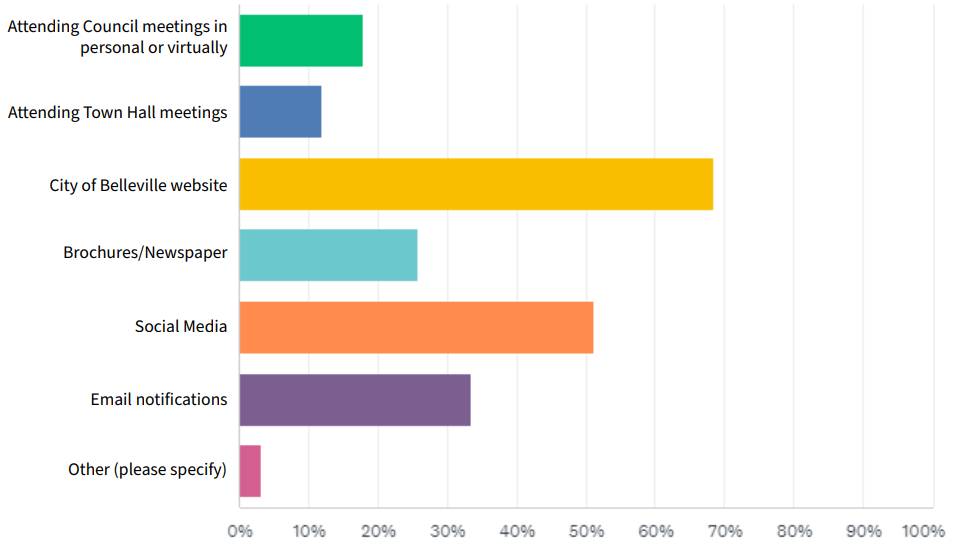

7. In 2023, Council approved the City’s first engagement strategy as it relates to the 2024 budget. This strategy included the distribution of a preliminary operating budget survey in October, the development of various education materials at belleville.ca/budget, and enhanced communication regarding the budget through the City’s webpage, social media, email subscriptions, and newsletters. Based on this information, do you feel adequately informed about the development of the City’s 2024 operating budget?

8. You selected, “No” to the previous question. Please explain.

While there was an array of comments, below are some of the highlights. See Appendix A for detailed responses.

- Respondents were unaware of prior survey/request for feedback.

- The City should increase its transparency in all capacities.

- There should be an increase in paper advertising of the budget (e.g. newspaper and/or bill inserts)

9. Are there any specific topics surrounding the City’s operating budget and process that you wish you had more information and background on?

10. You responded, “Yes” to the previous question. Please elaborate.

While there was an array of comments, below are some of the highlights. See Appendix A for detailed responses.

- Additional information regarding Policing levels of service.

- Information regarding the City addressing homeless issue.

- Information regarding affordable housing initiatives.

- Additional detail regarding City salaries & benefits.

December 5, 2023 – Finance Committee recommendation

The results of the survey were presented to the Finance Committee and Council to assist with the development of guidelines for budget preparation.

Based on this information, Report DDF-2023-02 recommended that the Finance Committee recommend the following guidelines be forwarded to council:

- Overall residential property tax rates under 5%

- Consider the service areas prioritized through public input received

- Prioritize operating issues based on Legislative, Compliance or Health & Safety, Maintenance of Service Levels and Enhancement of Service Levels categories

- Include a moderate increase in its tax-funded contributions to capital projects to maintain current levels of service relating to infrastructure

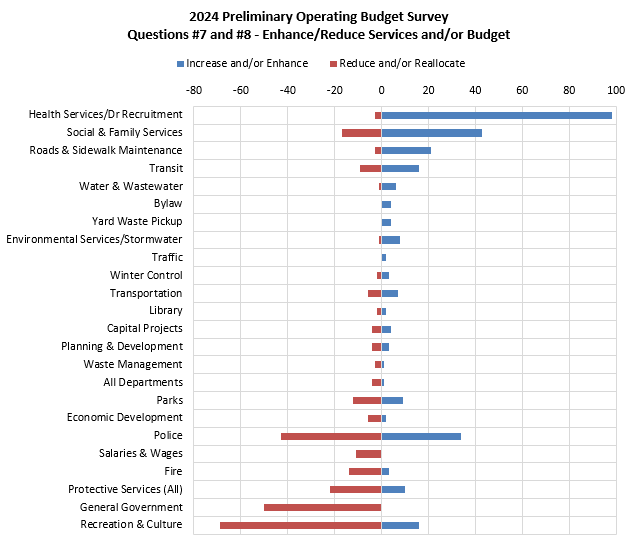

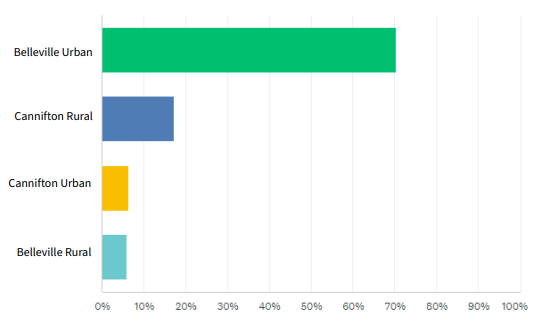

December 5, 2023 – Survey 1: Preliminary Operating Budget Survey & Results

Purpose: To obtain feedback regarding operating spending priorities and overall approach to operating budget development. Results were presented to the Finance Committee and are now presented to Council to establish budgetary guidelines.

The City’s Preliminary Operating Budget Survey is meant to engage stakeholders in the early stages of the budget process and allow them to provide their feedback on operational spending priorities and the overall approach to operating budget development.

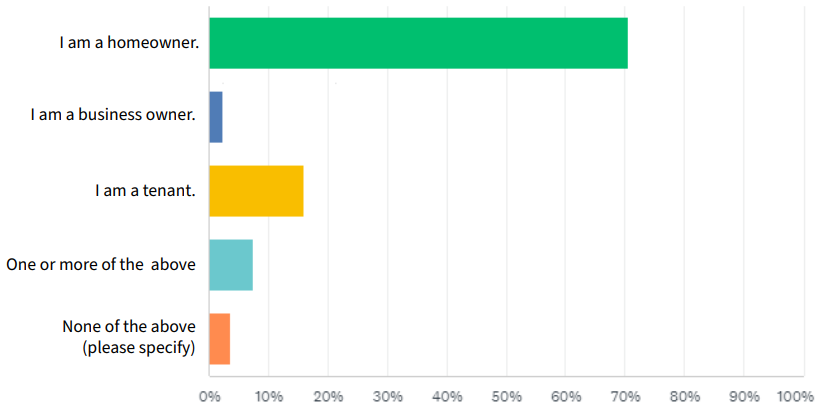

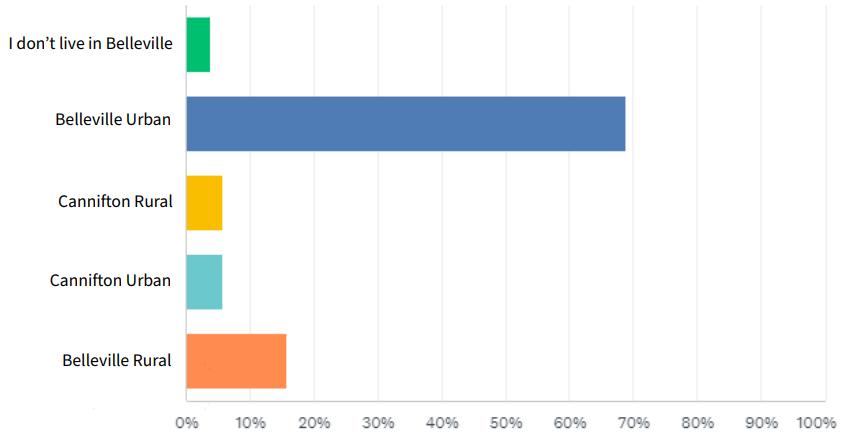

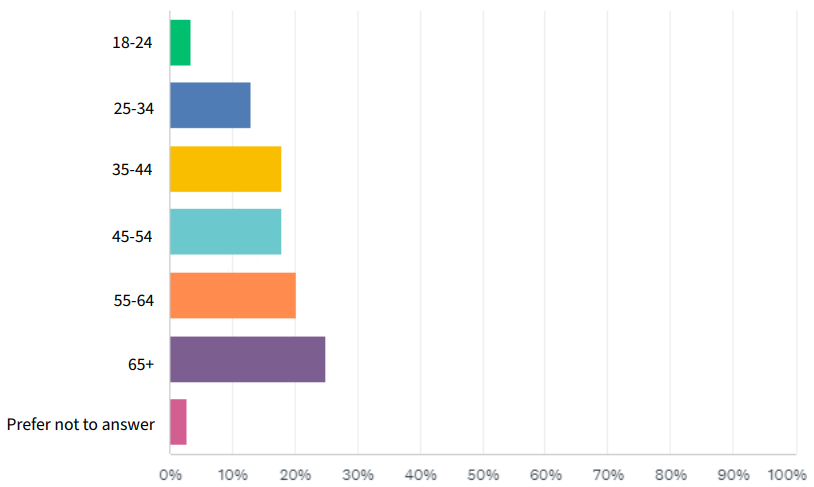

The survey was available from Oct. 12 to Nov. 6 and received 707 responses. ~70% were homeowners living within the Belleville Urban boundary. Household income ranges of respondents were generally balanced, but there was a higher proportion over the age of 65 compared to the 2024 Preliminary Capital Budget survey.

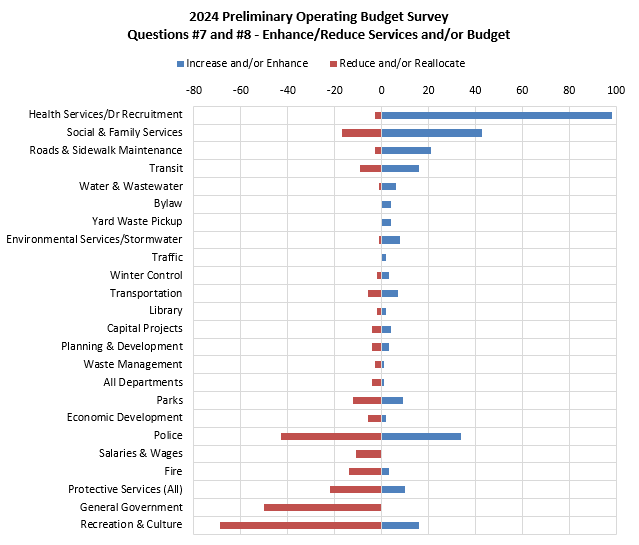

The survey results and engagement report found that respondents requested the following priorities:

Top 3 services to increase or enhance:

- Health Services/Dr Recruitment

- Social & Family Services

- Roads & Sidewalk Maintenance

Top 3 services to decrease or reduce:

- Recreation & Culture

- General Government

- Police

1. Do you live and/or own a business in Belleville?

- I am a homeowner

- I am a business owner

- I am a tenant

- One or more of the above

- None of the above (please specify)

2. Which tax billing area do you live in?

- Belleville Urban

- Cannifton Rural

- Cannifton Urban

- Belleville Rural

- I don’t live in Belleville

3. How old are you?

- 18-24

- 25-34

- 35-44

- 45-54

- 55-64

- 65+

- Prefer not to answer

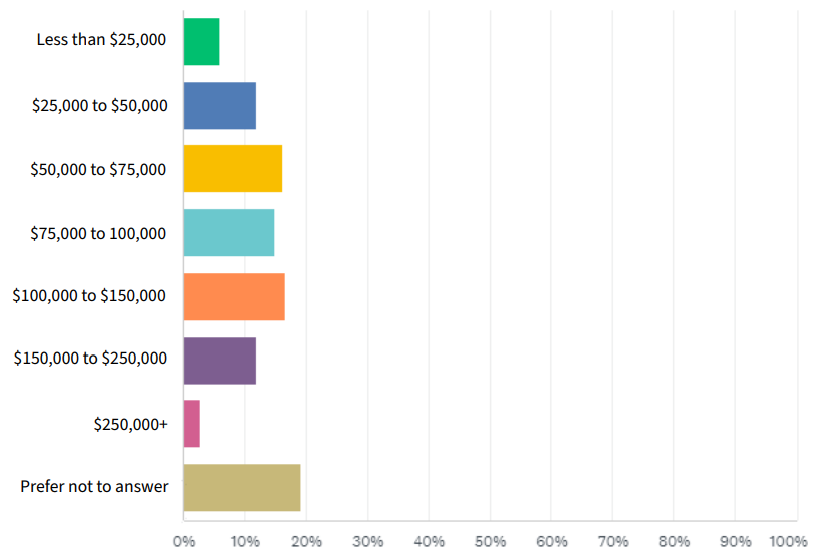

4. What is your gross annual household income?

- Less than $25,000

- $25,000 to $50,000

- $50,000 to $75,000

- $75,000 to $100,000

- $100,000 to $150,000

- $150,000 to $250,000

- $250,000+

- Prefer not to answer

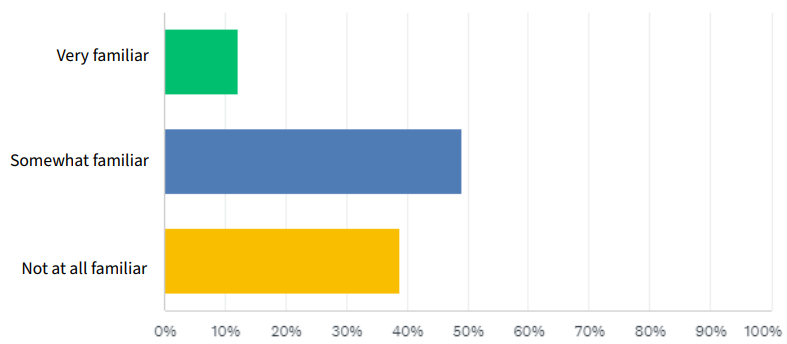

5. How familiar are you with how the City develops the annual Operating Budget?

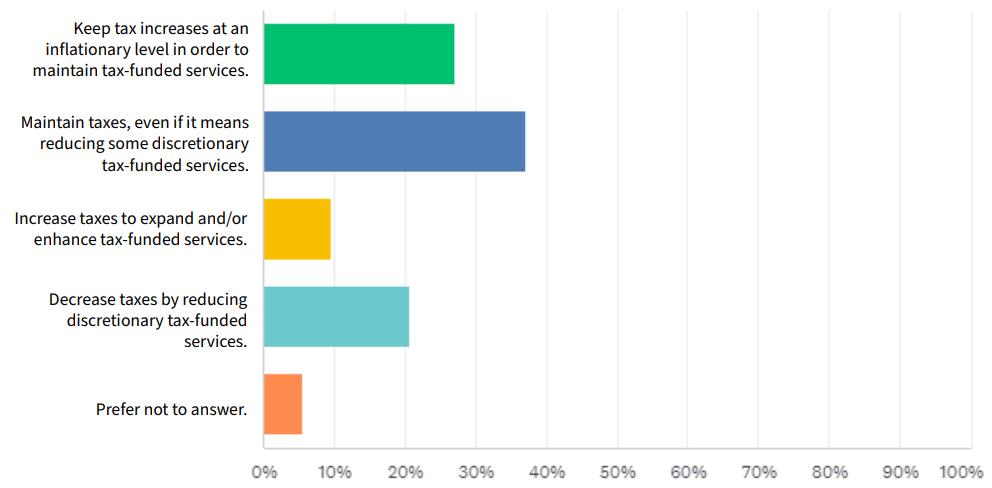

6. Due to the increased cost of maintaining service levels and supporting infrastructure, the City must balance property taxes with increasing demand for services. The City has a number of options when balancing the budget. Please indicate which of the following statements comes close to capturing your point of view:

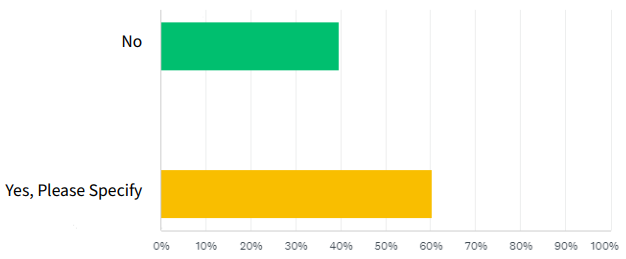

7. When reviewing the tax-funded net departmental spending in the 2023 approved operating budget, are there any service areas that you believe resources could be reduced or reallocated? If so, please specify.

Highlights/trending responses under “Yes, Please Specify”:

- Service areas, such as Recreation & Culture, Parks, and General Government should be redirected to

Health Services/Doctor Recruitment. - Perceived level of service provided by Police does not align with budgeted allocation as compared to

neighboring municipalities. Spending should be redirected to address homelessness and housing. - Social Services should have increased accountability for housing and assistance. Funding should be

reduced and allocated to the most needy and vulnerable. - Efforts should be made to identify job efficiencies to reduce salaries, wages, and benefits.

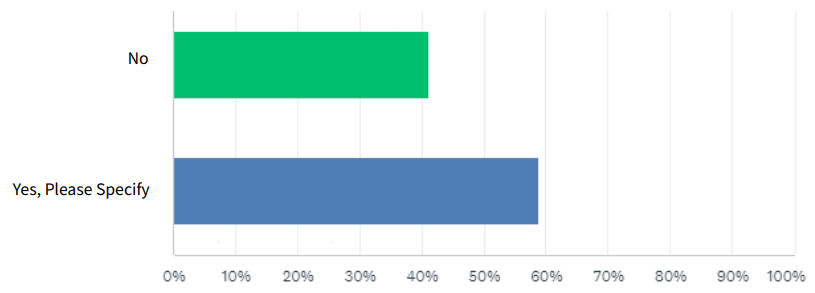

8. In your opinion, are there operating service(s) that you think the community would benefit from an enhanced level of service?

Highlights/trending responses under “Yes, Please Specify”:

- There is an urgent need for Doctors and Health Services.

- Social Services should be increased to facilitate affordable housing, thus addressing homelessness.

- There needs to be an increased police presence downtown. Response time is important for the

community to feel safe. - Roads are in dire need of repair and maintenance and should be prioritized.

- Transit services should be expanded to service growth in population.

9. From the list of services directly or indirectly provided by the City, please rank the five (5) that are most important to you.

10. In the 2023 approved operating budget, there is a designated portion ($9.6 million) of the City’s tax levy ($117.9 million) allocated for tax-funded infrastructure replacement and rehabilitation. However, as outlined in its 2022 Asset Management Plan, this allocation is not enough to fully fund the program, resulting in an infrastructure deficit. Given this

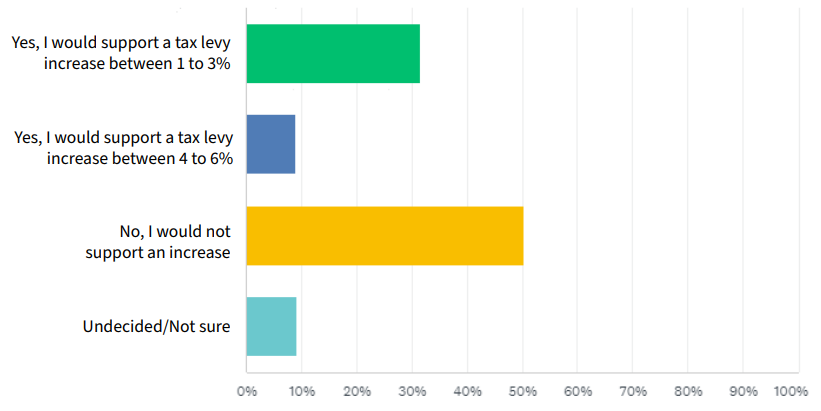

information, would you support an increase in property taxes to enable the City to increase its allocation of funds for tax-funded infrastructure replacement and rehabilitation? (For context, a 1% increase to the City’s tax levy equates to an approximate increase in your tax bill of 1% [if all other factors are equal].)

11. How would you prefer to see information about operating budget and its impact on the community?

Highlights/trending responses under “Other (please specify)”:

- Local media

- Tax bill inserts

- Radio ads

- Survey/online engagement

- Direct communication (email, phone, text alerts)

12. What suggestions do you think may enhance the City’s level of public engagement relating to annual budget? (Please Specify)

Highlights/trending responses:

- Increased transparency and information provided

- Surveys

- Use of social media

- Direct communication (mailouts, email, text alerts)

- In-person engagement (town hall meetings, question and answer periods)

More: Read the complete responses to questions 7, 8, 11, and 12 of the survey

October 10, 2023 – Public engagement strategy

As part of the October 10, 2023, Regular Council meeting, the 2024 Operating Budget timeline and Public Engagement Communication Plan was approved as recommended by the Finance Committee. The plan included two surveys.

The 2024 Operating budget was prepared under the Strong Mayors legislation (O.Reg. 530/22), and requires the Mayor prepare and present a budget to Council before February 1st.

Additional requirements under the Strong Mayors legislation that have been included in the budget timeline are:

- Amendment Period (February 1 – March 1): Council will have the ability to provide amendments to the budget within the 30 day deadline

- Veto Period (March 2 – March 11): The Mayor will have the ability to veto amendments (in writing) within 10 days after the expiry of the 30 day period above

- Overriding a veto (March 12 – March 26): Council will have the ability to override the Mayor’s veto (if utilized) with a 2/3 vote within 15 days of the expiry of the veto

- After the expiry of the time period for council to override the Mayor’s veto, the proposed budget is deemed to be adopted by the municipality and does not require a vote of Council.

Leave a comment

All comments are reviewed prior to appearing on the site.

Rules: