New to municipal budgets? Learn about the differences between Municipal Operating vs Capital Budgets.

Operating budgets

Existing and new programs/spending

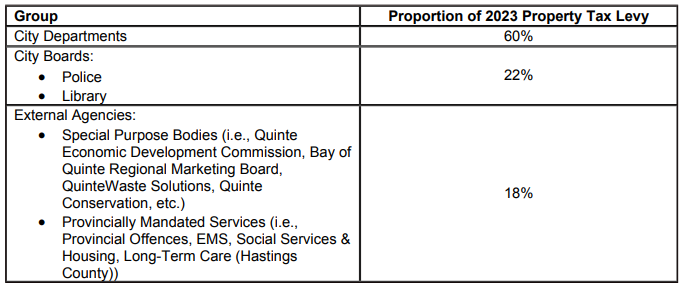

Net spending as outlined in the City’s Budget & Financial Controls Policy proposed in the operating budget is categorized as follows:

- Base Budget: prior year approved budget to maintain current levels of service, incorporating inflationary and other adjustments necessary.

- Operating Issues: new programs and/or services such as increased costs and staffing implications. These may be incorporated into the Base Budget moving forward or consist of a one-time expense and/or one-time revenue such as reserves or reserve funds.

The Operating Budget is led by Belleville’s Strategic Plan, annual Departmental Operating Plans, and relevant legislation and strategic initiatives adopted by Council.

The Budget & Financial Controls Policy outlines the process and responsibilities of the Finance Committee and Council relating to budget, which includes:

- Establishing and approving guidelines in advance of detailed budget preparation;

- Approving proposed level of public communication and engagement; and

- Review and debate budget submissions.

The City presents any adjustments to its prior year adopted budget through base adjustments, management recommendations, and any new operating issues that are meant to highlight new commitment of resources for Council to consider.

The City must also consider other key budget drivers in the proposed operating budget:

- Assessment base & growth

- New or enhanced programs and services

- Debt levels on past and committed capital projects.

- Non-discretionary pressures and inflation

- Availability of reserves & reserve funds

- Personnel

- Asset management

- Obligations to Special Purpose Bodies.

- Budgets of City Boards

Funding from property taxes and/or user fees

The operating budget is separated into two funding categories:

- Section A: Tax-supported services

- General Government: Council & Clerk, Finance, Human Resources, and Administration.

- Planning & Development Services: Planning & Approvals, Building Services, and Economic Development

- Engineering

- Environmental Services: Stormwater, Waste Management, and Pollution Control.

- Transportation Services: Road and Roadside, Structures, Traffic Operations, and Winter Control.

- Protective Services: Fire and Police

- Recreation & Culture: Programs, Facilities, Community Centres, Parks, Sports Fields, Library, and Heritage.

- Health Services: Doctor Recruitment and external contracts

- Social & Family Services (external contract)

- Section B: User-supported services (water, wastewater, and parking).

- Over 95% of the costs to provide these services are individually funded by its user fees.

- Core rate

- Area rate

- User rate

Timeline

- October 3 & 10 – Public engagement plan and timeline approved by Finance Committee and Council. Meant to engage residents in the early stages of the budget process and allow them to provide their feedback on operational spending priorities and the overall approach to operating budget development. Residents are encouraged to take the survey before Nov. 6 to have their say.

- December 5 & 11 – Preliminary public feedback and recommended guidelines presented to Finance Committee and Council.

- December to January – Internal draft Operating Budget deliberations

- February 1 – Draft Operating Budget posted for public feedback.

- February 27 & 28 – Presentation of public feedback and operating budget meetings.

- March 11 – Expiry of Mayor’s veto of Council’s budget amendments (if applicable).

- March 26 – Expiry of Council’s override period of Mayor’s veto of Council’s budget amendments (if applicable).

Capital budget

The Capital Budget is the City’s plan for making large investments in infrastructure and services and includes: major maintenance to public buildings, construction or purchase of new buildings, purchase of major equipment, significant road resurfacing projects, water and wastewater infrastructure, and more.

The Budget & Financial Controls Policy outlines the process and responsibilities of the Finance Committee and Council relating to budget.

Development of the budget is guided by the 2022 Asset Management Plan, which identified that the City’s annual investment in growth-related and replacement of capital infrastructure should be $78.1 million, which considers several plans and studies including but not limited to:

- Strategic Plan

- Transportation Master Plan

- Wet Weather and Wastewater Servicing Master Plan (2019)

- Parks and Recreation Master Plan

- Infrastructure Phasing Strategy

- Development Charges Background Study (2020), 2021

- Roads Needs Study

The City’s proposed capital projects must be evaluated on the following criteria:

- Public safety & Legislation

- Service levels

- Strategic initiatives

- Financial implications

- Economic & Growth implications

- Community support

- Other (e.g., timing, project readiness)

The City must also consider other key budget drivers in the proposed capital budget. These may result in deferrals of low-priority capital projects:

- Non-discretionary pressures and inflation

- Debt levels

- Availability of reserves & reserve funds

- Personnel/project management workload

- Infrastructure gap and future capital need

- Third party or community partner obligations

Timeline

The City typically begins annual Operating Budget planning in the fall.

- June 27 & July 10 – Public engagement plan and timeline approved by Finance Committee and Council. Survey launched and promoted.

- Aug. 10 – Preliminary 2024 capital budget survey closes.

- Aug. 14 – Survey results presented to Finance Committee

- Aug. 28 – Survey results presented to Council. City staff obtain guidelines and considerations for budget preparation.

- October through November – Series of working group meetings with Executive Management Team and Finance Committee to develop draft budget. Internal draft Capital Budget deliberations.

- November – 2024 Draft Capital Budget and final survey posted for public input

- December 6 – Capital Budget Council meeting, presentation of public feedback, and subsequent adoption.

Take action

For budget updates, subscribe to the Budget and Financial Reports page on the City’s website by completing the Notify Me form on the right-hand side of the page and to Regular and Special Council meetings on the CivicWeb portal.

If you have additional input on an upcoming budget, email it to [email protected]. Those who require accessibility supports to fully participate in the survey are asked to contact [email protected] so that appropriate arrangements can be made.

Leave a comment

All comments are reviewed prior to appearing on the site.

Rules: