As part of their financial plan, municipalities set the capital and operating budgets each year by taking into consideration their government-mandated responsibilities, maintaining service level standards and their community’s priorities.

These documents are the blueprint that outline the where money will be collected and spent in line with the municipality’s priorities and level of service according to their vision and mission statements, values and long-term strategic plan.

What is the Operating Budget?

The Operating Budget covers the ongoing, day-to-day expenses that the municipality incurs to provide programs and services to residents including items such as staff salaries (planning, departments, pensions), emergency services (police, fire and EMS) and water, social services and parks and recreation that are funded primarily by property taxes ($110 million), water and sewage fees.

Compared to personal budgeting, this is the equivalent to buying groceries, electricity, and insurance premiums.

Unlike the federal and provincial governments, municipalities are unable to levy income or sales taxes.

Operating budgets are prepared at the start of each financial year. Most cities in Ontario are on a calendar year.

What is the Capital Budget?

The Capital Budget plans for the acquisition and replacement of Tangible Capital Assets, which are defined as significant expenditures to provide municipal services with a benefit beyond one year. The capital budget excludes the costs of operating these services, which form part of the operating budget.

Compared to personal budgeting, this is the equivalent to buying a new car, furniture, or building an addition on the house.

It covers long-term investments in the purchase, construction, maintenance and repair of physical facilities and infrastructure such as road repairs, bridges, libraries and parks that are funded by water and wastewater fees, property taxes, government grants and long-term debt and are paid off over time.

In Ontario, municipalities can incur long-term debt to fund capital projects (ie. run a deficit), however they may not commit more than 25% of total own-source revenue to service long-term debt and other long-term obligations.

You can see individual approved projects in the 2023 Capital Budget Summary:

Capital budgets are prepared at the start of each financial year. Most cities in Ontario are on a calendar year.

Many municipalities report their capital budgets on a cash basis.

What are financial statements?

Annual financial statements

A municipality shall, for each fiscal year, prepare annual financial statements for the municipality in accordance with generally accepted accounting principles for local governments as recommended, from time to time, by the Public Sector Accounting Board of the Chartered Professional Accountants of Canada.

Section 294.1 of the Municipal Act

Financial statements are end-of-year reports that look back on the outcome of a municipality’s financial activities and balances during the previous financial year. They provide a measure of a government’s performance in the achievement of its objectives as set out in the operating and capital budgets.

They are prepared on an accrual basis, meaning revenues and expenses are shown when a decision/purchase agreement is made, which isn’t necessarily when money changes hands.

They are prepared in accordance with generally accepted accounting principles (GAAP) as recommended by the CPA Canada – Public Sector Accounting Board (PSAB) and must be audited by a professional accountant.

Statements must include:

- Statement of financial position (“balance sheet”) – long-term view of the municipality’s financial health

- Statement of operations (“income statement”)

- Statement of change in net debt

- Statement of cash flow

- Comparative figures from the prior year

- Comparison of actual to budget results

Showing

- Assets and liabilities

- Net financial resources (called net debt)

- Accumulated surplus or deficit

- Tangible capital assets

- Other non-financial assets

While budgets come out at the start of the fiscal year, financial statements come out at the end as an “aftermath” report.

What is the Financial Information Return (FIR)?

Annual return

The treasurer of a municipality shall in each year provide the Minister with a return containing information designated by the Minister with respect to the financial affairs of the municipality, at the times and in the manner and form designated by the Minister. 2001, c. 25, s. 294 (1).

Section 294 (1) of the Municipal Act

The Financial Information Return is a standardized form that municipalities must enter their financial standing and activities into and submit to the Ministry of Municipal Affairs and Housing every year.

Download FIR reports by year and municipality here

Operating budget process

The Operating Budget is guided by:

- Strategic Plan

- Annual Departmental Operating Plans

- Relevant legislation and strategic initiatives adopted by Council

In Belleville’s case, the Budget & Financial Controls Policy outlines the process and responsibilities of the Financial Committee and Council.

Operating budget must be balanced (zero ‘net profit or loss’)

In Ontario, municipalities are required by Section 289 and 290 of the Municipal Act to plan balanced operating budgets. This means that expenses must equal revenues every year and they cannot borrow money to fund operating expenses. In balancing the operating budget, the City can do one or more of the following:

- Increase its revenues via property taxes and/or user rates.

- Manage expenses through adapting or reducing the cost of programs and/or services.

- Apply to and use application-based grant programs from provincial and federal governments, when available/applicable.

Yearly budget, local municipalities

290 (1) For each year, a local municipality shall, in the year or the immediately preceding year, prepare and adopt a budget including estimates of all sums required during the year for the purposes of the municipality, including,(a) amounts sufficient to pay all debts of the municipality falling due within the year;

(b) amounts required to be raised for sinking funds or retirement funds; and

(c) amounts required for any board, commission or other body. 2001, c. 25, s. 290 (1); 2006, c. 32, Sched. A, s. 120 (1).

Section 290 of the Municipal Act

Upper-tier municipalities

For each year, an upper-tier municipality shall, in the year or the immediately preceding year, prepare and adopt a budget including estimates of all sums required during the year for the purposes of the upper-tier municipality, including,(a) amounts sufficient to pay all debts of the upper-tier municipality falling due within the year;

(b) amounts required to be raised for sinking funds or retirement funds;

(c) amounts in respect of debenture debt of lower-tier municipalities for the payment of which the upper-tier municipality is liable; and

(d) amounts required by law to be provided by the upper-tier municipality for any of its local boards, excluding school boards. 2001, c. 25, s. 289 (1); 2006, c. 32, Sched. A, s. 119 (1).

Section 289 of the Municipal Act

Financial Statements are prepared annually at year-end and reviewed by an independent auditor. All Statements must be in compliance with the Public Sector Accounting Standards for local municipalities.

The capital and operating budgets as well as financial statements must be made public so that residents can see how council is allocating and spending funds.

What services are funded?

For example, the 2021 Operating Budget for the City of Belleville, Ontario that totaled $162.6M.

Expense categories from largest to smallest include:

- Emergency services – $39.3M

- Police – $22.8M

- Fire – $12.5M

- EMS – $4M

- Environmental services (water, waste) – $33M

- General government (council, admin, taxation, property management, human resources) – $18.2M

- Recreation (parks, arenas, fields, community centres) – $13.4M

- Social & family services – $10.9M

- Transportation operations (roads, traffic) – $9M

- Debt – $8.4M

- Planning & development – $8.4M

- Capital projects – $8M

- Social housing – $5.3M

- Long term care – $3.2M

- Library – $2.34M

- Social services – $2.34M

- Engineering – $1.2M

- Public health unit – $1.1M

- Garbage – $1M

- Conservation – $785,000

Here are the percentages:

Staff salaries make up the bulk of municipal expenses

The Town of Bracebridge’s Line-by-line Review of the Municipal Budget (2020) found that Salaries, Wages and Benefits represented the largest item of expenditure (46% in 2020) and has experienced an average annual increase of 4.2% from 2015‐2020. This includes salary contract increases, changes in staffing and changes in benefit costs:

Many municipal employees are unionized and represented by Canadian Union of Public Employees (CUPE). For example, the City of Belleville has a collective agreement with CUPE Local 907. The new agreement covers January 1, 2024 to December 31, 2027 and will see the City’s unionized employees receive wage increases of 5.0% in 2024, 3.5% in 2025, and 3.0% in 2026 and 2027.

Average salaries in the municipal sector for those making more than $100,000 annually since 2000 have grown by only 8 per cent but the number of individuals making those salaries has grown in the thousands of per cent. Within the broader public sector, in 2000 municipal employees accounted for 6 per cent of individuals on the salary disclosure list whereas by 2022 they accounted for 23 per cent.

Fraser Institute – Municipal dollars in Ontario—where did the money go?

Salaries, wages, benefits and pensions also account for the vast majority of police expenditures, another large municipal expense category.

Where does the funding come from?

For revenue, municipalities rely primarily on property taxes (~80%), followed by federal and provincial cash transfers, user fees and revenue from government business enterprises.

The services in the budget were funded by the following sources:

Taxation

82.36%, or $133,931,500 was contributed by the following:

- Property taxes – $108M

- User fees & service charges – $15.1M

- Other taxation – $3.6M

- Development charges – $1M

- Municipal Accommodation Tax on short term rentals – $750,000

- Dividends from electrical utility (eg. Elexicon) – $969,000

- Investment income – $400,000

- Conditional grants – $379,000

User pay

The remaining 17.64% was contributed by the following user rates:

- Water rates – $16.6 million

- Wastewater rates – $11.3 million

- Parking fees – $750,000

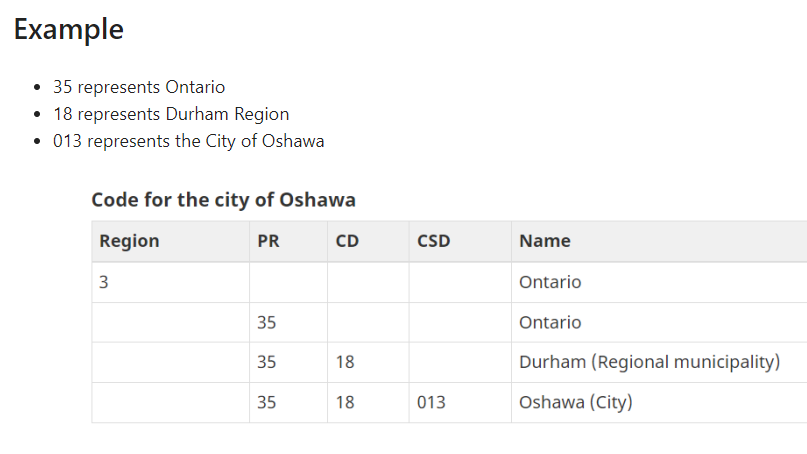

Example

You can see individual service adjustments made in the 2023 Operating Budget Issues Summary:

And all revenues and expenditures in the budget document:

Capital budget process

The Capital Budget is guided by:

- Asset Management Plan (Ontario Regulation 588/17 – Asset Management Planning for Municipal Infrastructure)

which in Belleville’s case considers several plans and studies including but not limited to:

- Strategic Plan

- Transportation Master Plan

- Wet Weather and Wastewater Servicing Master Plan (2019)

- Parks and Recreation Master Plan

- Infrastructure Phasing Strategy

- Development Charges Background Study (2020), 2021

- Roads Needs Study

The proposed capital projects must be evaluated on the following criteria:

- Public safety & Legislation

- Service levels

- Strategic initiatives

- Financial implications

- Economic & Growth implications

- Community support

- Other (e.g., timing, project readiness)

What projects are funded?

The 2023 Capital Budget in the Budget Presentation broke down as follows:

- Total – $59.2M

- Transportation services – $6.6M – Road, sidewalk, bridge, traffic infrastructure reconstruction and maintenance

- Combined services – $10M – Road reconstruction/widening, watermain replacement

- Facilities and parks – $10.3M – Parks, playgrounds, trails, dog parks, tennis/pickleball courts, soccer fields, skate parks, monuments

- Fleet and equipment – $14.2M – Pickup trucks, street sweepers, plows, Zamboni, buses, tractor, mower replacements

- Water services – $2.9M – Maintenance and equipment

- Wastewater and stormwater services – $13.7M – Upgrades, thickener, odour control

- Information technology – $500K – Servers, software, networks, system security

- Library – $45K – Network equipment

- Police services – $1.3M – Speed gun, transcription system, photo analyzing program, fleet vehicles

- Long term debt costs (interest) – $1.14M – Paid for by: property taxes ($432K) and user rates ($703K)

Where does the funding come from?

Sources of financing for these projects include:

- Total – $59.2M

- User rates – $7.5M

- Water – $5.7M

- Wastewater – $1.65M

- Parking – $175,000

- Property taxes (ie. operating budget) – $0 ($5.7M in 2022 to pay for police equipment, IT upgrades, fleet replacements)

- $1.14M to pay for long term debt costs (interests), paid for by property taxes ($432K) (0.39% tax impact) and user rates ($703K)

- Reserve funds – $17M – Funds set aside for specific use as approved by Council and in accordance with the City’s established policies. Contributions to these reserve funds are typically funded by an allocation from the operating budget.

- Development charges: Collected from developers when constructing a new building and used to fund/recover capital (and operating) expenses to service growth.

- Casino revenue share ($3.4 million in 2023)

- Asset Management

- Government grants (eg. Ontario Community Infrastructure Fund, Investing in Canada Infrastructure Program, EAF, NIF) – $12.4M

- Canada Community-Building Fund (Federal Gas Tax) – $3.7M

- Provincial Gas Tax – $766,700

- Long term debt – $17.2M – Issued to cover any infrastructure gap as approved by Council (this year it funded wastewater upgrades, trails and fire equipment)

- Property taxes – $6.5M

- User rates – $10.6M

- Donations/other – $582,100 (CN Tribute Monument fundraising)

Leave a comment

All comments are reviewed prior to appearing on the site.

Rules: