The operating budget is set by municipal council every year and covers the ongoing, day-to-day expenses that the municipality incurs to provide programs and services to residents including items such as staff salaries (planning, departments, pensions), emergency services (police, fire and EMS) and water, social services and parks and recreation.

Compared to personal budgeting, this is the equivalent to buying groceries, electricity, and insurance premiums.

Unlike the federal and provincial governments, municipalities don’t receive a cut of income or sales taxes and are unable to apply them, so budgets are funded primarily by property taxes, and user rates for water, wastewater and parking.

Operating budgets as well as capital budgets and financial statements must be made public so that residents can see how council is allocating and spending funds.

The City of Belleville will be used throughout this page as an example. Here is the full 2021 Operating Budget:

Operating budgets must be balanced (“revenue neutral” or zero “net profit/loss”)

In Ontario, municipalities are required by Section 289 and 290 of the Municipal Act to plan balanced operating budgets. This means that expenses must equal revenues every year and they cannot borrow money to fund operating expenses.

To balance the operating budget, the City can do one or more of the following:

- Increase its revenues via property taxes and/or user rates.

- Manage expenses through adapting or reducing the cost of programs and/or services.

- Apply to and use application-based grant programs from provincial and federal governments, when available/applicable.

What services are funded (expenses)?

The Operating Budget for the City of Belleville, Ontario totaled $162.6M. Here’s how funding was allocated:

Tax funded services

Expense categories that are funded by property taxes, from largest to smallest, include:

- Emergency and protective services – $39.3M

- Police – $22.8M

- Fire – $12.5M

- EMS – $4M

- General government (council, admin, taxation, property management, human resources) – $18.2M

- Recreation (parks, arenas, fields, community centres) – $13.4M

- Social & family services – $10.9M (external contract with Hastings County)

- Transportation operations (roads, traffic) – $9M

- Debt – $8.4M

- Planning & development – $8.4M

- Capital projects – $8M

- Social housing – $5.3M

- Long term care – $3.2M

- Library – $2.34M

- Social services – $2.34M

- Engineering – $1.2M

- Public health unit – $1.1M

- Garbage – $1M

- Conservation – $785,000

User funded services

Over 95% of the costs to provide these services are individually funded by its user fees.

- Environmental services – water – $16.6M

- Environmental services – wastewater – $11.4M

- Parking – $0.75M

Hybrid services are subsidized by property taxes, the rest is paid for by the user

Some user-pay programs/services are partially funded by property taxes with the remainder paid for by user fees, such as:

- Permits/planning applications

- Recreational programs/rentals

- Garbage bag tags

- Licenses

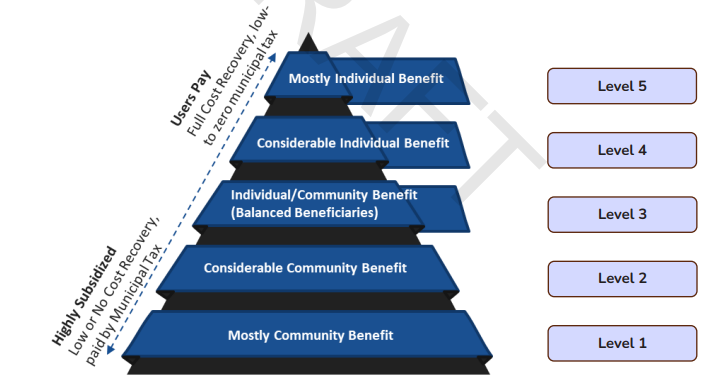

Belleville’s consultant used the Public Benefit Pyramid Methodology to determine what the split between property tax/user fees should be for these hybrid services:

Staff salaries make up the bulk of municipal expenses

The Town of Bracebridge’s Line-by-line Review of the Municipal Budget (2020) found that Salaries, Wages and Benefits represented the largest item of expenditure (46% in 2020) and has experienced an average annual increase of 4.2% from 2015‐2020. This includes salary contract increases, changes in staffing and changes in benefit costs:

Many municipal employees are unionized and represented by Canadian Union of Public Employees (CUPE). For example, the City of Belleville has a collective agreement with CUPE Local 907. A new agreement covers January 1, 2024 to December 31, 2027 and will see the City’s unionized employees receive wage increases of 5.0% in 2024, 3.5% in 2025, and 3.0% in 2026 and 2027.

Average salaries in the municipal sector for those making more than $100,000 annually since 2000 have grown by only 8 per cent but the number of individuals making those salaries has grown in the thousands of per cent. Within the broader public sector, in 2000 municipal employees accounted for 6 per cent of individuals on the salary disclosure list whereas by 2022 they accounted for 23 per cent.

Fraser Institute – Municipal dollars in Ontario—where did the money go?

Salaries, wages, benefits and pensions also account for the vast majority of police expenditures, another large municipal expense category.

Where does the funding (revenues) come from?

Municipalities in Ontario rely primarily on property taxes for revenue. They account for approximately 80% of Belleville’s budget. The rest of the budget comes from a variety of sources including user fees and service charges, federal and provincial grants, and transfers from municipal reserve funds.

In Belleville, services in the budget were funded by the following sources of revenue:

Tax funded

82.36%, or $133.9M was funded by taxes collected, the majority from property taxes:

- Property taxes (80%) – $108M

- User fees & service charges (water, wastewater, parking) – $15.1M

- Other taxation – $3.6M

- Government transfers

- Safe Restart Agreements Funds – $1.4M

- Development charges (new developments) – $1M

- Municipal Accommodation Tax on short term rentals (AirBnBs) – $750,000

- Dividends from electrical utility (eg. Elexicon) – $969,000

- Investment income – $400,000

- Conditional government grants – $379,000

- Transfers from municipal reserve funds

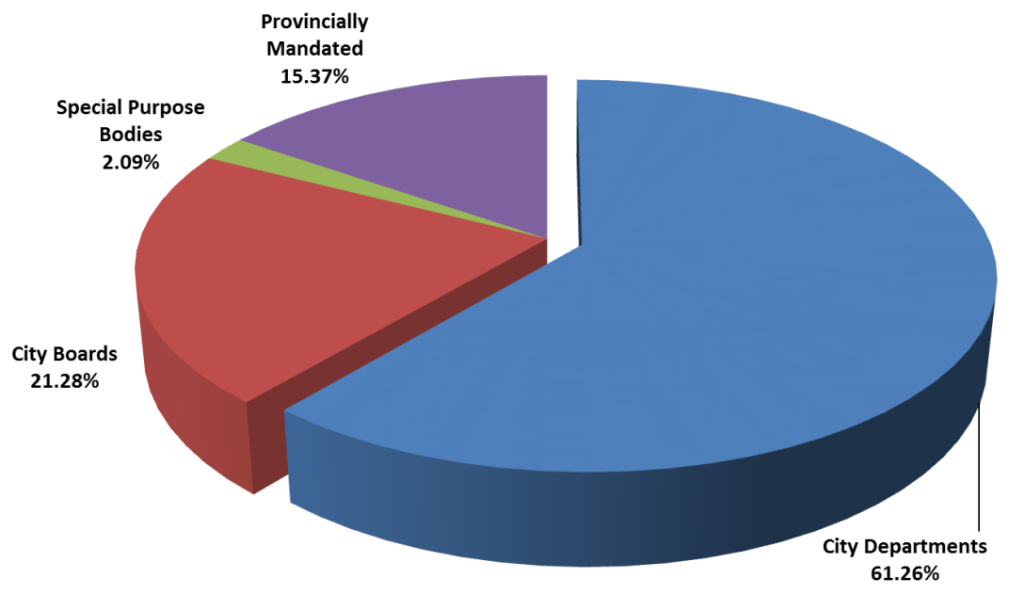

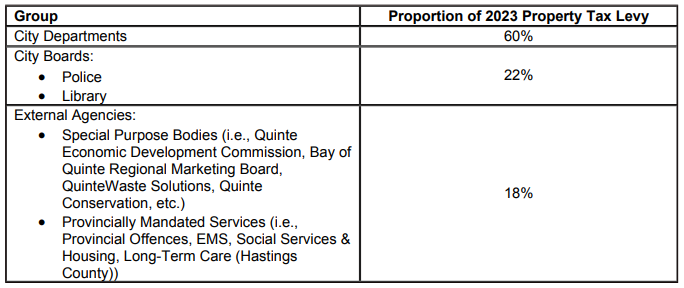

Belleville has direct control over 60% of the portion of the budget that is funded by property taxes. They have indirect or joint control or limited control over the remaining 40%, which is allocated to the budgets set and approved by external boards and agencies:

User funded (user fees)

The remaining 17.64%, or $28.7M was contributed by the following user rates:

- Water rates – $16.6 million

- Wastewater rates – $11.3 million

- Parking fees – $750,000

These user-funded revenues cover 95% of the costs to provide these services, with the remainder paid for by property taxes.

Operating budget development process

Guiding documents

Preparation of the operating budget is guided by:

- Strategic Plan

- Budget/Financial Policies, which outline budget principles and objectives, roles and responsibilities and processes

- Annual Departmental Operating Plans

- Relevant legislation and strategic initiatives adopted by Council

The municipality must also consider:

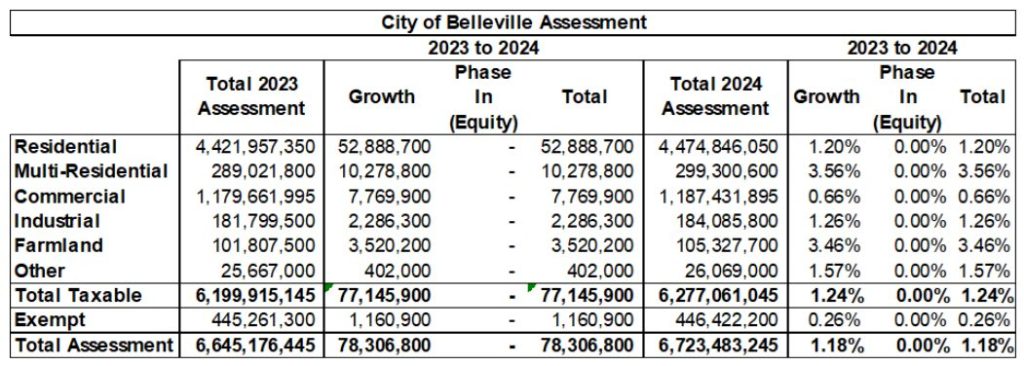

- Property assessment growth

- New or enhanced programs and services

- Debt levels on past and committed capital projects

- Non-discretionary pressures and inflation

- Availability of reserves & reserve funds

- Personnel

- Asset management

- Obligations to Special Purpose Bodies

- Budgets of City Boards

Total Assessed Value of properties is determined

For example, in 2024 Belleville had 21,329 taxable properties with a total value for property taxation purposes of $6.7B. Included in this total was $446.4M in “exempt” assessment (Municipal property, Schools, Hospitals, and Churches) – 6.64% of total assessment for the City.

Residents’ priorities are surveyed (optional, but recommended)

Starting in 2024, the City of Belleville held 2 surveys to obtain feedback from residents to help inform the budget development process, giving residents an opportunity to provide feedback on their spending priorities and have a say on how funds should be spent:

Preliminary survey – short, high-level preliminary operating budget survey to gauge residents’ spending priorities. Results were presented to the Finance Committee and Council to assist with the establishment of budgetary guidelines.

Example guidelines include:

- Overall residential property tax rate increase under 5%

- Consider the service areas prioritized through public input received

- Prioritize operating issues based on Legislative, Compliance or Health & Safety, Maintenance of Service Levels and Enhancement of Service Levels categories

- Include a moderate increase in its tax-funded contributions to capital projects to maintain current levels of service relating to infrastructure

Draft budget survey – obtain directed feedback on the draft operating budget by incorporating categorical results and funding plans. Results were presented to council at the operating budget meetings for Council’s consideration when making final decisions.

Staff prepare a proposed budget and present it to council

The operating budget is prepared by municipal staff in collaboration with management staff and the Finance Committee at the start of each financial year. Most municipalities in Ontario use the calendar year.

The operating budget is split into two funding categories:

- Section A: Tax-supported services

- Section B: User-supported services (water, wastewater, and parking).

- Base Budget adjustments (“status quo”): adjustments needed to maintain the same levels of service as the prior year, incorporating inflationary and other adjustments necessary.

- Operating Issues (adjustments): new programs and/or service level increases. These may be incorporated into the Base Budget moving forward or consist of a one-time expense and/or one-time revenue such as reserves or reserve funds.

Local boards and special purpose bodies submit their budgets to council for funding approval

In Belleville, council has direct control of 60% of the operating budget, while 40% is made of up contributions to the annual budgets of local boards and external agencies. These organizations submit their annual budgets to the municipality for review, but the amount of say a municipality has over the contents of their budget varies.

- Local boards (Municipal Service Boards)

- Mandatory

- Police Services Board (established by Police Services Act)

- Library Board (established by Public Libraries Act)

- Mandatory

- External agencies

- Special purpose bodies

- Conservation Authority (Conservation Authorities Act)

- Waste Management Board

- Business Improvements Area Board

- Economic Development Commission

- Regional Marketing Board

- Transit Commission

- Parking Authority

- Utilities Commission (Ontario Energy Board Act)

- Arts Council

- Provincially mandated services

- Provincial Offenses

- Emergency Medical Services

- Social Services & Housing

- Long-Term Care

- Public Health (expenses split 25% municipal, 75% provincial since 2019)

- Municipal Property Assessment Corporation

- Special purpose bodies

NOTE: In the case of the Police Services Board, the municipality has the authority to approve the budget estimates submitted by the Board, but does not have the authority to approve or disapprove specific items in the estimates.

Proposed budget is presented to council

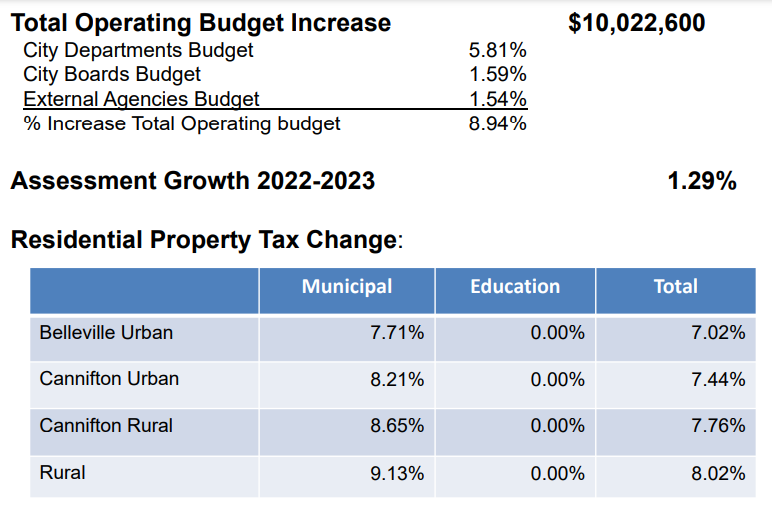

Belleville’s 2023 proposed operating budget was presented to council by the Director of Finance during a special operating budget meeting. After taking into account 1.29% growth in property assessment value, the budget would require a residential property tax increase of 7-8%, much higher than a typical annual increase of 3-4%. Rising internal and external costs due to high inflation was pointed to as the cause, and inflation in Ontario was 6.8% in 2022.

Council makes changes to reduce the tax increase

In Belleville in 2023, Council asked staff to review the budget line-by-line to find areas of lowest priority where the city could save and cut costs to reduce the property tax increase.

The following changes were made to get the increase down from 8-9% to 3.15-3.66%:

- Eliminated $500,000 in funding for the affordable housing program incentives from the 2023 Operating Budget in an effort to reduce the increase in property taxes for homeowners.

- Found efficiencies in various departments

- Withdrew $650,000 from the tax rate stabilization fund

You can see individual service adjustments made in the 2023 Operating Budget Issues Summary:

Council reviews how the rate increase will impact the taxpayer

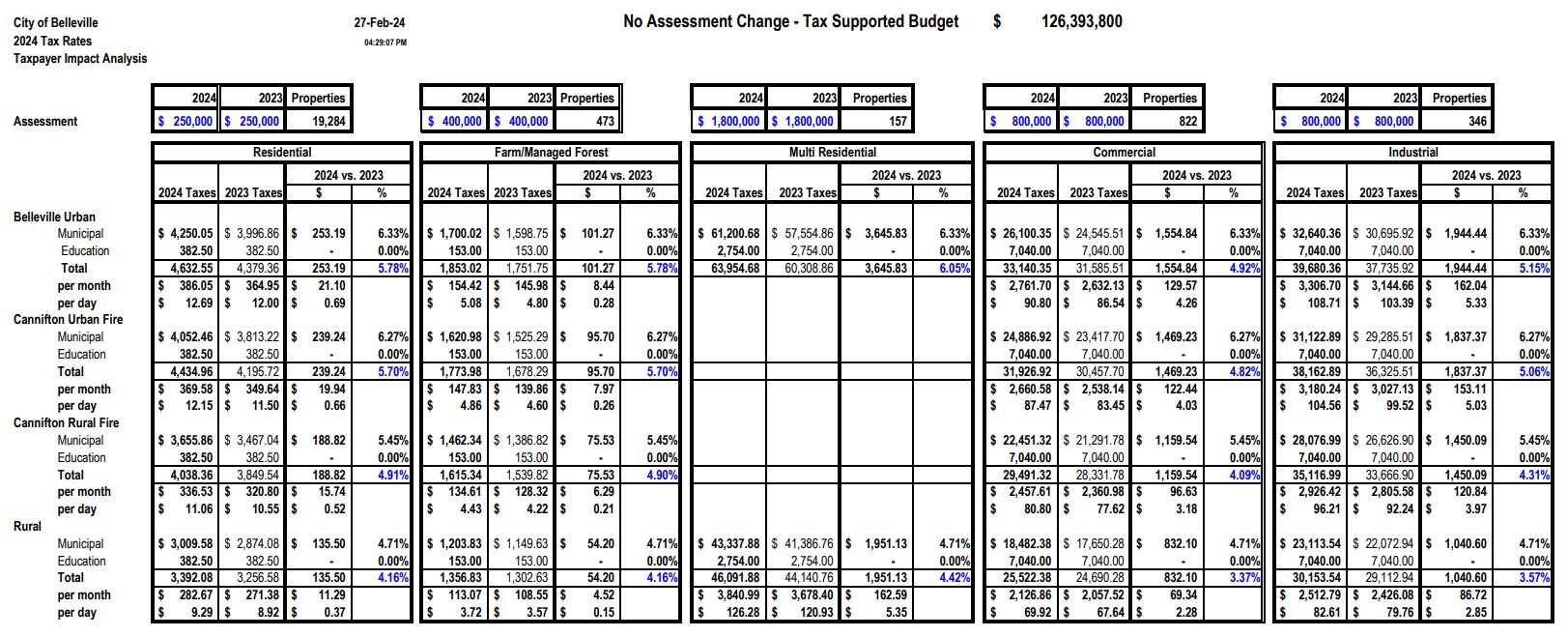

The following Taxpayer Impact Analysis table shows what the increase will be for each billing area and property type compared to the previous year. Council reviewed this table to see if it looked reasonable before deciding to find more efficiencies and cuts.

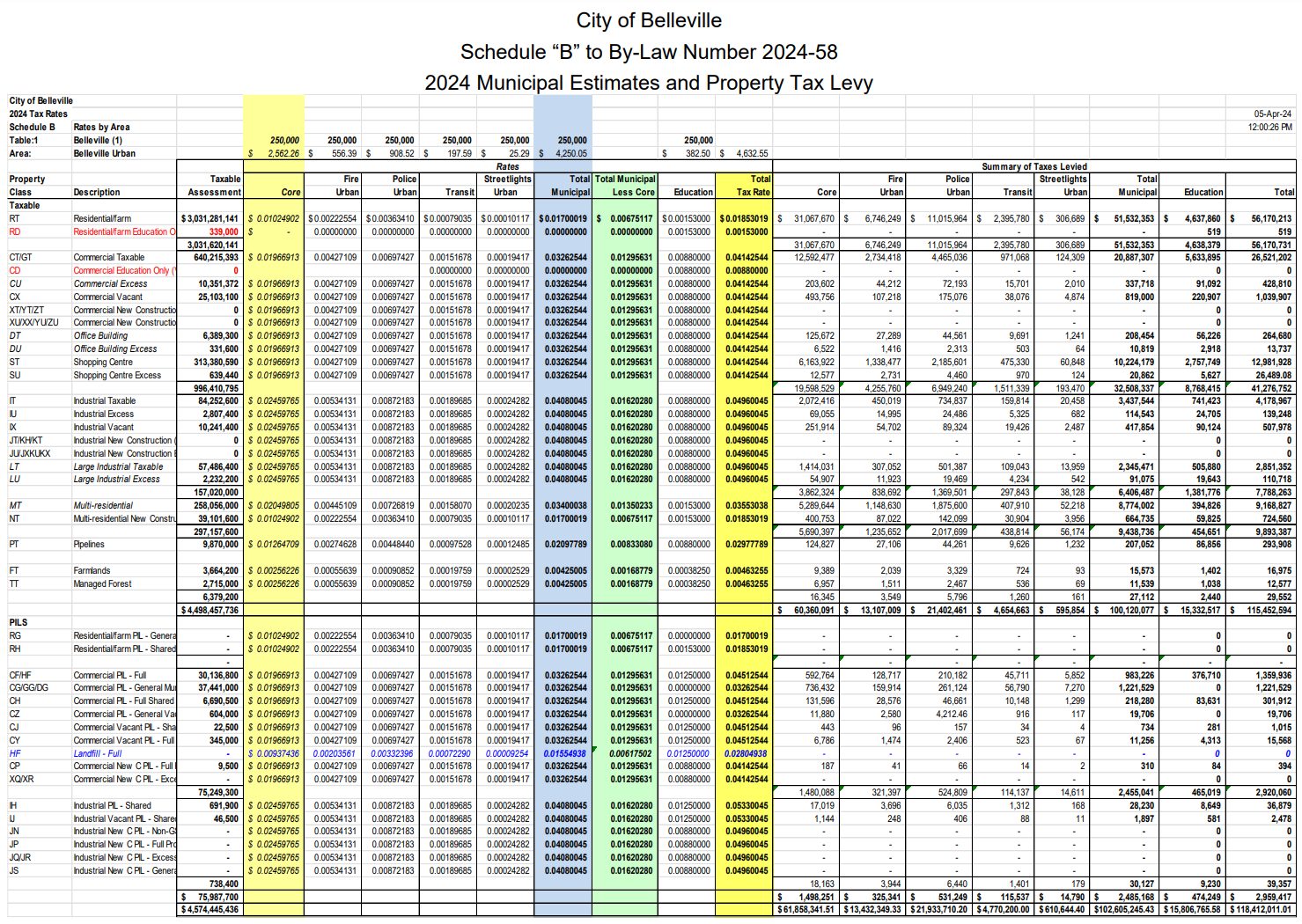

Complete breakdown of mill rates by area, property type and service

Property class, core and area rates

Tax rates are established for each property class, billing area and specific services:

Property class rates vary by each class of property:

- Residential

- Multi-residential

- Commercial

- Industrial

- Farm

- Forest

- etc.

Core rate is charged for services used throughout the municipality and applies equally to all billing areas based their assessments

Area rates are charged to specific billing areas of the municipality. They are determined by a process called “area rating” which weights the rates across the billing areas based on how much direct or indirect service each billing area actually receives. Belleville has 4 tax billing areas: Urban Belleville, Urban Cannifton, Rural Cannifton, and Rural Belleville.

Service rates for services such as policing, fire, transit, and streetlighting are applied separately.

For example, for residential fire services rural residents are charged 28% as much as urban residents due to the lower level of service:

- $0.00222554 in Urban Belleville

- $0.00063914 in Rural Belleville

Council approves final operating budget

All revenues and expenditures are listed in the budget document:

Progress is tracked and overages are reported to council

Operating budget project progress is reported at each Finance Committee meeting. Belleville’s Budget & Financial Controls Policy requires staff to report any net overages equal to or exceeding 10% and $50,000.

Leave a comment

All comments are reviewed prior to appearing on the site.

Rules: