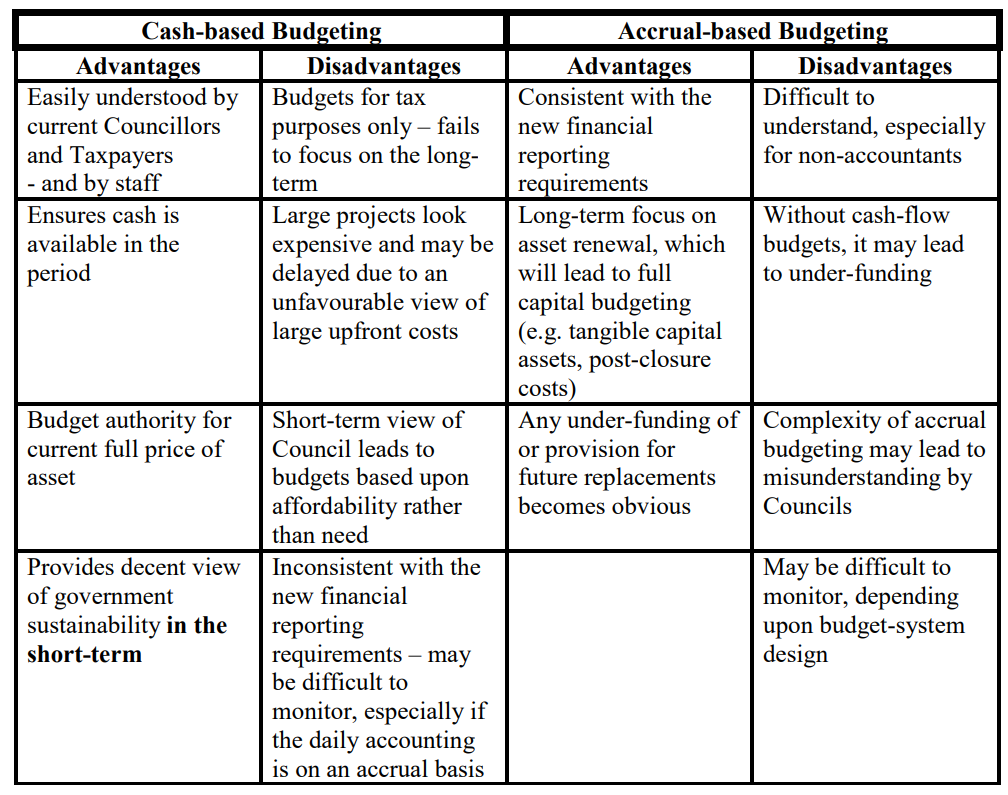

As of 2023, municipalities in Ontario prepare their budgets on a cash basis, while financial statements are prepared using the accrual-based accounting framework required by the Public Sector Accounting Standards, PSAS for all public sector entities.

Accounting standards to require municipal budgets and financial statements to align and connect with each other

On January 11, 2021, the Public Sector Accounting Board (PSAB) released 2 updates to public sector accounting standards for comment to respond to the need for understandable financial statements and improving accountability to the public, including the following changes:

- Relocating the net debt indicator to its own statement, providing the opportunity to better explain it.

- Separating liabilities into two categories: financial and non-financial. This would remove the liabilities that were muddying up the net debt indicator from the calculation and return the indicator to its original meaning – future financial resource requirements.

- Restructuring the statement of financial position to have a more familiar look to the public, reporting all assets together and all liabilities together.

- Removing the statement of change in net debt as a required statement, as it’s not well understood.

- Allowing the option to present the change in net debt along with the calculation of net debt if it provides good accountability information and can be made understandable. An explanation of what net debt means is also required.

- Requiring the budget amounts on the financial statements to be presented using the same basis of accounting, same accounting principles, for the same scope of activities, and using the same classifications as the actual amounts.

- Requiring that the reconciliation of the budget numbers reported on the operating statement with the approved budget, be understandable, if the actual and budget numbers are not prepared using the same basis of accounting, same accounting principles, for the same scope of activities, and using the same classifications.

PSAB also introduced new presentation concepts to promote the preparation of understandable financial statements, including:

- presenting complex items, transactions and other events as simply as possible

- demonstrating the relationship between different pieces of information

- evaluating presentation choices based on whether they add to or support the accountability value of the financial statements

- giving higher profile to matters of importance

- providing information at the appropriate level of detail

Cash-based vs Accrual-based accounting

Early adoption of these standards is optional, or mandatory in 2026

They will become effective for fiscal years beginning on or after April 1, 2026, but earlier adoption is optional.

Comments

We want to hear from you! Share your opinions below and remember to keep it respectful. Please read our Community Guidelines before participating.