Reserves and reserve funds are an important tool for a municipality’s long-term financial sustainability that can reduce the need for long-term borrowing or imposing sudden tax increases on current or future taxpayers.

They can be used to offset or set money aside money for:

- maintaining/controlling property tax rates if the economy suddenly takes a downturn

- unexpected expenses or revenue shortfalls

- onetime or short-term funding for special purposes

- uncontrollable but often predictable events like floods, forest fires and pandemics

- flexibility to deal with fluctuating cash flows

- capital projects (like road repairs)

Municipal reserve funds are either mandatory (required) or discretionary (optional):

- Obligatory (externally restricted) Reserve Funds are required by provincial legislation or contractual agreements and must be collected, set aside and used for their stated purpose. Examples include:

- Development Charge Reserve Funds as per the Development Charges Act

- Tax Rate Stabilization Reserve Fund

- Water, Wastewater & Stormwater Reserve Funds

- Discretionary (internally restricted) Reserves are an allocation of funds established by Municipal Councils through by-laws rather than provincial legislation. They can be specific to projects that are of a nature prescribed and managed by approval of Council for specific purposes. Councils can have flexibility to decide how the money is used. They are held in separately grouped bank accounts and receive an interest allocation. Examples are shown below.

Reserve funds can come from various sources including:

- Government grants

- Transfers from the operating budget

- Budget surpluses

Development Charge Reserve Fund

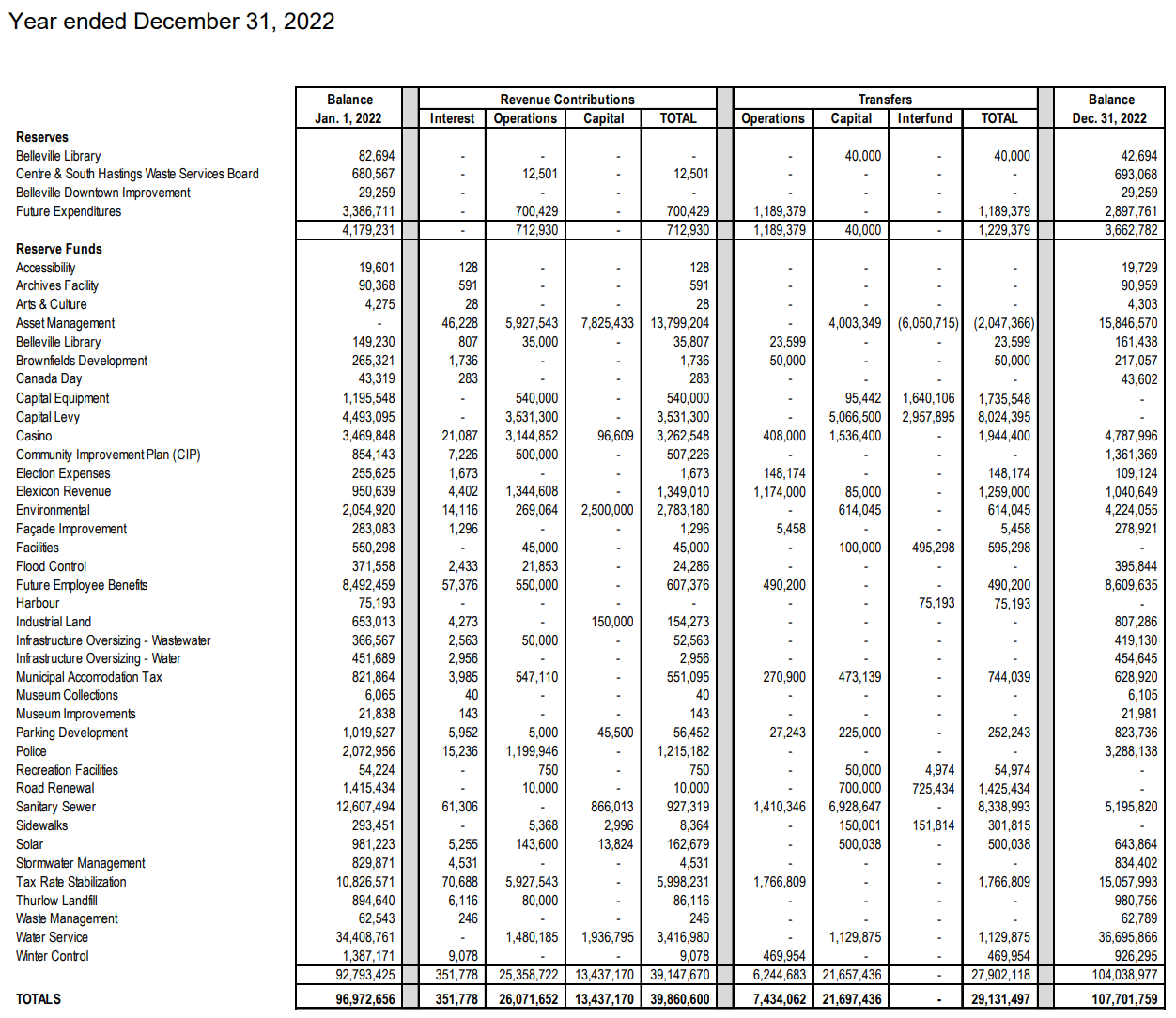

Section 43 of the DCA requires a municipality’s Treasurer to provide an annual statement of each Development Charge Reserve Fund, including opening and closing balances of the reserve funds and of the transactions relating to the funds. It must be posted the municipality’s website. For example, here is the City of Belleville’s Annual Treasurer’s Statement of Reserve Funds for Development Charges 2022.

Example reserve funds

For example, contributions to the Asset Management Reserve Fund are required to support current and future capital needs. Currently the Asset Management Plan is being updated to meet legislated requirements under O. Reg 588/17. Future increases and adjustments will be completed as updates are made to the City’s Asset Management Plan.

Comments

We want to hear from you! Share your opinions below and remember to keep it respectful. Please read our Community Guidelines before participating.