Here is how to find who owns a company incorporated in Ontario for as little as $3.

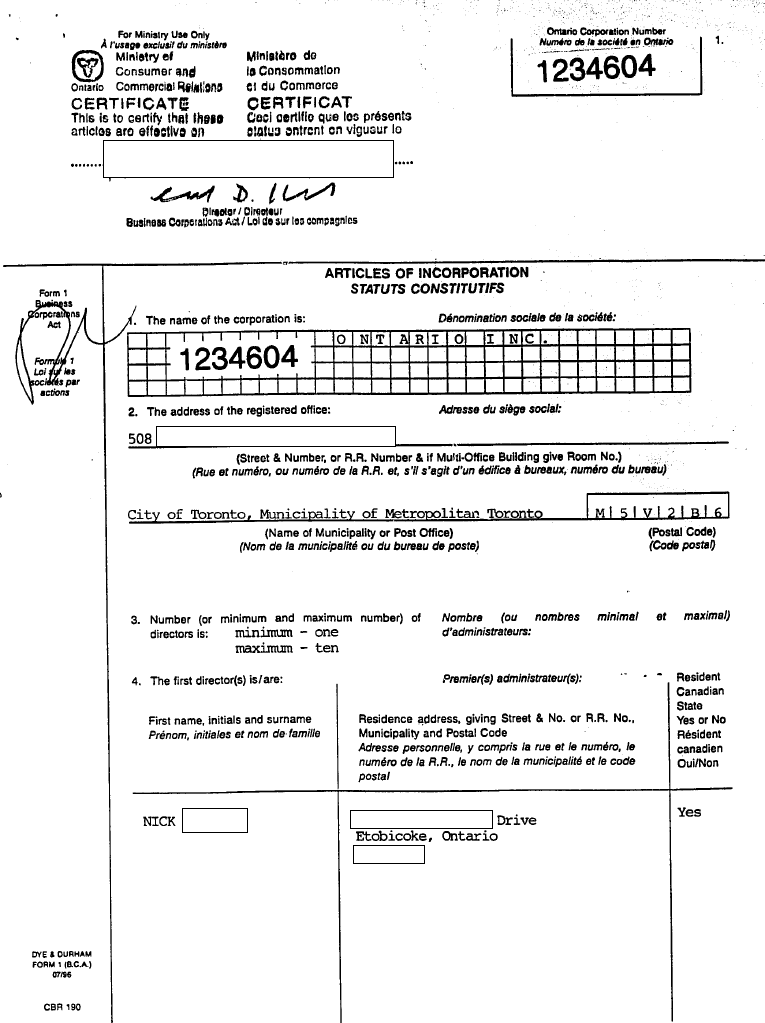

Request Articles of Incorporation from Ontario Business Registry

The Ontario Business Registry was established on October 19, 2021 and can be used to order a copy of the corporation’s Articles of Incorporation for $3 or a corporate profile report for $8.

- Go to My Ontario Account

- Log in or click Create Account to create an account. Alternatively you can click Sign-In Partner to log in with the Interac sign-in service by verifying your identity using your bank account.

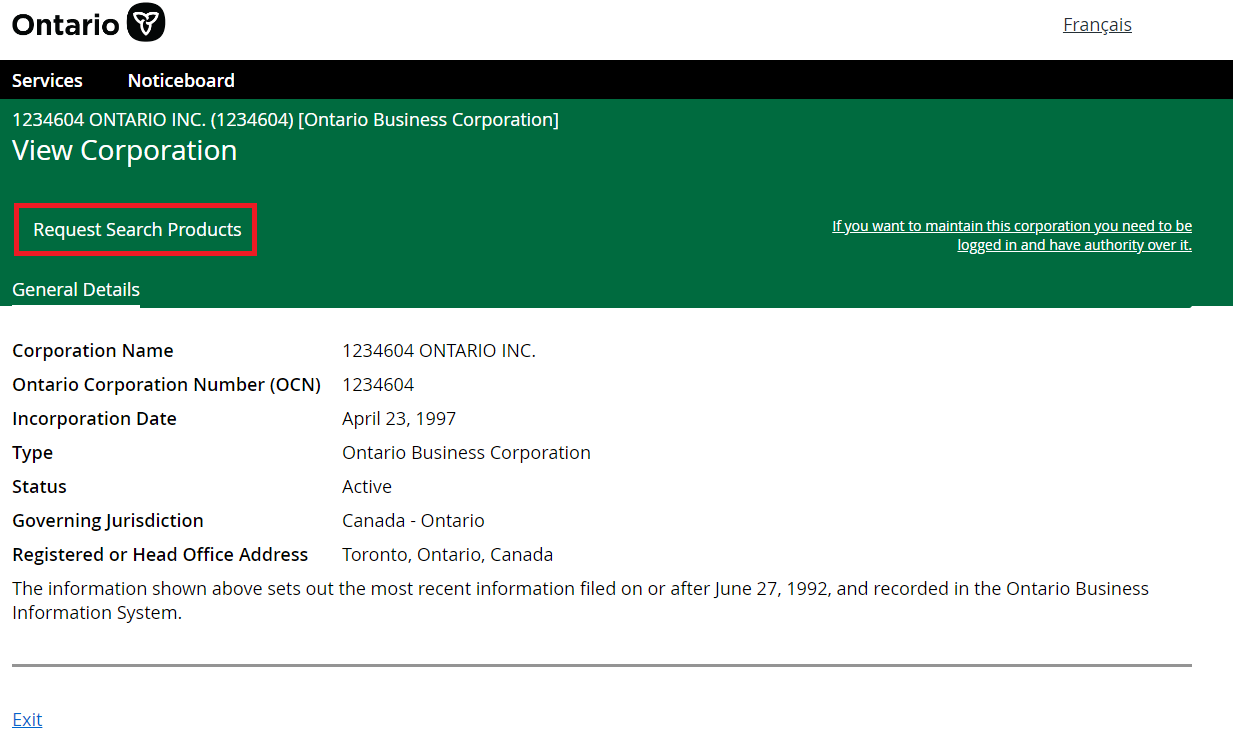

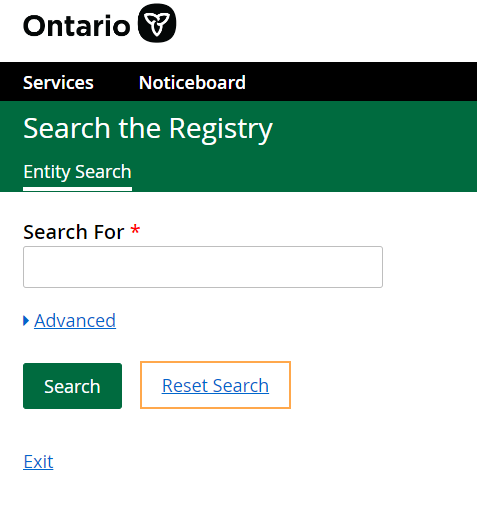

- Go to Search the Ontario Business Registry

- Search for an Ontario Corporation Name or Ontario Corporation Number (eg. “1234604 ONTARIO INC”)

- Click Request Search Products in the section with the green background

- Select from the Ministry (ordering from an authorized service provider will likely be faster, but more expensive. Ontario Business Central charges $12 and 1-10 business days, while from the Ministry it cost me $3 and took 6 weeks)

- Select Document Copies

- Document Copies cost $3 (some may be Fee Exempt) and includes the following details:

- Corporation Name/Ontario Corporation Number (OCN)

- Registered Office Address

- Municipality

- Director name(s)

- Director address(es)

- Director Canadian resident?

- Incorporator names and addresses

- Date of incorporation

- Profile Report costs $8 includes the following details:

- Ontario Corporation Number

- Ontario corporation name

- Head Office/Registered Office Address

- Mailing address

- Incorporation date

- Jurisdiction

- Corporate name history

- Corporation type

- Ontario corporation non-share

- Credit union

- Insurer

- Social club with share

- Social club non-share

- Co-op non-share

- Co-op with share

- Loan and trust corporation

- Condominium corporation

- Agencies, boards, commissions

- Non-filers

- Corporation status

- Active directors and officers

- Certificate of Status costs $26 and provides the current status of the corporation. It is available only for Ontario corporations or for Extra-Provincial foreign for-profit corporations.

- Document Copies cost $3 (some may be Fee Exempt) and includes the following details:

- Select Select all Documents

- Enter your email

- Click Request Documents

- Select Payment Method

- Enter payment information

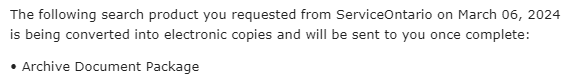

- Wait for ServiceOntario (~6 weeks in my experience) to convert the document into an electronic copy and email you a link to download the Articles of Incorporation

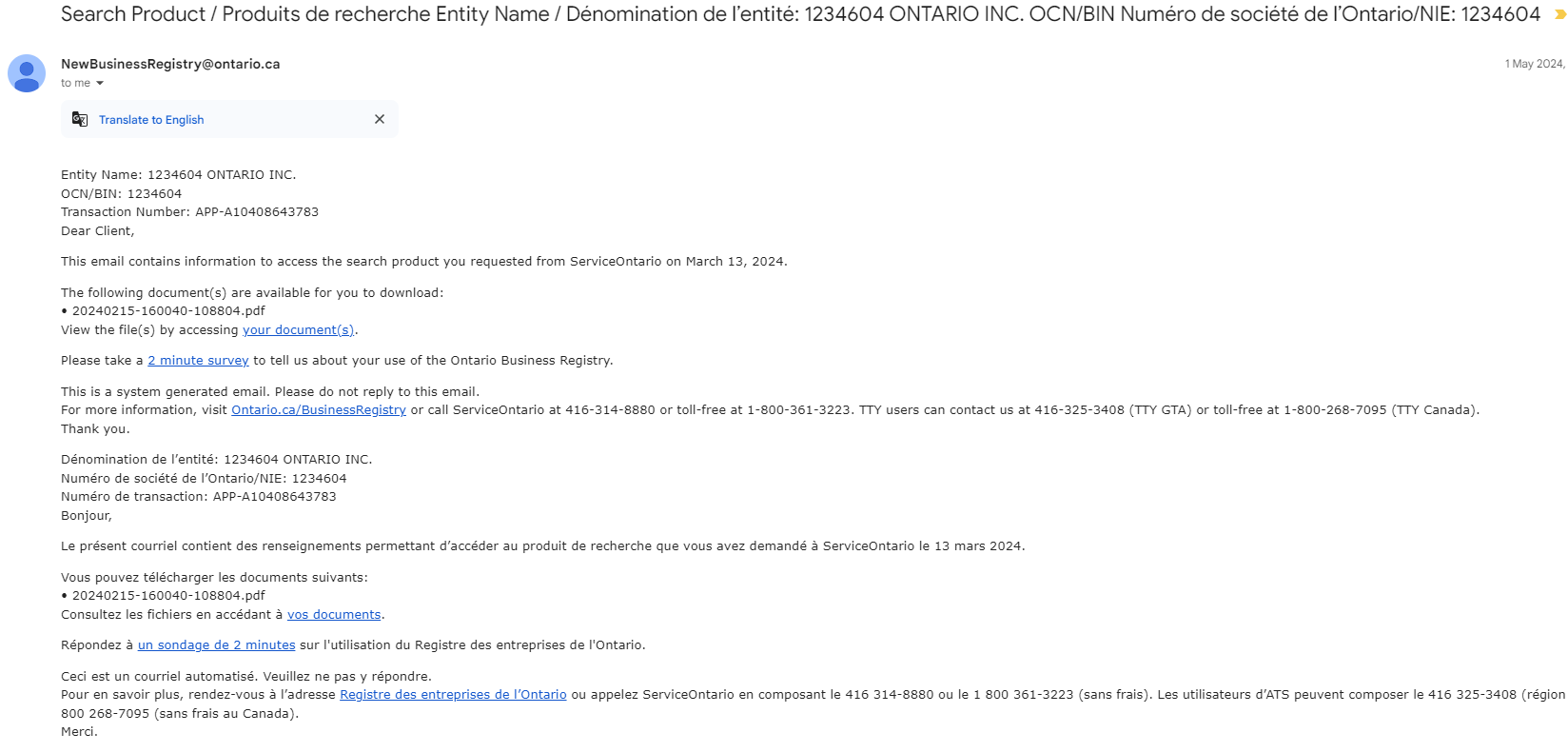

- Click the “your document(s)” link in the email and then click the link shown on that page to download the files

Steps in

Individuals with significant control registers not available to the public

As of January 1, 2023, privately-held corporations in Ontario are required to keep their beneficial ownership information, or “individuals with significant control” information, on file and to provide that information when requested by law enforcement, and regulatory and tax authorities. Public corporations and their wholly-owned subsidiaries are exempt from this requirement.

Registers will not be available to the public, however, the amendments permit disclosure of a corporation’s register to a number of inspecting officials, including law enforcement officers, tax officials and certain regulators.

Who is an individual with significant control?

An individual with significant control is someone who:

- owns, controls, or directs:

- 25% or more of the voting shares of the corporation or

- shares that are worth 25% or more of the fair market value of all outstanding shares of the corporation

- has direct or indirect influence over the corporation without owning at least 25% of the shares, or

- owns or controls a significant number of shares jointly with other people.

If a group of related persons collectively controls at least 25% of the shares of a corporation, then each person would be an individual with significant control.

A related person would include the individual and:

- their spouse

- their son or daughter

- any other relative living in the same house

What information must be kept on file?

For each individual with significant control, the corporation must keep the following information on file:

- Name, date of birth and last known address of each individual with significant control.

- Jurisdiction of residence for tax purposes.

- Day on which they became or stopped being an individual with significant control.

- Description of how the individual has significant control over the corporation, including a description of any interests and rights they have in shares of the corporation.

- Description of the steps the corporation takes to keep this information up-to-date each year.

When does it need to be updated?

The information must be updated:

- at least once a year and

- within 15 days of the corporation becoming aware of a change to any relevant information

The corporation must take reasonable steps to ensure that it has identified all individuals with significant control over the corporation and that the information in the register is accurate, complete, and up to date. If the corporation becomes aware of any new information referred to above, the corporation must record that information in the register within 15 days. Shareholders are required to comply with requests from the corporation for the information required to be included in the register promptly and to the best of their knowledge.

When were these rules introduced?

Introduced in late November 2021 and received royal assent on December 9, 2021, Bill 43 – Build Ontario Act made changes to the Business Corporations Act (OBCA) requiring certain private corporations incorporated in Ontario to prepare and maintain a register of individuals with “significant control” over the corporation.

These new rules are similar to those enacted for federally incorporated corporations in 2019 and have been introduced in British Columbia, Québec, Saskatchewan, Manitoba, Nova Scotia, PEI, and Newfoundland and Labrador. Other jurisdictions, including the United Kingdom and the European Union, have implemented similar transparency regimes.

What are the potential penalties for non-compliance?

Upon conviction of such offence, the director, officer or shareholder, as applicable, is liable to a fine not exceeding CA$200,000, or to imprisonment for a term not exceeding six months, or both.

Leave a comment

All comments are reviewed prior to appearing on the site.

Rules: