Many community programs and services are partially funded by user fees (what you pay to do the activity), while the rest is covered/subsidized by property taxes (homeowners).

Increasing user fees reduces the property tax subsidy required to fund a program or service – shifting the cost sharing from homeowners (via property taxes) to those who use the particular service (user fees).

Study findings

- Belleville 2024 user fee rates are below comparable municipalities.

- Users are not paying their share of the costs for programs and services that would expected based on how much the individual paying benefits compared to the community at large. In other words, programs are being overly subsidized by property taxes.

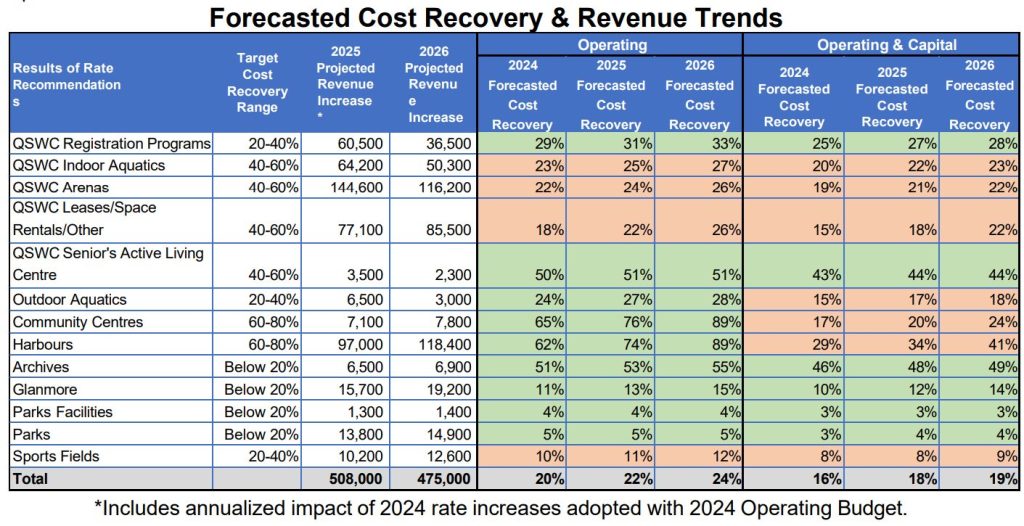

- Fee increases could increase revenues by $508,000 in 2025 and further increase $475,000 in 2026.

Proposed use fees

Current and recommended user contributions

| Program or Service Group | Assessed Level in Pyramid | Target Cost Recovery Range | Outliers/Comments |

|---|---|---|---|

| QSWC Registration Programs | Level 2 – Considerable Community Benefit | 20-40% | Adult fitness and sports are outliers that warrant lower municipal subsidization (Level 3). |

| QSWC Indoor Aquatics | Level 3 – Balanced Beneficiaries | 40-60% | Public swimming is an outlier that warrant higher municipal subsidization (Level 2) |

| QSWC Arenas | Level 3 – Balanced Beneficiaries | 40-60% | The Belleville Senators lease of the CAA Arena is an outlier that impacts overall arena revenue and expenses. |

| QSWC Leases/Space Rentals/Other | Level 3 – Balanced Beneficiaries | 40-60% | Advertising is an outlier in this category where little or no municipal subsidization should be required (Level 5). |

| QSWC Senior’s Active Living Centre | Level 3 – Balanced Beneficiaries | 40-60% | |

| Outdoor Aquatics | Level 2 – Considerable Community Benefit | 20-40% | Aquafit and private bookings are outliers that warrant lower municipal subsidization (Level 3). |

| Community Centres | Level 4 – Considerable Individual Benefit | 60-80% | Rentals by non-profit organizations is an outlier that warrants higher municipal subsidization (Level 2). |

| Harbours | Level 4 – Considerable Individual Benefit | 60-80% | |

| Archives | Level 1 – Mostly Community Benefit | <20% | |

| Glanmore | Level 1 – Mostly Community Benefit | <20% | |

| Parks Facilities | Level 1 – Mostly Community Benefit | <20% | Private/for-profit events and bookings are outliers that warrant lower municipal subsidization (Level 4) |

| Parks | Level 1 – Mostly Community Benefit | <20% | |

| Sports Fields | Level 2 – Considerable Community Benefit | While these types of sports would ordinarily be categorized in Level 3 in terms of their perceived community benefit and cost recovery, they have been categorized in this report as Level 2 because they require outdoor facilities that have shorter operating seasons, are impacted by weather, and require longer recovery periods for growth and maintenance. Adult soccer programs could be an outlier that warrants lower municipal subsidization (Level 3). |

As a point of reference, the United States National Recreation and Park Association’s (NRPA) 2024 Agency Performance Review found that the

average operating cost recovery rate in a survey of its 60,000 member agencies was around 25%, with median cost recovery rates higher than this amount for areas with under 100,000 residents was nearly 29%.

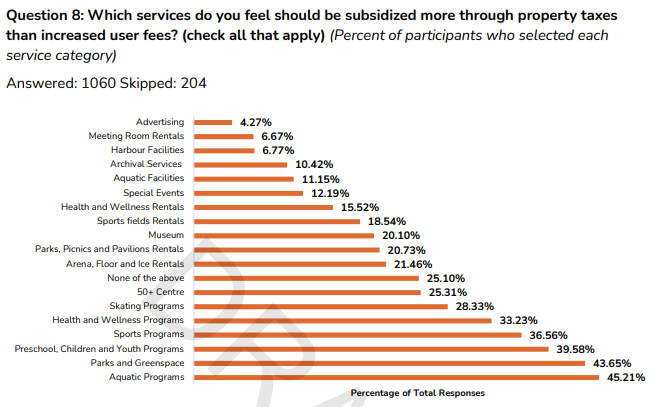

User fee survey results

The survey gathered 1,264 total responses.

- Over 70% of respondents were residents of Belleville, and over 60% had lived in the City for 10+ years.

- A large majority (84%) of respondents were homeowners, followed by about 10% being renters.

- While approximately 4% of respondents were below the age of 25, nearly 40% of respondents indicated that they had children. Of those with children, 46% have children that are 11 to 16 years old, and 48% have children that are 4 to 10 years of age.

- Regarding the most used services/programs, 59% selected parks and greenspace, 48% special events, 48% health & wellness programs, and 30% sports programs.

- The majority (49%) selected “other” when asked the reasons behind not using the services and programs offered by the City. Respondents highlighted limitations in senior and children’s programming, a shift towards online alternatives due to COVID-19, and personal circumstances like time constraints impacting participation in city programs. Additionally, concerns about program costs, access issues, and the need for a more accessible fee structure were prevalent, affecting the usage of City facilities.

- 69% of survey participants believe the balance between tax subsidies and user fees is appropriate. Regarding the statement that services benefiting the broader community should be funded by higher taxes instead of user fees, 41% agreed or strongly agreed, while 35% disagreed or strongly disagreed with this approach.

- Nearly 97% of respondents have not utilized the City’s Recreation Fee Assistance Program, with 70% unaware of its existence. Despite this, more than 67% strongly agreed/agreed with the idea of adjusting fees according to an individual’s life and financial situation.

Why was the study done?

Most of the City of Belleville’s parks, recreation and culture user fees have not undergone significant review or changes in recent years. The user fees for parks, recreation, and culture services, despite some minor adjustments, have remained stable since 2015. This is due to various factors, including the impact on users of the CAA arena renovation, results from fee comparisons with other municipalities and operational challenges created by the COVID-19 pandemic.

As part of the City’s Parkland and Recreation Master Plan approved in 2021, it was identified that a User Fee Study and Policy should be undertaken to address the appropriateness of the current level of cost recovery and to ensure prudent capital and operational planning. The 2023 review will include an assessment of the City’s existing user fee schedule, potential new user fees and the development of user fee-related policies.

What are examples of user fees?

Facilities and associated fees to be considered in the study include:

- Ice/floor surfaces and event fees

- Gymnasiums

- Aquatic facilities

- Multi-purposed spaces

- Playing fields, ball diamonds, parks, marina operations, community centres, museum services and more. In order to begin this process, Strategy Corp Inc. will engage stakeholders to develop recommendations.

More: Belleville User Fees

Timeline

September 23, 2024 – Council approves “Option 2 – Reduced Impact” in User Fees Study 5-4

- Councillor Lisa Anne Chatten raised concerns about increases to the marina fees and asked to delay the decision.

- Councillor Sean Kelly raised concerns about reduced enrollment brought about by higher fees, citing the importance for families to have a healthy, physical life and supported delaying the decision.

- Councillor Paul Carr raised concerns that amending the motion to “be received” would be akin to shelving the $50,000 it cost to produce the study which would not a good use of taxpayers money.

- Councillor Kathryn Ann Brown wanted to approve the original motion.

- Mayor Neil Ellis said he would propose adjusting the amendment so that it would return to council for consideration in a future meeting to avoid shelving it.

- Councillor Enright-Miller supported adjusting the proposed marina fees to make it more fair and equitable.

- Councillor Lisa Anne Chatten supported a friendly amendment to “until next meeting” or “for the purposes of further consultation”, saying her concern is that “there will be no revenue if no one can afford to use it”.

- Councillor Kathryn Ann Brown pointed out that the increased user fees will mean a property tax reduction of 0.2-0.3% in 2025 and again in 2026.

- Mayor Ellis raised a motion to table everything until the next meeting, seconded by Councillor Lisa Anne Chatten saying the waters were getting a bit murky.

- Recorded votes to table the motion, and amend the motion both failed 4-4.

- Councillor Garnet Thompson inquired about how much a 20% reduction to the increase to the marina fees would impact the costs of a typical 30 foot boat and proposed an amendment, which did not receive a seconder.

Property tax impact

By increasing the user fees, 19,000 households in the City of Belleville will have their property taxes reduced by:

- 2025 – 0.26%

- 2026 – 0.21%

August 8, 2024 – Staff explains why fees have not increased and are lower than comparator municipalities

Following completion of the major expansion of the Quinte Sports and Wellness Centre in 2012, ice fees were significantly increased in 2015, resulting in considerable negative reaction by clients and the departure of numerous groups. These departures resulted in excess capacity and a significant decline in related revenue. Because of this, ice fees were frozen (recreation program fees continued to be increased annually) while those of adjacent municipalities caught up with Belleville’s rates.

Then in 2016-17, the former Yardmen Arena underwent a major renovation in preparation for becoming the home of the Belleville Senators. Because of the many inconveniences imposed on clients by having to squeeze into only three arenas rather than four, the City chose not to increase ice fees during this period. Ice fees were held again the following year due to a decline in minor hockey registrations.

Just as program and revenue numbers once again began to grow, the COVID pandemic erupted in early 2020, which had a profound impact on the operations, revenue and cost recovery of all parks, recreation and culture programs. It also impacted public attitudes and goals related to health, employment and mobility, which has led to higher salaries and employee shortages. Operating costs for Belleville’s programs and services have increased while some programs, especially for adults, are still lagging behind due to staff shortages and lower registrations, which affect revenue and cost recovery.

Staff Report by Director of Community Services

August 8, 2024 – City of Belleville 2024 Draft User Fees Study finds even after 2024 fee increases, some fees are still too low

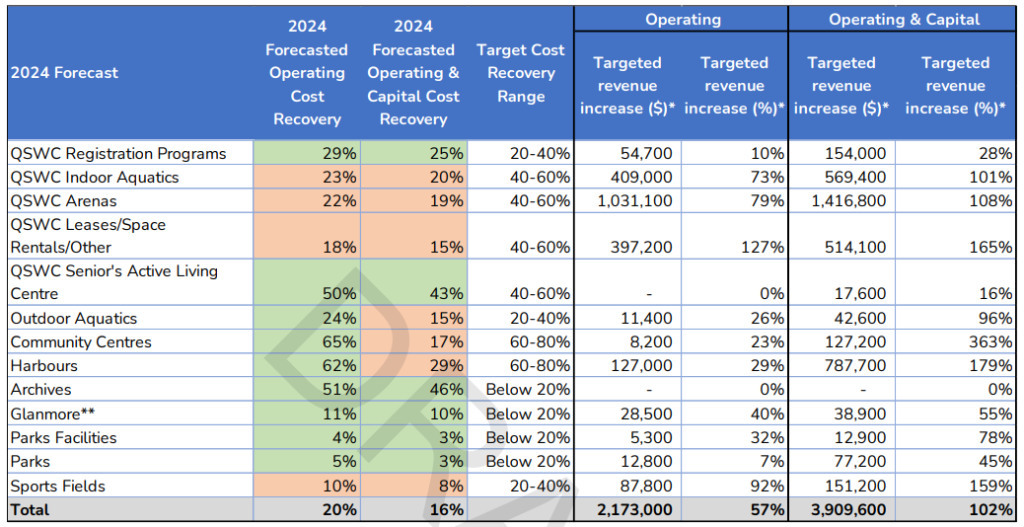

After an extensive analysis, the Study concludes that even after the fee increases enacted in the 2024 Budget, there remain a number of gaps between Belleville’s current fees and optimal fee levels.

While the Study documents the specific details of the gaps and the specific recommendations, the bottom line is that it recommends some significant fee increases in both 2025 and 2026 (see Appendix A in Study). These increases will raise the City’s cost recovery rates which will

simultaneously reduce the level of taxpayer subsidy. The increases will also better align the City’s fees with those of similar and nearby municipalities.

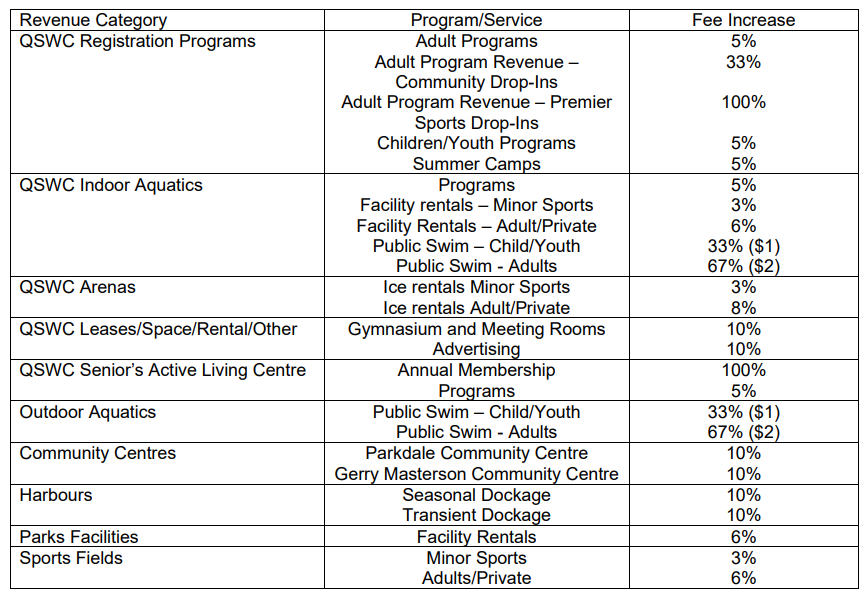

Recommended increases

Property tax impact

By increasing user fees, for 19,000 households in the City of Belleville, property taxes will be reduced by:

- Option 1 – User Fees Study Recommendations

- 2025 – 0.34%

- 2026 – 0.30%

- Option 2 – Reduced Impact (Recommended)

- 2025 – 0.26%

- 2026 – 0.21%

- Option 3 – Reduced Impact and Longer Rollout

- 2025 – 0.24%

- 2026 – 0.18%

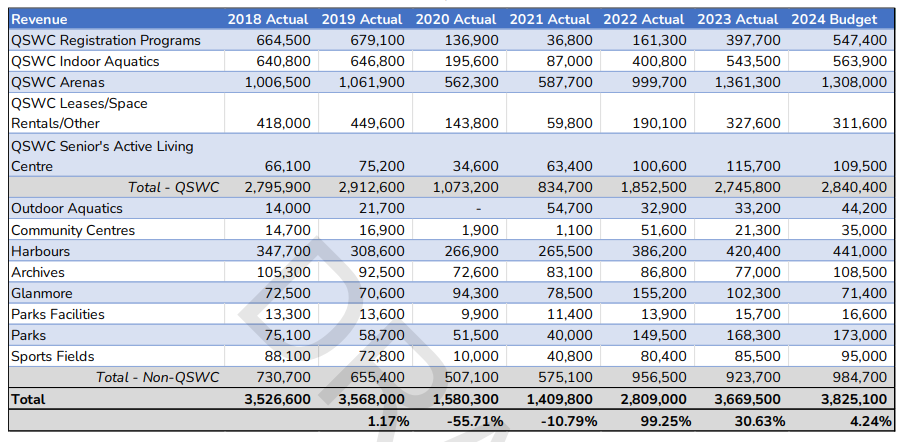

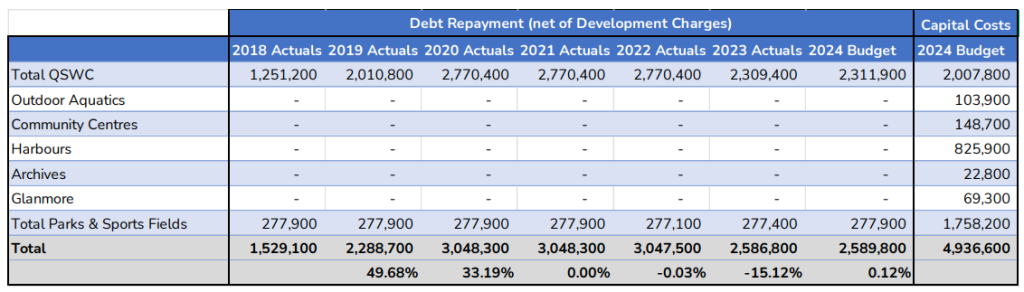

Parks revenue 2018 to 2024

Parks capital costs and debt 2018 to 2024

The study was made available for public comment here: 2024 User Fees Study Survey

Council increases user fees in 2024 ahead of study results

The complexity of the review process, combined with an expedited budget schedule, meant the 2024 Operating Budget had to be approved by Council prior to the completion of the Study. Nevertheless, the preliminary findings of the study were available and pointed convincingly toward the need for fee increases. Based on that early information, and given the rising costs of operations, the City chose to incorporate numerous fee increases into the Budget for implementation at different dates throughout 2024. The result was an estimated revenue increase of $210,000 in 2024 with an annualized increase of approximately $300,000. The following table highlights the general approach to those increases.

March 2024

A final report with recommendations to Council was slated for November 2023, but as of April 2024 the report has not yet been finished.

The City is still working with the consultant on the User Fee Review.

February 1, 2024 – Operating Budget survey results

Feedback received by 707 respondents through the City’s preliminary draft operating budget survey highlighted a desire to prioritize non-discretionary service areas funded by the City’s property tax levy. This engagement strategy helped to shape the 2024 Operating Budget

guidelines that were approved by Council, the most significant being:

- That the overall residential property tax rate increase should not exceed 5%; and

- That the 2024 draft operating budget consider the service areas prioritized through public input received.

January 30, 2024 – Draft user fees indicate Belleville’s fees are lower than comparator communities

Although the user fees review is not yet complete, an early draft of the consultants’ findings and recommendations suggest that many of Belleville’s fees are lower than its local and provincial comparator communities. Therefore, the consultants will be recommending that the City increase those fees.

January 9, 2024 – Interviews and surveys completed

According to City staff, as of January 9, 2024, all the interview and surveys had been completed, and the consultants were working on some additional benchmarking with other municipalities. A draft report was expected in the next couple of weeks. From there the project team/staff will review the draft report and then it will be finalized with a report going to Council. Part of this process will include a communication out to all our stakeholders/user groups.

October 2023 – User fee review survey

The User Fee Survey ran until October 6, 2023. It received 1,264 responses.

July 2023 – Staff select Strategy Corp Inc. to conduct a comprehensive user fee review

In July 2023, City staff engaged project consultant Strategy Corp Inc. to conduct a comprehensive user fee review to evaluate the City’s current fee schedule and property tax subsidization rates against comparable municipalities and industry standards. The consultant conducted interviews with key stakeholders and surveyed residents as part of the review.

2022 – Council allocates $50,000 from Tax Rate Stabilization Fund for User Fees Study

In line with the Parks and Recreation Masterplan Recommendation #29, the City allocated $50,000 in the 2022 Operating Budget funded by the Tax Rate Stabilization Fund to undertake a comprehensive User Fee Study and Policy to outline a sustainable basis for reducing municipal subsidy on activities where possible and supporting ongoing subsidy where appropriate.

Comments

We want to hear from you! Share your opinions below and remember to keep it respectful. Please read our Community Guidelines before participating.