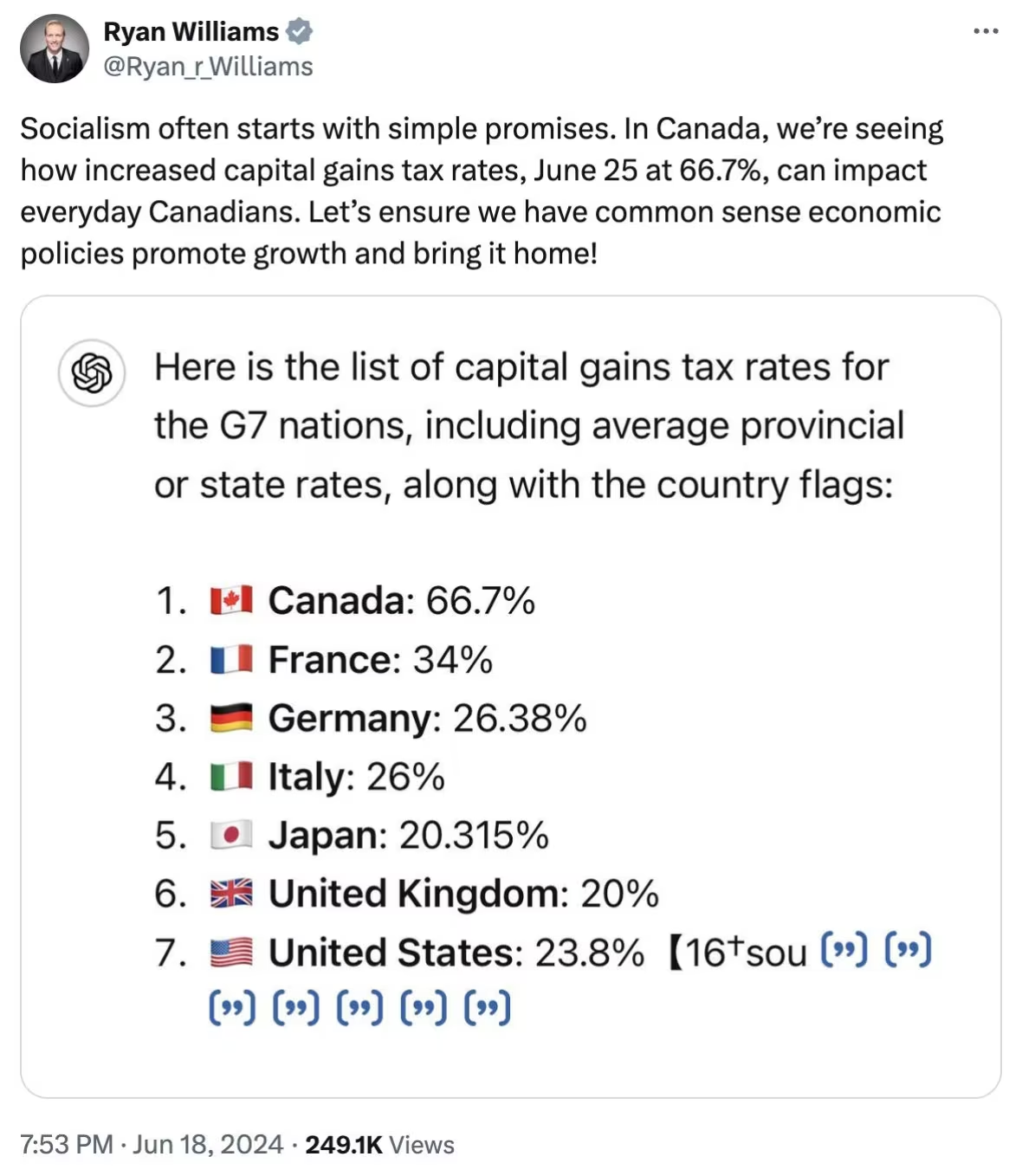

On June 18, 2024, MP Ryan Williams shared an inaccurate and misrepresented list of capital gains tax rates to his social media. The tweet was seemingly from a screenshot a screenshot of a ChatGPT response. The post received more than 250k views before being deleted shortly thereafter.

Corrections

- Canada – 66.7% is the capital gains inclusion rate, not than the capital gains tax rate. The capital gains tax rate ranges from 10% to 26.76% for the first $250,000 of gains in a single year and – depending on your income tax bracket.

- France – Flat tax rate of 30%. 34% only applies to individuals earning more than €177,106 ($261,501 CAD)

- Germany – 26.375% (correct)

- Italy – 26% (correct)

- Japan – 20.315% (39.63% for properties held for 5 years or less)

- United Kingdom – Income up to £50,270, 10% on your gains (or 18% on residential property and carried interest). Above that amount, 20% (or 24% on residential property and 28% on carried interest).

- United States – 0% to 20% maximum federal tax for assets held for more than 12 months. 20% is for gains over $459,750 USD. Shorter term capital gains are taxed as regular income. Some states do not tax income or capital gains, including Florida, Nevada and Texas, but most tax capital gains as ordinary income, ranging from 2.9% to 13.3% (California, which is the highest).

Canada’s increase to the capital gains inclusion rate

On June 25, 2024, the capital gains inclusion rate in Canada was increased from 50% to 66.67% for:

- Individuals on the portion of capital gains realized in the year that exceed $250,000

- Corporations and trusts

and after deducting any:

- current year capital losses (assets sold for less than the price they were purchased for)

- capital losses of other years applied to reduce current-year capital gains (losses can be carried forward indefinitely and applied in any future tax year)

and only if the following exemptions do not apply:

Exemptions

- Principal residence sale exemption

- Inheriting a deceased’s principal residence

- Capital gains in Tax Free Savings Accounts (TFSA)

- Capital gains in First Home Savings Accounts (FHSA)

- Lifetime Capital Gains Exemption (LCGE)

- proposed Employee Ownership Trust Exemption

- proposed Canadian Entrepreneurs’ Incentive

Who does change this affect?

The federal government estimates that 28.5 million Canadians will not have any capital gains income in 2025, while three million others will fall below the $250,000 annual threshold, suggesting that these changes will not have an impact on the majority of Canadians.

The change affects all corporations and trusts regardless of value. It also affects individuals with capital gains of $250,000 or more, commonly those who:

- Sell a secondary property – such as a cottage, rental or investment property – and earn more than $250,000 in profit from that sale.

- Sell investments for a value of $250,000 more than the original purchase price.

How an individual’s capital gains tax rate is calculated

Calculating capital gains tax in Canada requires a couple simple calculations. It depends on the inclusion rate and your personal marginal tax rate:

Capital Gains Tax Rate = Your Marginal Income Tax Rate x Capital Gains Inclusion Rate

For individuals in situations where no exemptions apply, for gains of up to $250k the inclusion rate is 50%, above is 66%:

- Before June 25, 2024, all capital gains were subject to a 50% capital gain inclusion rate means that half (50%) of your capital gain is added to your taxable income. Half (50%) of your gains are tax-free.

- After June 25, 2024:

- Capital gains from $1 to $250k in a single year: No change. A 50% capital gain inclusion rate means that half (50%) of your capital gain is added to your taxable income. Half (50%) of your gains are tax-free.

- Capital gains above $250k in a single year: A 66.67% capital gain inclusion rate means two-thirds (66.67%) of your capital gains will be added to your taxable income. One-third (33.33%) of your gains are tax-free.

An individual in Ontario making the highest marginal income tax bracket (all income over $246,752 per year is taxed at 53.53%):

- Their first $250k in capital gains each year are taxed at 50% x 53.53% = 26.76%

- Any capital gains above $250k in the same year are taxed at 66.7% x 53.53% = 35.7% (the maximum tax rate on capital gains in Canada)

Note: In Australia, a 66% inclusion rate would be called a “33% capital gains discount“.

For comparison, employment income has a 100% inclusion rate. There is no exempted tax free portion.

Example: $250,000 capital gains

- Income from your full-time job is $75,000

- You make a $100,000 profit from the sale of your rental property (after you pay real estate fees, closing costs, etc.)

- 50% of the profit is taxable, which means you add $50,000 to your income during the tax year in which you realized this capital gain

- $75,000 + $50,000 = a total income for that tax year of $125,000

- Your total marginal rate is 43.41% and 50% of that is 21.7%, your “capital gains tax rate”

Example: $1 million capital gains in a single year

Assumptions:

- You live in Ontario

- Your gross income is over over $246,752, putting you in the highest marginal tax bracket

- The highest marginal tax bracket is 53.53%

- You realized $1 million in capital gains in one year (Stocks, Investment Property, Cottage, etc.)

- You had initially invested $500,000

| Line Item | Before | After (new inclusion rate) |

|---|---|---|

| Principal Amount | $500,000 | $500,000 |

| Capital Gains | $1,000,000 | $1,000,000 |

| Inclusion Rate 1 | 50% of total | 50% up to $250,000 |

| Inclusion Amount 1 | $500,000.00 | $125,000.00 |

| 53.53% Tax on Inclusion Amount 1 | $267,650 | $66,912.5 |

| Inclusion Rate 2 | N/A | 66.67% of $750,000 |

| Inclusion Amount 2 | N/A | $500,025 |

| 53.53% Tax on Inclusion Amount 2 | N/A | $267,663.38 |

| Total Tax Owed | $267,650 | $334,575.88 |

| Total Take Home | $1,232,350 | $1,165,424.12 |

The change to the capital gains inclusion rate on gains over $250,000 means that on 1 million dollars of capital gains in a single year, would mean an extra $66,925.88 in taxes.

MP Williams: capital gains tax rate too complicated for an AI to figure out

A week later, MP Williams posted a thread that seemed to acknowledge the mistake and indicate that the capital gains inclusion rate was too complicated for an AI to figure out:

Coverage and discussions

- Conservative MP shares inaccurate, ChatGPT-generated stats on capital gains tax rate – CBC

- AI causes problem for MP – Quinte News

- r/Canada

- r/CanadaPolitics

Open Council commentary

My email to MP Ryan Williams:

Good morning Mr. Williams,

The inaccurate and misrepresented list of capital gains tax rates to your social media. https://www.cbc.ca/news/politics/conservative-tweet-capital-gains-chatgpt-1.7244186 which received more than 250k views.

I understand that mistakes happen, but this one seems to indicate that your office/staff does not fact-check your social media posts before they are published. I say this because it is immediately obvious that the graphic is incorrect to anyone who understands how the capital gains inclusion rate works.

My concerns are that you and/or your staff:

- Asked ChatGPT to provide the statistics. ChatGPT is a language model, not a fact model. It’s like asking someone something; and if they don’t know the answer they say whatever sounds the best; facts be damned. From OpenAI’s website: It might sound right but be wrong. Sometimes, ChatGPT sounds convincing, but it might give you incorrect or misleading information (often called a “hallucination” in the literature). This seems to indicate a misunderstanding of how the tool works.

- Did not check ChatGPTs response to confirm the accuracy of the statistics. ChatGPT provided links to sources, and it is not difficult or time consuming to double-check the tax rates for 7 countries.

To me, this says that you may be less concerned about facts, happy to share something that pushes the narrative you want, and possibly misunderstand how the capital gains inclusion rate works.

One of the last things Canada needs right now is more misinformation or disinformation.

Social media posts should not be shared without an attempt to verify their accuracy, and those who spread misinformation just to dunk on their political opponents, are part of the problem, not the solution.

My question is: what steps have been taken since this incident to ensure that your social media posts will be accurate and factual going forward?

My request is: that you re-publish an accurate list of the tax rates of the 7 countries to show where Canada actually stands to educate your followers who you have misled.

I look forward to hearing from you.

I will update this post if I receive a response.

Comments

We want to hear from you! Share your opinions below and remember to keep it respectful. Please read our Community Guidelines before participating.