What is the Therme Spa project?

In 2017, the Wynne government issued a Request for Proposals for Ontario Place redevelopment and a bid from Therme Group was one of the shortlisted submissions. However, after the 2018 Ontario provincial election, the Ford government restarted the selection process.

The 2019 Call for Development received 34 bids, and the Ford government signed a Lease Agreement with Therme Canada OP Inc. – a private Austrian company – allowing them to build a 65,000 square metre, 7-storey indoor private wellness facility (spa) and waterpark on the publicly-owned lands of West Island of Ontario Place and operate it for up to 95 years.

Therme Group is a spa and waterpark development company founded in Vienna, Austria in 2011 by Robert C. Hanea, Chairman and CEO of the company. Theme Group is a subsidiary of A-Heat Allied Heat Exchange, a Vienna-based conglomerate specializing in engineering heat systems.

Other bids came from Cirque du Soleil, Strom Nordic Spa, Badenhaüs Spa and two other projects titled OP Adventure Park and The McLuhanesque Experience.

To expedite the project, the Ford government passed Bill 154, New Deal for Toronto Act enacting Rebuilding Ontario Place Act, exempting it from laws that apply in the:

and shielding the Ford government from any claims for damages arising from the project, including breach of contract.

What is Ontario Place?

Ontario Place was an Ontario-themed park that opened on May 22, 1971 and operated until 2012 when the Government of Ontario announced that it would close for redevelopment. It was re-opened as parkland and Budweiser Stage and the Cinesphere continued to operate.

It was protected under the Ontario Heritage Act in 2014 and given the highest level of protection – provincial heritage property of provincial significance – reserved for heritage sites in need of the most stringent protection.

2.9 million people visited in 2022 and operations produced a record $5.7M profit.

Investment commitments

Ontario

Ford government will invest at least $532M to $675M:

- $200M (Infrastructure Ontario) to prepare the site – they’ve invested “hundreds of millions” as of October 2024

- $307M (Infrastructure Ontario) to $450M for a five-story, 2,000 space underground parking lot, in addition to 600 new ground-level spaces according to 2022 costing guidelines by Altus Group suggesting underground parking can amount to $470 a square foot to build. As of October 2024, the estimate is now $800M for an underground lot or $125,000 per underground stall.

- $25M “Landlord Contribution” in the Lease Agreement for flood mitigation, shoreline repair measures, and extending a public trail across the West Island before Therme starts building, including:

- $15M for Shoreline Components

- $10M for Therme Public Area Components

Ontario required to provide at least 1,800 parking spaces

2,700 parking spots are needed to support the three tenants of the redeveloped Ontario Place: Therme Canada, Live Nation and the Ontario Science Centre.

Ontario must provide at least 1,800 parking spaces by the “Parking Facility Completion Date”, which is the earlier of:

- December 31, 2030, and

- completion of construction by Live Nation of its new facility

Ontario will pay a penalty to Therme of $5 per parking space – indexed for inflation – for every day the parking spaces are not available to Therme (a “Parking Facility Event of Default”) after that date up to a maximum of $30M total (the “Landlord LD Maximum Liability Cap”).

Therme

In 2023, Therme said it will invest $450M:

- $350M to build the 65,000-square-foot private-access spa building, and

- $100M to develop the public-access portions.

In 2024, the Ford government said Therme Canada will invest $700M:

- $500M to build the 8.4 acre waterpark facility

- $200M for lake infill, shoreline works, and to create 16 acres of freely accessible public parkland, gathering spaces, trails, parkland, gardens and a new beach. Therme can conduct commercial activity on up to 30% of this parkland according to the Lease Agreement as long as they are “year-round, inclusive and diverse, family-oriented, indoor and outdoor aquatic facilities focused on fun, health, wellness and relaxation”

Therme must spend $7.5M to advertise the project in return for rent reduction

Therme must spend $7.5M to advertise the project to the public in the first 6 years of operation. In return, inflation adjustments of minimum rent don’t kick in until Year 3 and additional performance-based rent isn’t charged until Year 6:

- Inflation Factor Holiday – Inflation adjustment of minimum rent doesn’t kick in until year 3

- Performance Rent Holiday – Performance Rent doesn’t kick in until year 6.

Ontario gives Therme a rent subsidy/reduction as long as they use some of it to advertise their business. Ontario has a vested interest in the project being a financial success. They are forgoing some rental revenue to promote the project.

Open Council commentary

Return on investment estimates

Ontario

- $1.96B over the 95 year term according to Ford government estimates

- $1.1B in rent

- $855M to maintain the lands

The province expects to receive a minimum of $17M in Annual Provincial Tax Revenue from the project.

Rent and maintenance payments depend on Therme being profitable for 95 years.

Net Present Value (NPV) analysis

The Province’s “fact sheet” boasts that the province will recover $1.96 billion in rent and maintenance payments over the life of the lease. It calls the payments nominal, which means they are in current rather than constant dollars. Any economist knows that, for a valid comparison of today’s dollars and future dollars, the payments should be in constant dollars. In addition, future payments should be discounted to take into account the time value of money, or the fact that money in hand today can be invested.

Sandford Borins, Professor of Public Management Emeritus at the University of Toronto

Net Present Value calculations help determine whether a project or investment is expected to generate value over time by comparing the values and costs of an investment in present-day dollar values using a “discount rate” to account for the time value of money. A NPV greater than zero generally indicates the investment will be profitable.

In Canada, the real social discount rate (SDR) – often set at 3% to 5% – is a common benchmark used in Canada for public sector investments to account for the opportunity cost of public funds, long-term economic growth, and inflation adjustments.

Using a 3% discount rate: $580M back in present value

Based on our calculations (Therme Spa Lease Agreement Financial Analysis), the Ford government plans to invest $525-675M now to receive $580M back in present value, plus an estimated $128M in GDP and 800 jobs, assuming a 3% discount rate and the business were to operate for the full 95 years and grow by 3% per year (land value and Therme revenue).

If rent were maximized by the project bringing in at least $100M in revenues from the first year (operating 365 days of the year, 3096 visitors a day/1.1M per year, spending $100 after-tax), which would mean a total of up to $746M back in present value.

Using a 5% discount rate: $380M back in present value

A standard discount rate to analyze public sector investments is 5% according to Professor of Public Management Emeritus at the University of Toronto Sandford Borins.

Using a 5% discount rate instead, the government plans to invest $525-675M now to receive $380M back in present value, plus an estimated $128M in GDP and 800 jobs assuming a 5% discount rate and the business were to operate for the full 95 years and grow by 3% per year (land value and Therme revenue).

Property tax (Toronto)

Therme must pay all applicable property taxes, corporate taxes, sales taxes and any other fees due as any other company would.

Provincially-owned property is exempt from regular property taxes under Section 3 of the Assessment Act, but the Government of Ontario makes Payment-in-Lieu of Taxes (PILTs) to municipalities.

The City of Toronto charged Ontario Place Corporation about $1M in payments in lieu of taxes (PILT) per year from 2019 to 2023. Therme’s new facilities would likely increase the assessed value of the property as determined by MPAC and therefore increase the property taxes owed.

In 2000, MPAC classified the Ontario Place:

- parking lot (851 Lake Shore Boulevard West) as Commercial, given that the property is used and operated as a parking lot; and, subject to Payment-in-Lieu of Taxes (PILTs) given that the property is owned by an agency of the Crown;

- the portions of the property occupied by commercial tenants and the amphitheatre as Commercial Taxable (CT) for 1998-2000 tax years. Due to a regulation change MPAC correctly converted these taxable components to Commercial PILT (CP) for 2001and subsequent years;

Lease Agreement summary

Once the Therme is operating, if they go under, they get to look for a buyer for 2 years, and if they can’t find one Ontario will buy their business for 50% of its value, minus 4 months rent and some other fees and penalties.

If Therme stops declares bankruptcy, they must:

- Pay $250K for a Tenant Event of Default

- Be given 2 years to sell or assign the Lease to company(s) of equal or greater financial capability to operate or repurpose the Project.

- If successful, they keep the proceeds and Ontario can can recover damages for Material Tenant Event of Default

- If unsuccessful, Ontario pays them 50% of the Fair Market Value of the Project (estimated payment of $35M at Year 10), net of appraisal costs and costs to bring Project to a marketable state. The 50% discount on the buyout is instead of the liquidated damages owed to Ontario. Get back any unused portion of the $5M deposit.

- Pay 4 months of Base Rent (the “EOB Rent”) (estimated total of $800,000 at Year 10), deducted from Ontario’s purchase of the Project at 50% of its value ($35M), for a net payment by Ontario to Therme of $34.2M.

However, if Ontario wants out of the deal, they have to pay to for a full replacement elsewhere and if that doesn’t work out, pay Therme the cost of the facility (depreciating starting Year 15) plus highest 5 years profits.

If Ontario wants to cancel the agreement, they must:

- Wait until Therme has operated for at least 10 years

- Give 5 years notice to Therme of the intent to cancel

- Attempt to find an alternative site for a replacement facility

- If a site is agreed upon:

- Pay Therme an amount equal to their previous year’s profit and the cost to build a replacement facility (the “Replacement Cost of the Facility”), increased by inflation

- Adjust rent at the new facility to account for impact to profits

- Let Therme operate at the existing location for up to 5 years

- Pay to demolish the building and not be allowed to use the lands until it’s demolished.

- If a site is not agreed upon:

- Pay Therme the depreciated cost of the facility (straight line from Year 15 to Year 75), increased by inflation, and

- Pay Therme the 5 highest years worth of profits before taxes and depreciation, out of the last 10

- Let Therme can continue to operate at the existing location for up to 5 years

- Pay to demolish the building and not be allowed to use the lands until it’s demolished.

Summary

- Land is valued at roughly $3.5M per acre. There are approximately 16 acres of Core Land that Therme can operate on valued at around $55 million.

- Minimum Rent is 3.5% of the land’s value, which is adjusted for inflation annually starting in 3rd year of operations. Starting rent will be around $2M per year.

- Performance Rent is an additional 2.45% of core gross revenues starting in the 6th year (doesn’t include Therme Public Area Gross Revenues raised from commercial activity on up to 30% of the Therme Public Areas). Ontario estimates will be $2.07M in 2034, so Therme is estimated to have $84.5M in Core Gross Revenue.

- Maximum rent is 8% of the land’s value.

- Land value will be re-assessed after 20, 40 and 60 years of operation.

- Public will have “unrestricted access to the waterfront at all times” while within the leased area.

- Facility is expected to contribute $128M to Ontario’s GDP and create 800 jobs once fully operational.

Details

- Tenant: Therme Canada OP Inc.

- Land: 21.88 acres at Ontario Place, 851 and 955 Lake Shore Boulevard West, Toronto

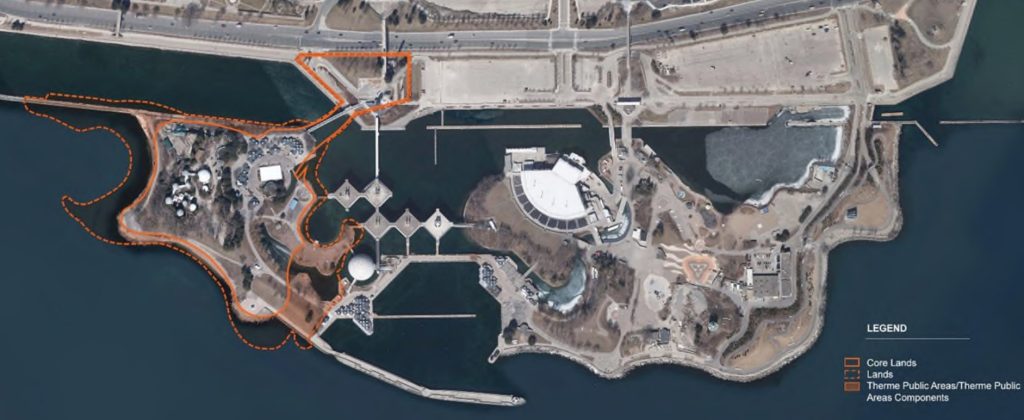

- Core Lands: the land on the West Island, not including the publicly-accessible waterfront Therme Public Areas. The government estimates the ~16 acres of land is valued at around $55M ($3.5M per acre)

- Therme Public Areas: Shoreline and beaches accessible to members of the general public without paid admission. Therme can conduct commercial activity on up to 30% of the gross area.

- Uses: Tenant must operate a thermal spa and indoor and outdoor aquatic facility, and is not allowed to operate any other business on the site, such as a casino or shopping mall. See “Permitted Use”.

- Subletting: Tenant may sublet up to 25% of the gross floor area of the building(s) or the land itself to a third party. See “Permitted Third Party Subletting”.

- Tenant may sublet up to 40% of the land, project, or lease to affiliated persons (i.e., related entities) See “Permitted Programming Arrangements”.

- Term: 75 years, with tenant option to extend by 20 years for a total of 95 years. The lease is set to begin in 2025.

- Deposit: Tenant must provide a $5M cash deposit or letter of credit

- Rent: means the sum of all Base Rent and Additional Rent:

- Base Rent is payable as follows:

- First 2 years – Minimum Rent of 3.5% of $3.5M per acre of Core Lands, not subject to Adjustment

- Years 3-5 – Minimum Rent of 3.5% of the land’s value indexed to inflation in Ontario and re-valuated by 2 independent valuators every 20 years (the “Minimum Rent Indexed Land Value”)

- After year 5 – the sum of:

- Minimum Rent of 3.5% of the Minimum Rent Indexed Land Value (Ontario estimates will be $1.95M in 2032), and

- Performance Rent, the greater of:

- 2.45% of annual Core Gross Revenues (excluding sales tax) (Ontario estimates will be $2.07M in 2034), not including rent, and

- zero.

- to a maximum rent of 8% of the “Base Rent Ceiling Indexed Land Value”.

- Base Rent Ceiling Indexed Land Value and means:

- $3.5M per acre of Core Lands increased by the Consumer Price Index [for Ontario] annually up to a maximum of 3%, then

- in Year 20, 40 and 60 (the “New Rent Commencement Dates”), the fair market value of the Core Lands is determined by the Tenant and Landlord each appointing a qualified independent valuator and taking the average of the 2 valuations if they are within 10%.

- Base Rent is payable as follows:

- Gross Revenues

- Core Gross Revenues means Gross Revenue from or related directly to the Core Lands, whether paid for at the Core Lands or otherwise. Where Gross Revenues come from or relate directly in part to the Core Lands and in part to the Therme Public Areas, they shall be allocated between as Core Gross Revenues and Therme Public Area Gross Revenues on an appropriate basis in full and without duplication.

- Therme Public Area Gross Revenues means Gross Revenues that are not Core Gross Revenues. Revenues from the commercial activity on up to 30% of the Therme Public Areas

- Minimum Rent Indexed Land Value is

- as of the Index Commencement Date, $3.5M per acre of Core Lands increased by the Consumer Price Index [for Ontario] annually (the “Inflation Factor”)

- as of each New Rent Commencement Date, the fair market value of the Core Lands is determined by the Tenant and Landlord each appointing a qualified independent valuator and taking the average of the 2 valuations if they are within 10%. For greater certainty, if the Inflation Factor is negative, the Minimum Rent Indexed Land Value will not decrease.

- Additional Rent means any payment of any kind, other than Base Rent, required to be made by the Tenant under this Lease, whether or not designated as “Additional Rent”.

- Quarterly Statements: Tenant must report their Gross Revenue (broken down by Core Gross Revenues and Therme Public Area Gross Revenues) to Ontario 4 times per year to calculate Performance Payments.

- Annual Reports: Tenant must provide their audited financial statements to Ontario every year.

Damages

Ontario defaults

If Ontario defaults on the Lease Agreement (a “Landlord Event of Default”), including:

- Failure of Ontario to pay the Landlord Contribution

- Failure to comply with Applicable Law

- Restricts access of Therme or its invitees to the premises

- Failure to maintain Other Public Areas

- A Parking Dedicated Spaces Default

- Failure to fulfill other obligations under the Lease, other than a Material Landlord Event of Default

they must pay Therme $250K, indexed to inflation. Ontario’s maximum liability for these, as well as failure to provide parking for the Term of this Lease is $30M (the “Landlord LD Maximum Liability Cap”, which can be reset every 15 years). If this process is not followed, Therme can take Ontario to court for any unpaid amounts.

Therme defaults

If Therme defaults on the Lease Agreement (a “Tenant Event of Default“), including:

- Failure to pay rent and sales tax for more than 5 days

- Stopping operations

- Declaring bankruptcy

- Selling its assets

- Failure to comply with Applicable Laws

- Restricts access of the public to Therme Public Areas

- Defaulting on loans to third party lenders for over 30 days

- Failure to fulfill other obligations under the Lease, other than a Material Landlord Event of Default

they must pay Ontario $250K indexed to inflation, for each event up to a maximum liability for defaulting during the Term of this Lease of $30M (the “Tenant LD Maximum Liability Cap”, which can be reset every 15 years.). If this process is not followed, Ontario can take Therme to court for any unpaid amounts.

Terminations

During the preliminary period (16.13 Termination for Convenience)

If Therme ends the agreement between the Lease Date and Regime Change Date (when first building/excavation permit excavation permit for construction is issued), they would have to pay Ontario $5M, indexed to inflation.

If Ontario ends the agreement between the Lease Date and the Regime Change Date, they would have to pay Therme $30M, indexed to inflation.

Ontario’s option to terminate (17 Landlord’s Option to Terminate) (some have called the “poison pill”)

After the first building/excavation permit is issued (the “Regime Change Date”, estimated to be in 2025), unless Therme defaults, Ontario can only terminate the Lease after Therme has operated for 10 years, with 5 years notice. In this case, Ontario and Therme must attempt to find an alternative site for a replacement facility and agree on a Replacement Cost of the Facility.

If the site is agreed upon and secured:

- Ontario must pay Therme an amount equal to their previous year’s profit and the cost to build a replacement facility (the “Replacement Cost of the Facility”), increased by inflation

- Rent at the new facility will be adjusted to account for impact to profits

- Therme can continue to operate at the existing location for up to 5 years

- Ontario must also pay to demolish the building and isn’t allowed to use the lands until it’s demolished

If a site is not agreed upon within 18 months:

- Ontario must pay Therme:

- Depreciated cost of the facility (straight line from Year 15 to Year 75), increased by inflation, and

- 5 highest years worth of profits before taxes and depreciation, out of the last 10

- Therme can continue to operate at the existing location for up to 5 years

- Ontario must also pay to demolish the building and isn’t allowed to use the lands until it’s demolished.

Termination by Ontario if Therme defaults

Otherwise, Ontario can only terminate the agreement if a “Material Tenant Event of Default” or “Material Tenant Construction Event of Default” occurs and has not been cured during the cure period, including:

- Failure to pay rent or sales tax for more than 30 days

- Event of Bankruptcy – dissolved, liquidated or has its existence terminated or has any resolution passed therefor; or makes a general assignment for the benefit of its creditors or a proposal under the Bankruptcy and Insolvency Act

- Abandonment or attempted abandonment of the Project following Completion of Construction of the Project

- Ceasing to operate the Project anytime after completion for more than 30 consecutive Business Days

Then Therme must do the following based on the project’s status:

- Lease period (between Lease Date and the Regime Change Date) – Lease terminates, pay $5M and forfeit the $5M deposit

- Preliminary period (between Regime Change Date and the Construction Commencement Date) – Lease terminates, pay $30M and forfeit the $5M deposit

- Construction period (between Construction Commencement Date and Envelope Completion)

- Sell the Project to one or more companies of equal or greater financial capability to operate or repurpose the Project within 2 years and Ontario will then collect damages.

- If unsuccessful, the Lease terminates, and must pay $30M and demolish the partially completed Project

- After main facility construction (after Envelope Completion)

- Sell the Project to a company equal or greater financial capability to operate or repurpose the Project within 2 years and keep the proceeds. Ontario will then collect damages from the new owner.

- If unsuccessful, the Lease terminates and Ontario must pay Therme 50% of the Fair Market Value of the Project (the “Material Default Termination Amount”) to buy the facility and Therme must provide all details needed for Ontario to complete construction. The Parties have agreed that the fifty (50%) percent discount on the Fair Market Value of the Project constitute liquidated damages for any damages that the Landlord may have incurred.

- Bankruptcy after “Completion of Construction” – Pay 4 months of Base Rent (the “EOB Rent”) deducted from the Material Default Termination Amount Ontario must pay Therme (see above) to buy the facility.

See: 16.2 Right to Terminate for a Material Tenant Event of Default and 16.9 Remedies for a Landlord Event of Default

Termination by Therme if Ontario defaults

Therme may terminate the Lease if a “Material Landlord Event of Default” occurs and has not been cured during the cure period, including Ontario’s failure to obtain:

- Title to the land

- Construction Licenses

- Zoning Approval

- Heritage Determinations

- EA Approvals

- Acquisition of Rights

Then the Lease terminates and Ontario must then pay $30M, index by inflation (the “Landlord Material Default Termination Damages”) and return the $5M deposit.

See: 16.9 Remedies for a Landlord Event of Default and 16.10 Remedies for a Material Landlord Event of Default

If Ontario hits the $30M Maximum Liability Cap in any 15 year period and doesn’t agree to reset it:

- Before 10 years, Therme can terminate the Lease and be paid $5M

- After 10 years, Therme can terminate the Lease and must be paid

- Depreciated cost of the facility (straight line from Year 15 to Year 75), increased by inflation, and

- 5 highest years worth of profits before taxes and depreciation, out of the last 10

Timeline

October 16, 2024 – Ontario NDP files complaint with Ontario Integrity Commissioner about Infrastructure Minister Kinga Surma

Note: The Integrity Commissioner of Ontario has the power to investigate complaints received from one MPP regarding the activities of another MPP. The Act does not provide for complaints to be received from the public.

We’re deeply concerned about what seems to be a pattern of preferential treatment

I think there’s enough evidence now that we’ve seen the lease that we obtained and some other additional information through freedom of information to make the case that there is a reason for the integrity commissioner to dig a little deeper

The evidence suggests that Therme received preferential treatment, and its private interests were improperly furthered, as a result of decisions for which Minister Kinga Surma is ultimately responsible

Ontario NDP leader Marit Stiles

October 3, 2024 – Ontario estimates new Ontario Place will get 6 million visitors a year, or 16,500 a day

Michael Lindsay, CEO of Infrastructure Ontario, said the estimation was made in consultation with subject-matter experts.

For reference, here is how many visitors other attractions get:

- Ontario Place (2012 when it closed) – 300K

- CN Tower – 1.8M

- Ontario Place (2022) – 2.9M (concerts, Cinesphere, Inflatable Waterpark, Cirque du Soleil, marina, walking through the park)

- New Ontario Place – 6M (Infrastructure Ontario estimate)

- Chimelong Water Park in Guangzhou, China – 3M

- City of Niagara Falls – 12M

October 3, 2024 – Ontario Releases Theme Spa Lease Agreement

Government had spent “hundreds of millions” to get the site ready for the private company to build.

Infrastructure Ontario CEO Michael Lindsay

August 30, 2024 – Ontario Place Development application form says the province may select a proposal that did not meet

The province may select a party which did not submit a response to this Process to Seek Development Concepts or whose response did not meet the requirements.

The Province shall become the owner of all programming, concepts and ideas contained within such response and/or Submission

They’re putting in place a process that is clearly designed to ensure one particular outcome… this is a very expensive project that frankly nobody asked for. A private, luxury spa in downtown Toronto in a space that lots of people love very dearly.

Ontario NDP leader Marit Stiles

December 6, 2023 – Auditor General releases Science Centres Value-for-Money Audit

The 2023 cost/benefit analysis used to support the decision to relocate the Ontario Science Centre did not include all costs for

both options assessed—relocation and the rehabilitation of the current site.A business case prepared by Infrastructure Ontario in March 2023 with assistance from an external consultant incorporated a cost/benefit analysis that concluded the relocation would save the Province $257 million (net present value) over a 50-year period, which is consistent with the 2016 business case. This analysis was included in the April 2023 proposal to government decisionmakers. In our review of the cost/benefit analysis, we found that costs for both options were not fully identified and determined.

For example, financing, transaction and legal costs projected under the public-private partnership (P3) model to design, build, finance and maintain (DBFM) the new site at Ontario Place were not included in the analysis. Similar costs for the repairs and upgrade of the science centre were also not included, since an assessment for the delivery model for the repairs and upgrade of the current site was not done.

At the time of the finalization of this report, Infrastructure Ontario informed us that it was reassessing whether the DBFM model would be the approach used for the project. In addition, the incremental parking costs were not included in the cost/benefit analysis.

December 6, 2023 – Bill 154, New Deal for Toronto Act enacts Rebuilding Ontario Place Act, 2023, shields the Ontario government from legal trouble

Rebuilding Ontario Place Act, 2023 gives the Ontario Minister of Infrastructure (currently Kinga Surma) sweeping powers to expedite Ontario Place redevelopment.

It exempts the project from laws in the:

It shields the Ford government from any claims for damages related to the redevelopment of Ontario Place:

No remedy

(2) Except as otherwise provided under section 4, in an order under section 13 or in a regulation under clause 19 (c) [relating with City of Toronto property], if any, no costs, compensation or damages, including for loss of revenues or loss of profit, are owing or payable to any person and no remedy, including but not limited to a remedy in contract, restitution, tort, misfeasance, bad faith, trust or fiduciary obligation, any equitable remedy or any remedy under any statute, is available to any person in connection with anything referred to in subsection (1) against any person referred to in that subsection.

It forces the City of Toronto to sell (expropriates) the 16 acres it owns at Ontario Place to the province. The parcel of land, which runs parallel to the Lake Ontario shoreline, is at the foot of Dufferin Street and south of Lakeshore Boulevard West.

November 3, 2023 – Toronto and Ontario deal to advance shared priorities, gives Ontario the authority to advance Ontario Place Rebuilding Project

The City acknowledges that while city officials have not had sufficient time to complete their review of the Development Application the Province must provide project approvals by December 31, 2023 or it will otherwise be in legal breach and put millions of taxpayer dollars at risk.

The City acknowledges the changes made by the Province and its partners regarding the proposed Ontario Place Rebuilding Project and its associated initiatives, such as:

- Refinements to the planned design of the facility, including reducing its height and overall size, and increasing the amount of free and accessible public realm space.

- The Province agreeing to change its current planned location for parking at the Ontario Place site and work with the City to establish an alternative parking solution at Exhibition Place that will improve public access to the shoreline at Ontario Place and could reduce the overall area needed for parking.

- The Province agreeing to discuss partnership opportunities with the City for maintaining public, community-oriented science programming at the legacy Ontario Science Centre. The City accepts that the Province has the authority to advance all project approvals and intends to assume ownership of identified City-owned properties necessary to enable site access and servicing for the

rebuilding project, and appropriately compensate the City for these lands.

November 3, 2023 – Auditor General says they will conduct a value-for-money audit into the re-development of Ontario Place to be released in December 2024

The Office of the Auditor General is conducting audits for both Ontario Place and the Ontario Science Centre

As these audits are currently in progress, we cannot comment on them further.

Spokesperson for the Office of the Auditor General

October 16, 2023 – Procurement process had no Fairness Monitor, which is standard for large procurements to ensure fairness and integrity

October 13, 2023 – Ford government refuses to publish Ontario Place’s annual reports since 2018, despite being legally required to do so

Internal research confirms that Ontario Place Corporation has submitted reports beyond 2018. The annual reports for 2019 and 2020 have been received by the Ministry of Infrastructure but they have not been made public. Ontario Place Corporation – a public entity – is obligated to publish their reports on their website, however, until they are approved by the Ministry, the reports remain confidential.

October 5, 2023 – Former Toronto Police Chief Mark Saunders received $70,000 to hold a weekly meeting as Special Advisor on Ontario Place development

September 24, 2023 – Therme Canada says they have no ties to Ares Management

Background: In 2022, the Ford family sold the US branch of their label business US DECO Chicago to Resource Label Group LLC, which is owned by the alternative investment firm Ares Management. Therme’s current CFO (Adrian Ion) hired in September 2019 was a Financial Director for Ares Management from 2017-2019.

June 6, 2023 – Ontario Place Chair informs Infrastructure Minister Kinga Surma that 2.9 million visited Ontario Place in 2022 and produced a record $5.7M profit

Since then, Minister Kinga Surma has continued claim that Ontario Place is “not being used“, that people “do not enjoy the space anymore“, and that the project is being done “so that Ontarians can enjoy the lands once again“.

February 24th, 2023 – Toronto NDP MPPs call for audit of deal in support of Ontario Place For All, Waterfront For All and Architectural Conservancy Ontario’s request

This agreement is cloaked in secrecy

Ontario Place has a long and rich history and a place we should be celebrating, not handing over to the highest bidder. The government’s plan has exempted itself from the Environmental Protection Act. What do Ontarians get from this 99-year lease with a mysterious foreign company? Doug Ford is binding Ontarians to something today and potentially generations into the future.

NDP MPP Kristyn Wong-Tam (Toronto Centre)

December 5, 2022 – Ontario Place For All, Waterfront For All and Architectural Conservancy Ontario request the Auditor General conduct a value-for-money audit

November 2022 – Infrastructure Ontario report says redevelopment estimated to cost around $200M in public funds

Summer 2022 – A now-outdated proposal of Therme’s spa was projected to have the capacity for up to 3 million visitors per year

July 30, 2021 – Ford government selects Therme Group, Live Nation and Écorécréo Group for Ontario Place redevelopment

- Live Nation is a publicly-traded company merger of Live Nation and Ticketmaster owned by Liberty Media Corporation.

- Écorécréo is a Montreal company founded in 1998 that develops and operates creative, outdoor and environmentally friendly activities.

February 25, 2021 – Former Toronto Police Chief Mark Saunders appointed as special advisor to Ontario Place

January 28, 2021 – Infrastructure Ontario had plans to build a parking garage by Therme’s entrance at Ontario Place 6 months before Infrastructure Ontario announced that they were the successful bidders of the project on July 30, 2021

Ontario NDP has obtained FOI documents from Infrastructure Ontario that show plans to build a parking garage by Therme’s entrance at Ontario Place The document is dated January 28, 2021, which is six months before Infrastructure Ontario announced on July 30, 2021, that Therme, Live Nation, and Écorécréo Group were the successful bidders for this project, nearly two years before the public learned about the below-grade parking garage in late 2022.

July 17, 2020 – Theme lobbyist emailed Infrastructure Ontario bid evaluation team to warn them of imminent media coverage

December 2019 – Ontario Place Call for Development Assessment Report says 7 of the 34 other bids came from Cirque du Soleil, Strom Nordic Spa, Badenhaüs Spa and two other projects titled OP Adventure Park and The McLuhanesque Experience

Infrastructure Ontario recently agreed to release a list of seven of the 34 bidders for Ontario Place without explaining why the seven were selected and the rest of the report was withheld.

May 28, 2019 – Ford government launches Call for Development submissions to reinvent Ontario Place

July 2, 2018

Provincial officials had selected a shortlist of three private companies from more than 20 proposals to rebuild the one-kilometre long complex, but were unable to finalize a deal before the writ was dropped in May

The top 3 shortlisted submissions out of 20 proposals were:

- Therme, a spa-and-waterpark company which would have included a new beach.

- Ken Tanenbaum, vice-chairman of Kilmer Van Nostrand and Co. and son of Maple Leaf Sports & Entertainment Ltd. chairman Larry Tanenbaum for the construction of an educational campus and a large park.

- Film industry development that would have included soundstages and an interactive tourist attraction.

September 25, 2017 – Therme lobbyist Riyaz Dattu lobbies City of Toronto officials regarding “Therme Canada wishes to seek a site to build a wellness centre”

June 2017 – 7.5 acre Trillium Park and 1.3 kilometre William G. Davis Trail open

Feb. 23, 2017 – Therme North Inc. and Therme Group Canada Inc. incorporated in Canada

Former Swimming Canada CEO Pierre Lafontaine as the sole other director listed on the businesses’ original registration filings.

July 7, 2017 – Wynne government issues Request for Proposals for Ontario Place redevelopment

The government wants privately-led development to redevelop the site. The land will continue to be publicly owned and operators will be given a long-term lease.

Public access to the site must be preserved and there can be no casinos, residential development or large-scale music events.

May 19, 2014 – Wynne government’s describes vision for rebuilding Ontario Place

The Liberal vision for revitalizing the shuttered amusement park site includes an “urban park,” a waterfront trail, a year-round music venue and an unspecified “cultural attraction,”

Critical reception

Without the spa, there might have been a more modest redevelopment of Ontario Place, renovation of the Ontario Science Centre in Don Mills, and more money spent on low-to-moderate income housing and healthcare. The Therme Spa is Doug Ford’s vanity project for Toronto, his exaltation of the body at rest and immersed.

Sandford Borins, Professor of Public Management Emeritus at the University of Toronto

Sources

- Therme Canada Lease Fact Sheet – Infrastructure Ontario

- Who helped Therme secure Ontario Place – The Trillium

- How Therme landed with Ontario Place – The Trillium

- What is the source of Therme’s Financing? – Spacing

- Amid 865 trees coming down, Province releases 95-year lease with Therme – Canadian Architect

- Ontario Place Revitalization – Infrastructure Ontario

- Ontario Place redevelopment – Government of Ontario

- EngageOntarioPlace.ca by the Government of Ontario has a Document Library

- Ontario Place: A Better Idea – Ontario Place for All

- Ontario Place Redevelopment – City of Toronto

Leave a comment

All comments are reviewed prior to appearing on the site.

Rules: