In 2017, the majority of councillors and heads of council in Ontario were paid less than $40,000 per year.

The average council salary in small communities sits between $12,000 and $15,000 a year.

In Belleville, which had a population of 55,071 in 2021, councillors (part time) made $34,694.16 plus $244.08 in taxable benefits in 2022, while the mayor (full time) made $111,619.04 plus $5,944.25 in taxable benefits according to the Remuneration and Benefits By-law.

Compare that to Hamilton, which had a population of 579,200 in 2017, where councillors made $97,357.26 and the mayor made $184,662.66 (full time) the same year. In 2020, they made $100,486.40 and $190,594.61 respectively.

How much council members are paid and for what work varies by municipality. Larger municipalities are more likely to pay their councils a salary, and smaller municipalities are more likely to pay an honorarium or stipend.

Reimbursed expenses

Belleville pays the mayor an additional $400 monthly as an estimate for travel expenses within the municipality. Members of council are reimbursed for reasonable expenses incurred while acting in their official capacity and an allowance of $0.52 per kilometer for use of their personal vehicle on municipal business.

Hamilton reimburses members of council’s expenses for business events, travel, hospitality, seminars, conferences and other business expenses incurred during the conduct of approved City of Hamilton business. This includes event tickets (fundraisers, galas, dances), business lunch meetings, $75 per diem for travel within Canada and $100 USD per diem for travel outside Canada. In 2020, the Mayor of Hamilton was reimbursed $3,574.10 for a flight to a mayors’ event, business meetings and fuel charges.

Benefits and pensions

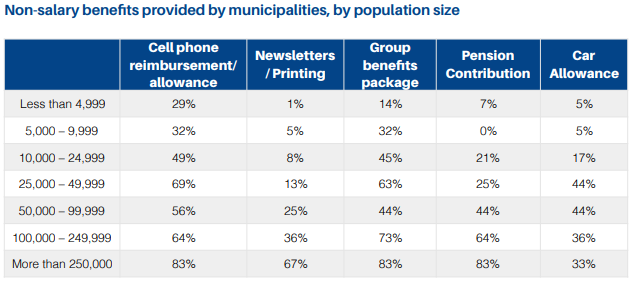

Larger municipalities are more likely than smaller ones to provide optional benefits such as life and dental insurance, cell phone reimbursement or a pension contribution.

The majority of municipalities provide mileage reimbursement, travel expenses, and dedicated funding for attending conferences, training

and professional development. Reimbursement or an allowance for cell phones are offered by 40% of municipalities, while group benefits are offered by 33%.

Approximately 16% of municipalities provide a pension contribution, while 14% provide a car allowance, and 8% provide a budget for printing newsletters and other materials.

As of 2019, Belleville pays for 100% of the premium for Life, AD&D, Extended Health, Travel, Semi-Private and Dental Insurance of the members of council.

Ontario Municipal Employees Retirement System (OMERS)

In addition to hearing, vision, and dental benefits and travel, life, and disability insurance, Hamilton council members participate in the Ontario Municipal Employees Retirement System (OMERS) alongside permanent full-time City of Hamilton employees (for whom enrolment is mandatory).

They contribute a percentage of their earnings from every paycheque and receive a lifetime pension protected against inflation starting as early as age 55 (early retirement) up to 65.

In 2022, the contribution rates were 9% of earnings up to the Canada Pension Plan (CPP) earnings limit also referred to as the Year’s Maximum Pensionable Earnings (YMPE) – and 14.6% of earnings over that limit. These contributions are tax deductible under the Income Tax Act, which means that when they are deducted from your gross income, they reduce the amount of taxable income you will owe for that tax year (similar to contributing to an RRSP). Member contributions are matched 100% by the City of Hamilton.

The payout amount is based upon the average annual income during the five consecutive years during which you had the highest earnings and years of service and is calculated as follows:

1.325% x credited service years (up to a maximum of 35) x “best five” average earnings.

For example, if a Hamilton Councillor served for 12 years (3 terms) on council and retired in 2022 at the age of 65, their annual OMERS pension would be roughly:

1.325% x 12 x $100,000 = $15,900

No longer a tax-free portion

At the beginning of 2019, the federal government removed a perk for elected officials that had been around for 70 years: that 1/3 of their salary be tax-free. Members of council’s salaries were made to be fully taxable – effectively resulting in an immediate pay cut initiated by the federal government.

Many councils responded by voting to give themselves a raise – typically in accordance with how much their pay was cut, which depended on what tax bracket they were in.

Continuing the example, Belleville members of council raised their pay enough to keep their take-home pay the same. Councillors in Hamilton had already removed the perk back in 2015, voting in favour (8-5) of making their pay full taxable and increasing their salaries accordingly.

This change made by the federal government effectively took money from municipalities (increased salary expenses) and gave it to the provincial and federal government (through taxed owed on the salaries)

- Increased the municipalities annual expenses by eg. $37,398 (Belleville), $434,245 (Hamilton) per year

- The federal and municipal governments collects the added income tax revenue created by the increased salaries

- Increases councillors’ pensions which are based on pensionable income to the tune of $1,453 per councillor and $3,074 for the mayor (Hamilton) for each year of service on council. For long-serving members, that’s pretty significant.

Comments

We want to hear from you! Share your opinions below and remember to keep it respectful. Please read our Community Guidelines before participating.