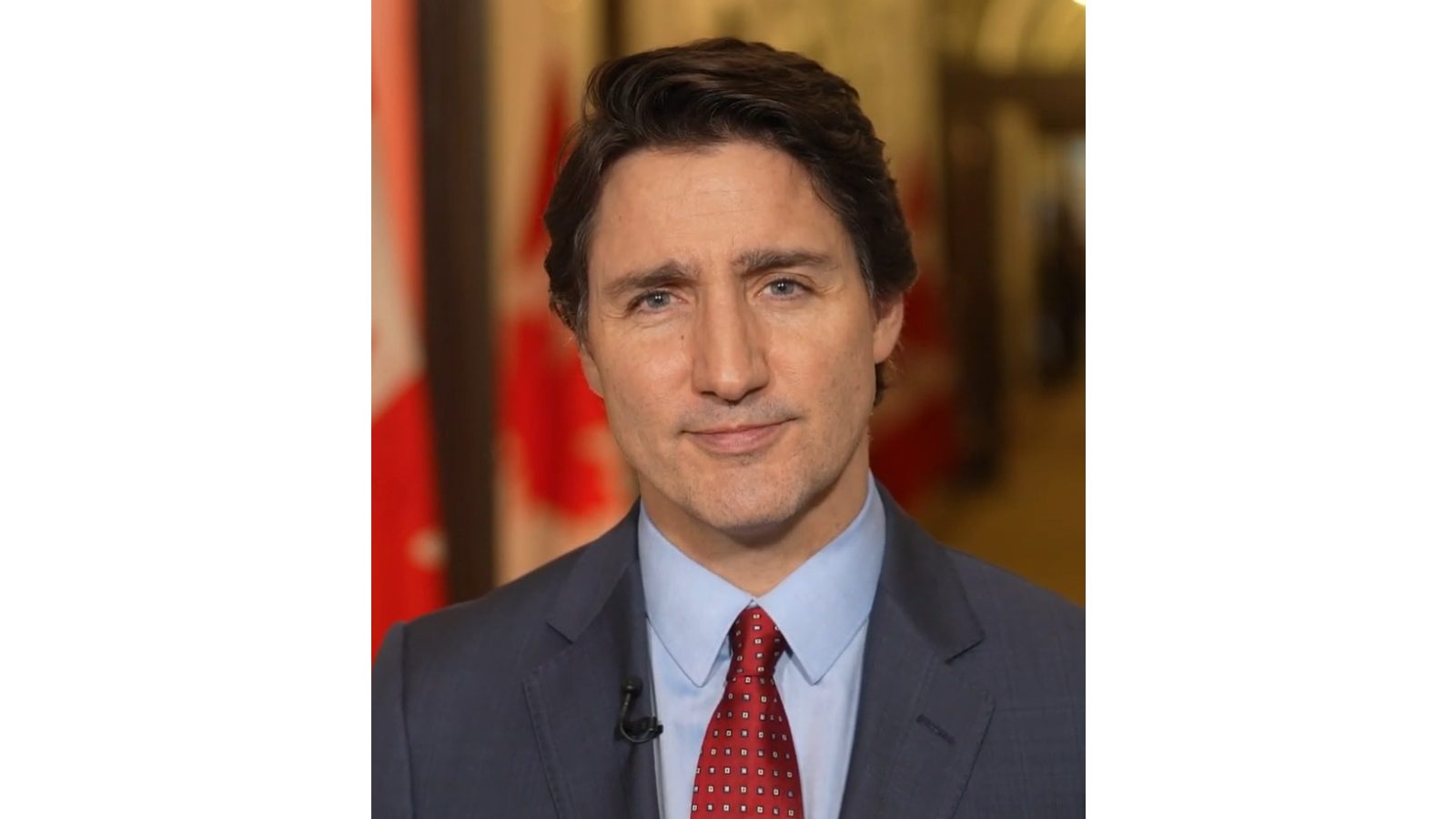

November 21, 2024 – The Trudeau federal government announced the Working Canadians Rebate which would pay $250 to 18.7 million Canadians who worked in 2023 and made less than $150,000 individual net income in early spring 2025 – around the same time as Doug Ford’s $200 payment to each taxpayer in Ontario. No application is required and payments will be automatically delivered by the CRA through direct deposit or cheque.

The timing aligns with Canadians feeling the pinch of employment insurance deductions and holiday credit card bills.

Amount

Working Canadians will receive $250. Families with 2 working parents will receive $500.

Eligibility

All Canadians who:

- Worked in 2023

- Earned up to $150,000 individual net income

- Filed their 2023 tax return by December 31, 2024, and:

- claimed the tax credit for Canada Pension Plan or Quebec Pension Plan contributions on employment or self-employment earnings;

- claimed the tax credit for Employment Insurance (EI) or Quebec Parental Insurance Plan (QPIP) premiums on employment or self-employment earnings; or,

- reported income from EI or QPIP benefits;

- Resident of Canada on March 31, 2025;

- Not incarcerated for a period of at least 90 days immediately prior to April 1, 2025; and,

- Not deceased on April 1, 2025.

Timeline

November 21, 2024 – Trudeau government announces Working Canadians Rebate

Past government rebates

- 2025 Trudeau Liberal: $250 ($4.7B), $150,000 income cut off

- 2025 Eby NDP BC: $500 ($1.8B), $100,000 cut off

- 2024 Ford PC Ontario: $200 ($3.2B), no income cut off taxpayer rebates to all 16 million Ontarians in 2025, families receiving Canada Child Benefit (CCB) will get $400 per child under 18

- 2023 King PC PEI: $500 ($58M), $100,000 income cut off from

- November 2022 Legault CAQ Quebec: $400-600 ($3.2B), $50,000-$104,000 income cut off – Legault CAQ Quebec government 5 weeks after the October 3, 2022 provincial election

- 2022 Moe Sask Party Saskatchewan: $500 ($450M), no income cut off

- 2022: Furey Liberal NL: $500 ($194M), $100,000-$125,000 income cut off

- March 2022 Legault CAQ Quebec: $500 ($3.2B) rebates to all adults who earn less than $100,000 a year to help them cope with inflation. The 2022 Quebec provincial election was 6 months later in which he won a majority.

- 2006 Ralph Klein PC Alberta: government issued $400 Prosperity Bonus (or Ralph bucks) to almost 3M Albertan residents after a massive oil-fuelled provincial budget surplus.

- May 2, 2000 Harris PC Ontario: issued $200 “Taxpayer Dividend” cheques to everyone who paid taxes in Ontario in 1999 after balancing the budget for the first time in 30 years.

Critical reception

Critics argue that this move is a gimmick akin to buying votes before the 2025 federal election by essentially giving back taxpayer’s own money they paid in taxes and calling it a gift.

However, it isn’t a refund of taxes already paid. Since the federal government runs a considerable deficit, the payments will be financed by additional taxpayer debt (deficit spending) – transferring cash from the future taxpayers to those in the present.

Open Council commentary

It appears that offering modest rebate payments that don’t amount to more than a week’s groceries as a tactic to win votes transcends party boundaries, with the federal Liberals, BC NDP, and Ontario PC parties all engaging in the gimmick in the last few years.

The payments will stimulate demand in the Canadian economy at a time when the inflation rate has settled back to 2%, economic activity has slowed, the economy continues to be in excess supply and GDP per capita is decreasing.

Trudeau’s rebate payments are slightly means-tested meaning those with income of $150,000 or more are cut off, unlike Doug Ford’s rebate cheques, which will even be received by Galen Weston.

The government can’t set prices at the checkout, but we can give Canadians more money in their pockets.

They don’t directly set prices, but the federal government could do much more to increase competition in Canada, including retail. For example, the federal Liberals reduced cell phone wireless plans by 25% and prevented Freedom Mobile from being included in the Rogers-Shaw merger in order to create a 4th national provider of phone plans, increasing competition and bringing down prices.

Take action

Donate to a political party

Some commenters suggested they’d donate the $250 payment to another federal political party.

If you donate $250 to a federal political party, you would would get $187.50 (75%) back in non-refundable income tax credits:

Comments

We want to hear from you! Share your opinions below and remember to keep it respectful. Please read our Community Guidelines before participating.