Property taxes are municipalities’ largest source of revenue to fund the services they are responsible for.

Belleville property tax rates

You can view your property tax account and bills online at my.belleville.ca.

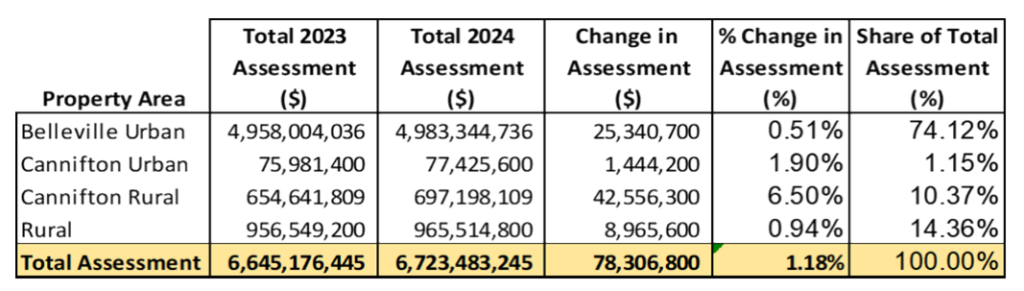

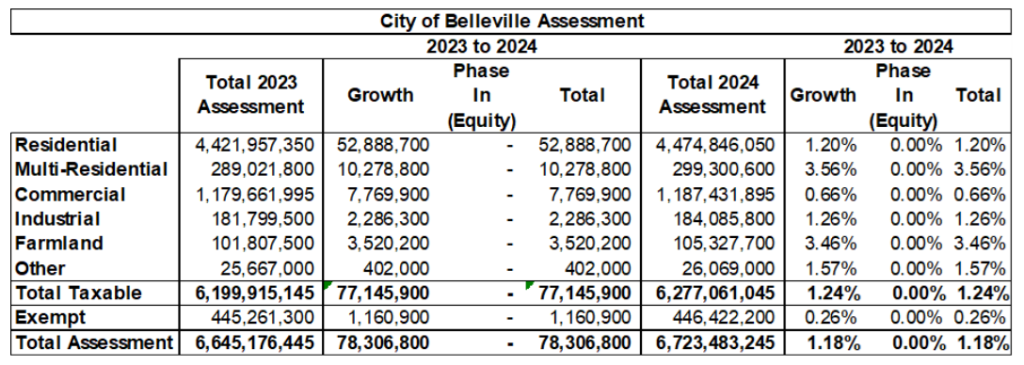

Based on the 2024 returned assessment, the City of Belleville has 21,329 taxable properties with a total value for property taxation purposes of $6.7 billion. Included in this total is $446.4 million in “exempt” assessment which represents 6.64% of total assessment for the City.

How are property taxes calculated?

The annual property tax amount owing can be calculated by multiplying the Current Assessed Value, the Tax Ratio and the Total Property Tax Rate together:

Annual Property Taxes Owed = Current Assessed Value x Tax Ratio x Total Property Tax Rate

- Current Assessed Value: Determined by Ontario’s Municipal Property Assessment Corporation (MPAC) – not the municipality – as per the Assessment Act. The value can be found on your Property Assessment Notice, at AboutMyProperty.ca or by inspecting the municipality’s assessment roll.

- Tax Ratio: Equal to 1 for residential properties. For non-residential properties, it is set by the municipality within upper and lower limits set by the province in Allowable Ranges for Tax Ratios (O. Reg. 386/98).

- Property Tax Rate: Municipal Tax Rate + Education Tax Rate

- Municipal Tax Rate: Set by the municipal government to cover their annual budgets they set and fund the services municipalities are responsible for.

- Education Tax Rate: Set by the provincial government in Ontario Regulation 400/98 under the Education Act. Helps fund elementary and secondary schools in Ontario. All residential properties in Ontario are subject to the same education tax rate.

Property tax rebate and credit programs

Applications for the Low Income Senior and Persons with Disabilities tax credits only become available after Council has approved the Annual Budget each year, up to 4:30 p.m. on Aug. 31 of each year.

Low Income Senior Property Tax Credit

Senior Rebate Application – $900 credit to homeowners who occupy the principal residence who receive Guaranteed Income Supplement under the Old Age Security Act (Canada) who are 65 years of age or older by Dec 31st of the current year. Eligibility requirements may apply. Applications must be made every year and the deadline is Aug. 31st.

Persons with Disabilities Property Tax Credit

ODSP Rebate Application – $900 credit to homeowners who occupy the principal residence who receive Ontario Disability Support Program (ODSP) Benefits. Eligibility requirements may apply. Applications must be made every year and the application deadline is Aug. 31, 2023.

Property Tax Rebates for Eligible Charities

Charity Rebate Application – This program provides a 40% property tax rebate to registered charities that are tenants in Commercial or Industrial class properties. The landlord may be contacted by the charity to provide relevant information required for the City of Belleville application. The deadline for 2022 applications was 4:30 p.m. on Feb. 28, 2023. Applications must be made every year.

Please Note: Charity applications are only available between Jan. 1 and Feb. 28 of each year.

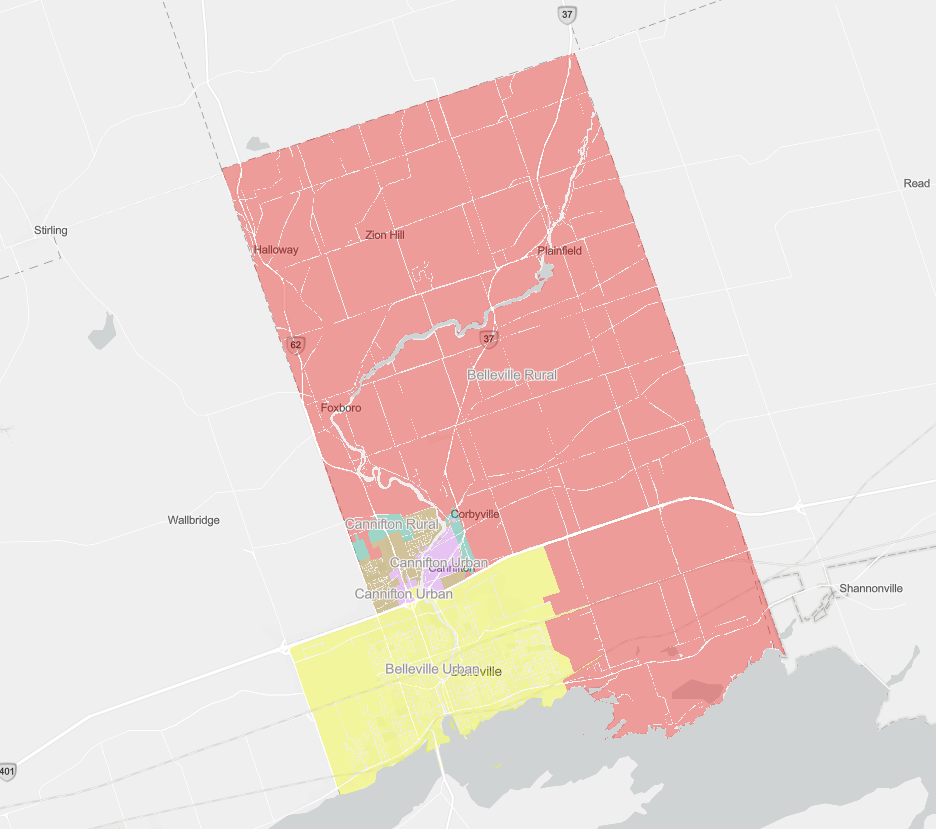

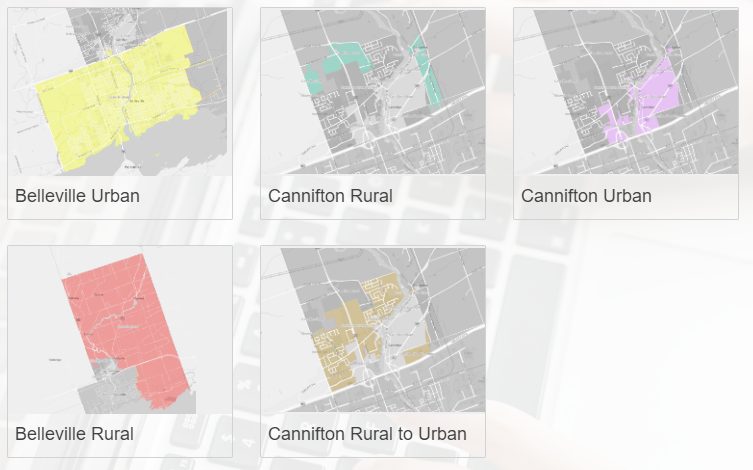

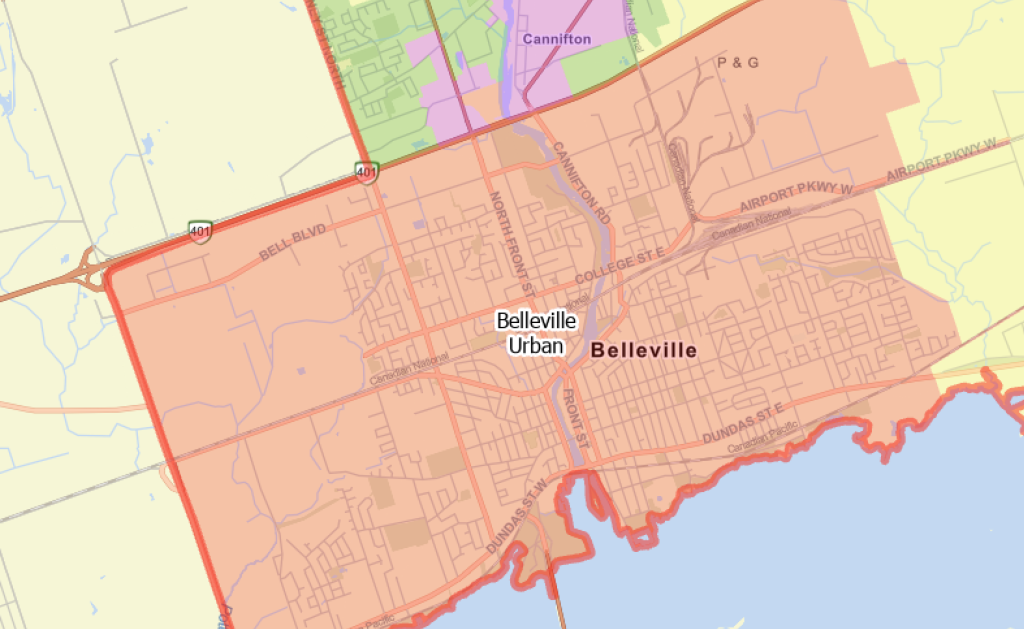

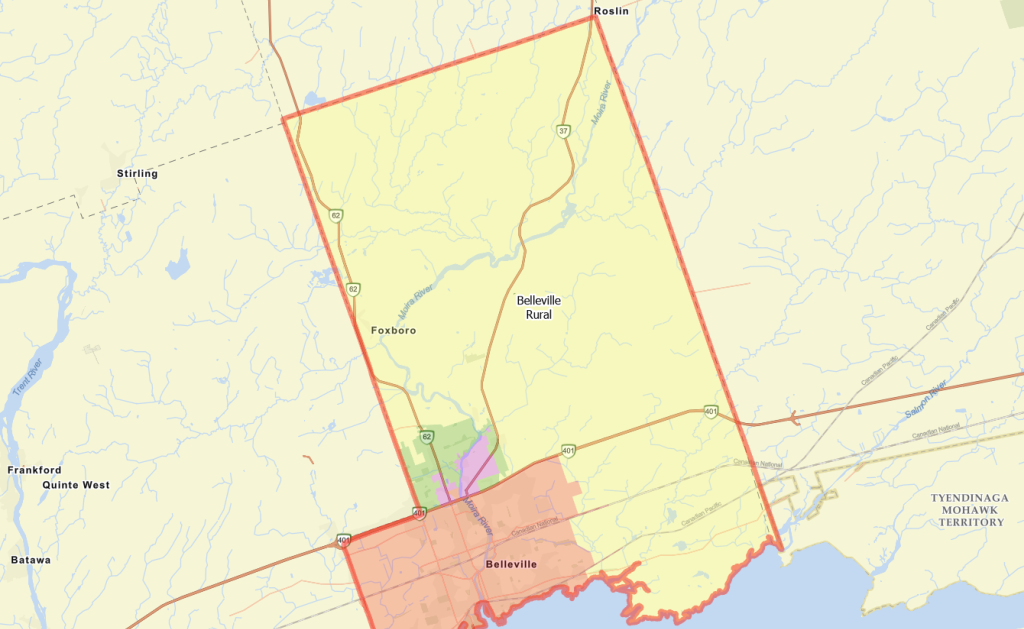

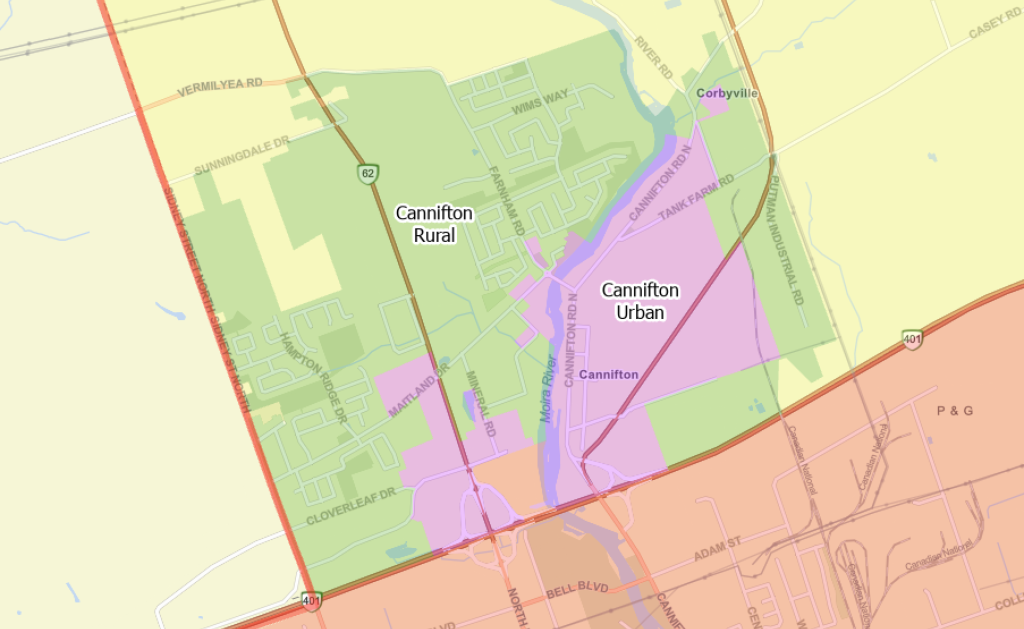

Tax billing areas

Tax rates depend on what tax billing area you live in. The residential rates in urban areas are higher than rural and Belleville urban rates are higher than Cannifton urban rates, while Belleville rural rates are lower than Cannifton rural rates.

2025

Change to tax billing areas starting in 2025 were made in the Belleville Fire Master Plan 2024:

2024

Tax rate billing table

Area rating

Based on the 2023 tax rates, Cannifton Urban’s property tax rates are 4.59% lower than Belleville Urban, while Belleville Rural (Thurlow) are about 28% lower:

| Tax Rate Area | 2023 | 2022 |

|---|---|---|

| Belleville Urban | – | – |

| Cannifton Urban | 4.59% | 4.62% |

| Cannifton Rural | 13.26% | 13.77% |

| Belleville Rural | 28.09% | 28.32% |

The relative rates are the same for all property tax classes (residential, commercial, etc.), but changed slightly year-over-year.

Tax rates can vary throughout the four billing areas within the municipality due to a process called “area rating” which provides a mechanism for taxpayers to pay for the direct or indirect services they actually receive. When Council establishes the annual budget, individual areas may be impacted to a greater or lesser extent, depending on the cost of the services, causing tax rate changes to vary by area.

Tax ratios

Belleville is currently applying as much of the tax burden to the commercial and industrial classes as is allowed by Allowable Ranges for Tax Ratios (O. Reg. 386/98). They could shift the tax burden onto residential taxpayers, but cannot shift further tax burden onto the commercial and industrial classes.

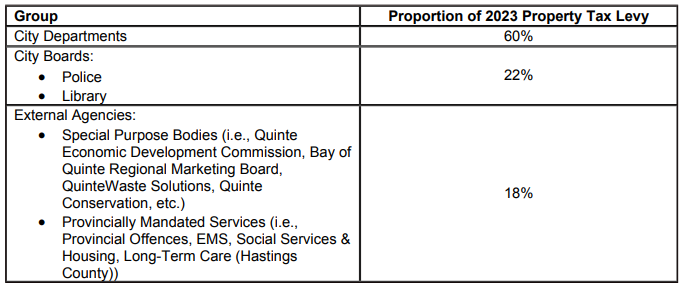

Where are my property taxes spent?

City Departments

Council has direct control of 60% of the annual municipal budget. This includes areas such as:

- General government

- Capital Financing

- Planning & Development

- Engineering

- Environmental Services

- Transportation Services

- Protective Services

- Recreation

- Cultural

- Health Services

- Social & Family Services

To find out how much of your property tax bill goes to these services, use the tax calculator. For a property valued at $250,000 in 2023, the breakdown is as follows:

| Tax Rate | 2022 | Percentage | 2023 | Percentage |

|---|---|---|---|---|

| Summary | ||||

| Core | $2,370.37 | 55.83% | $2,456.21 | 56.09% |

| Police – Urban | $782.10 | 18.42% | $828.84 | 18.93% |

| Police – Rural | $0.00 | 0.00% | $0.00 | 0.00% |

| Fire – Full Time | $506.41 | 11.93% | $502.80 | 11.48% |

| Fire – Volunteer | $0.00 | 0.00% | $0.00 | 0.00% |

| Transit | $178.58 | 4.21% | $183.65 | 4.19% |

| Street Lighting | $25.57 | 0.60% | $25.36 | 0.58% |

| Debt – Fire Rural | $0.00 | 0.00% | $0.00 | 0.00% |

| Debt – Fire Urban | $0.00 | 0.00% | $0.00 | 0.00% |

| Area Rated Total | $1,492.66 | 35.16% | $1,540.65 | 35.18% |

| Municipal Taxes | $3,863.03 | 90.99% | $3,996.86 | 91.27% |

| Education | $382.50 | 9.01% | $382.50 | 8.73% |

| Total | $4,245.53 | 100.00% | $4,379.36 | 100.00% |

| Core Breakdown | ||||

| Tax Rate – General Government | ||||

| Council | $18.22 | 0.43% | $20.46 | 0.47% |

| Administration | $87.09 | 2.05% | $90.80 | 2.07% |

| Finance & Taxation | $201.78 | 4.75% | $86.64 | 1.98% |

| Corporate Services | $70.28 | 1.66% | $94.89 | 2.17% |

| Facility Management | $11.43 | 0.27% | $7.61 | 0.17% |

| Human Resources | $33.11 | 0.78% | $34.30 | 0.78% |

| Total General Government | $421.91 | 9.94% | $334.70 | 7.64% |

| Tax Rate – Capital Financing | ||||

| Debt – Core | $0.00 | 0.00% | $0.00 | 0.00% |

| Capital Projects Financing | $262.83 | 6.19% | $305.36 | 6.97% |

| Total Capital Financing | $262.83 | 6.19% | $305.36 | 6.97% |

| Tax Rate – Planning & Development | ||||

| Planning & Approvals | $43.33 | 1.02% | $25.47 | 0.58% |

| Building Services | $16.48 | 0.39% | $17.52 | 0.40% |

| Economic Development | $71.74 | 1.69% | $77.60 | 1.77% |

| Total Planning & Development | $131.55 | 3.10% | $120.59 | 2.75% |

| Tax Rate – Engineering | ||||

| Engineering | $19.01 | 0.45% | $17.84 | 0.41% |

| Total Engineering | $19.01 | 0.45% | $17.84 | 0.41% |

| Tax Rate – Environmental Services | ||||

| Stormwater Management | $6.46 | 0.15% | $9.38 | 0.21% |

| Waste Management | $70.14 | 1.65% | $71.87 | 1.64% |

| Pollution Control | $13.06 | 0.31% | $14.56 | 0.33% |

| Total Environmental Services | $89.66 | 2.11% | $95.81 | 2.19% |

| Tax Rate – Transportation Services | ||||

| Roads | $41.06 | 0.97% | $47.79 | 1.09% |

| Roadside | $58.52 | 1.38% | $66.21 | 1.51% |

| Structures | $1.60 | 0.04% | $1.54 | 0.04% |

| Traffic Operations | $33.24 | 0.78% | $35.98 | 0.82% |

| Winter Control | $72.42 | 1.71% | $84.69 | 1.93% |

| Transportation Administration | $175.83 | 4.14% | $186.47 | 4.26% |

| Total Transportation Services | $382.67 | 9.01% | $422.68 | 9.65% |

| Tax Rate – Protective Services | ||||

| Emergency Measures | $2.73 | 0.06% | $4.35 | 0.10% |

| 911 Program | $2.40 | 0.06% | $2.54 | 0.06% |

| Quinte Conservation | $29.11 | 0.69% | $33.50 | 0.76% |

| Total Protective Services | $34.24 | 0.81% | $40.39 | 0.92% |

| Tax Rate – Recreation | ||||

| Administration | $55.64 | 1.31% | $65.95 | 1.51% |

| Programs | $53.66 | 1.26% | $58.83 | 1.34% |

| Major Facilities | $175.00 | 4.12% | $187.93 | 4.29% |

| Community Centres | $11.74 | 0.28% | $11.68 | 0.27% |

| Parks, Sports Fields & Harbour | $129.08 | 3.04% | $127.32 | 2.91% |

| Total Recreation | $425.12 | 10.01% | $451.71 | 10.31% |

| Tax Rate – Cultural | ||||

| Glanmore | $14.70 | 0.35% | $17.99 | 0.41% |

| Heritage Belleville | $0.20 | 0.00% | $0.21 | 0.00% |

| Archives | $2.69 | 0.06% | $3.11 | 0.07% |

| Belleville Library | $75.06 | 1.77% | $81.30 | 1.86% |

| Total Cultural | $92.65 | 2.18% | $102.61 | 2.34% |

| Tax Rate – Health Services | ||||

| Health Unit | $34.18 | 0.81% | $37.66 | 0.86% |

| Emergency Medical Services | $126.69 | 2.98% | $143.78 | 3.28% |

| Doctor Recruitment | $0.00 | 0.00% | $3.74 | 0.09% |

| University Hospital Kingston (New) | $0.00 | 0.00% | $1.59 | 0.04% |

| BGH Foundation | $0.00 | 0.00% | $0.00 | 0.00% |

| Total Health Services | $160.87 | 3.79% | $186.77 | 4.26% |

| Tax Rate – Social & Family Services | ||||

| General Assistance | $70.54 | 1.66% | $67.41 | 1.54% |

| Social Housing | $171.83 | 4.05% | $196.10 | 4.48% |

| Long Term Care – Hastings Manor | $84.84 | 2.00% | $96.29 | 2.20% |

| Long Term Care – Centennial Manor | $15.25 | 0.36% | $18.00 | 0.41% |

| Total Social & Family Services | $342.46 | 8.07% | $377.80 | 8.63% |

External Agencies

External costs account for 40% of the annual municipal budget. These costs include:

- Police and other emergency services

- Provincially mandated programs and other boards and commissions.

- Services funded by user fees including water, wastewater and parking

How do Belleville’s property tax rates compare to comparator municipalities?

Property taxes compared to comparator municipalities:

- Quinte West

- Kingston

- Prince Edward

- Ontario average

- Canada average

How do I request property tax relief?

A municipality may cancel, reduce or refund all or part of an applicant’s property taxes if the applicant is unable to pay taxes because of sickness or extreme poverty according to Section 357 (1) (d.1) of the Municipal Act.

Belleville has delegated its decisions to the Assessment Review Board (ARB), so file an application there if you fit into the description above. The ARB is an independent adjudicative tribunal that hears appeals from property owners who believe that their properties are incorrectly assessed or classified.

Past rates

Property tax policy changes

2023 – Vacant and excess land property tax reduction

In Belleville, the 30% Tax Reduction policy for Commercial vacant and excess land and the 35% reduction for Industrial Vacant and Excess Land was removed by city council in the 2023 Operating Budget (D7-38).

In 2022, there was $35 million worth of vacant and excess commercial property and $9 million worth of vacant and excess industrial property in Belleville paying a $730,000 and $218,000 worth of property taxes, respectively. Removing the discounts for vacant and excess properties does not cause a change or reduction in the overall tax levy, but means that the vacant commercial and industrial properties will be paying roughly $430,000 more, while other property classes will pay less.

[In the] previous term, we brought in a reduction or elimination of the vacancy rebate in certain areas of the city and essentially the message was build it, sell it, do something with it, but sitting on vacant property and then getting the incentive of not paying full taxes just allows the perpetuation of vacancy. I understand in this world, particularly in the retail sector trying to get occupancy is difficult as the economy changes, but nonetheless, it’s not lost on me that we do have some properties that are in a perpetual state of vacancy and we just can’t keep cutting the brakes.

Paul Carr, Councillor

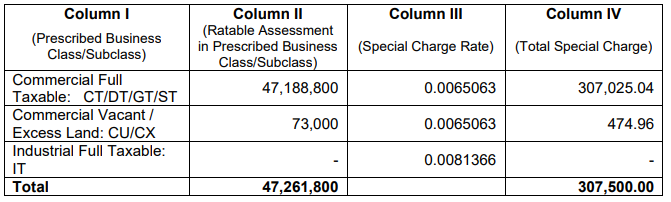

There was $73,000 worth of commercial vacant / excess land in the downtown BIA:

2020

- Keep the 2020 tax ratios the same as 2019 except for the Multi-residential and Landfill property classes that are subject to a tax ratio and levy restriction;

- Apply an annualized tax limit of 10%;

- Apply a 10% increase based on the previous Current Value Assessment (CVA) tax;

- Set a maximum threshold of $500 for both increasing and decreasing properties with a billing adjustment of less than the threshold to their full CVA tax liability for the year;

- Exclude Commercial Properties previously at CVA;

- Exclude Commercial Properties that go from capped to clawed back;

- Exclude Commercial Properties that go from clawed back to capped;

- 2020 is the first year of a 4 year capping phase-out for Commercial Properties.

2019

- Keep the 2019 tax ratios the same as 2018 except for the Multi-residential property class that is subject to a tax ratio and levy restriction for 2019 and the new Landfill property class ratio for 2019;

- Apply an annualized tax limit of 10%;

- Apply a 10% increase based on the previous CVA tax;

- Set a maximum threshold of $500 for both increasing and decreasing properties with a billing adjustment of less than the threshold to their full CVA tax liability for the year;

- Exclude Commercial Properties previously at CVA;

- Exclude Commercial Properties that go from capped to clawed back;

- Exclude Commercial Properties that go from clawed back to capped;

Ontario legislation required them to lower the tax ratio for multi-residential units to two per cent. Belleville is one of 44 Ontario municipalities with a multi-residential tax rate exceeding two per cent and is now caught needing to raise more funds. Council voted for a tax increase to make up for a $656,000 shortfall.

Before 2019

A couple large high rises were successfully converted to condos and when that happens they leave the multi-residential property classification and go to residential, which is lower than the multi-res.

2018

- Keep the 2018 tax ratios the same as 2017 except for the Multi-residential property class that is subject to a tax ratio and levy restriction for 2018 and the new :Landfill property class ratio for 2018;

- Apply an annualized tax limit of 10%;

- Apply a 10% increase based on the previous CVA tax;

- Set a maximum threshold of $500 for both increasing and decreasing properties with a billing adjustment of less than the threshold to their full CVA tax liability for the year;

- Exclude Commercial Properties previously at CVA;

- Exclude Commercial Properties that go from capped to clawed back;

- Exclude Commercial Properties that go from clawed back to capped;

- Apply the Capping phase-out option for the Multi-Residential property classes for 2018;

2006

Property tax credit system for low income seniors and those with disabilities established.

Property tax bylaws

Rates

Ratios

Questions

How much did this change reduce residential property tax rates for the Belleville Urban zone by? Or approximately how many dollars per $250k assessed value? How much was shifted across between draft budget proposal and final budget approved?

Comments

We want to hear from you! Share your opinions below and remember to keep it respectful. Please read our Community Guidelines before participating.