In 2023, Belleville City Council voted to eliminate the $500,000 in funding for the affordable housing program incentives from the 2023 Operating Budget in an effort to reduce the increase in property taxes for homeowners.

- First, they reduced it by $300,000 down to $200,000 on April 5, 2023

- The next day, they reduced it by a further $200,000 down to $0, functionally eliminating the City’s only affordable housing programs.

As of July 11, 2022 the current annual budgeted contribution to the C.I.P. program is $500,000 and the reserve fund balance currently totals $1.35M.

What are the results of the Affordable Rental Community Improvement Plan (CIP)?

Between the first intake in 2021 and September 1, 2022, 88 apartment rental units had been approved for CIP funding, 81 of which will be held “affordable” (no more than Average Market Rent) for a period of 10 years.

The 81 affordable units will mean the City will forego $886,000 in property taxes via Tax Increment Equivalent Rebates, which works out to $10,068.18 per unit over 10 years.

| Address | Units | Affordable Units | Type | Amount | Frequency | Incentive Total | Incentive Per Unit | Program | Owner | Application Date | Approval Date |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 7 Aldersgate Drive | 84 | 50 | Apartments | $54,800.00 | Annually for 10 years | $548,000.00 | $10,960.00 | 3 | Aldersgate Homes Inc. | 31/03/2022 | 11/07/2022 |

| 88, 190, 196 Dundas Street East and 126 Burnham Street | 38 | 12 | Apartments | $12,000.00 | Annually for 10 years | $120,000.00 | $10,000.00 | 3 | Iqbal Hossen/Razia Sultanta/Artistic Holdings Inc. | 16/03/2022 | 11/07/2022 |

| 193 North Park Street | 54 | 19 | Apartments | $21,800.00 | Annually for 10 years | $218,000.00 | $11,473.68 | 3 | Quinte Seniors | 21/03/2022 | 11/07/2022 |

| 261 Front Street (former Pinnacle Music Studio) | 4 | Above Commercial | $800.00 | Annually for 10 years | $8,000.00 | $2,000.00 | 8 | 1234604 Ontario Inc | 30/03/2022 | 11/07/2022 | |

| 307 Front Street | 3 | Above Commercial | $1,000.00 | Annually for 10 years | $10,000.00 | $3,333.33 | 8 | Olympus Company B Inc | 30/03/2022 | 11/07/2022 |

Program funding

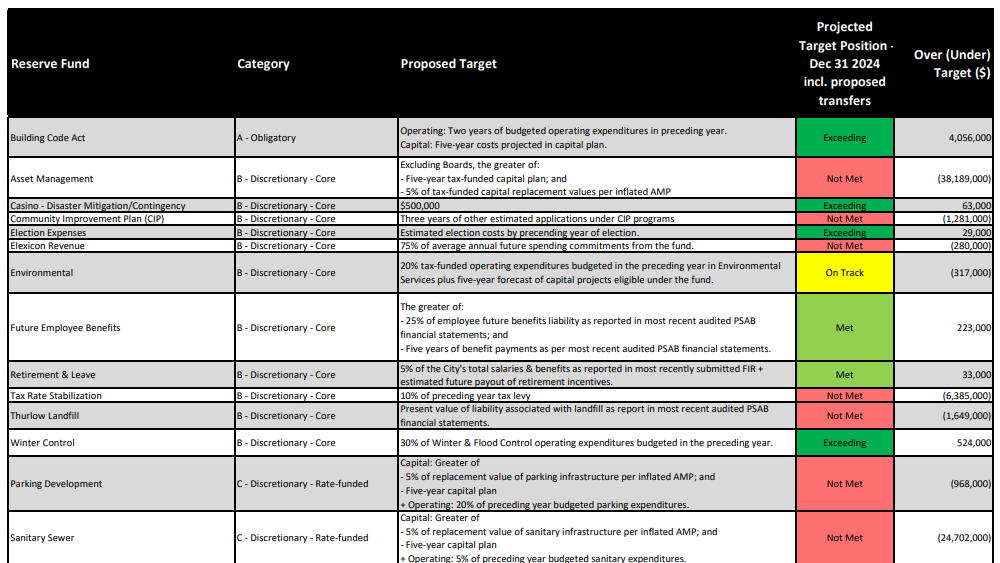

The Community Improvement Plan Reserve Fund was reported to be underfunded by $1.28M as of December 31, 2024:

Notably, as of April 2023 – almost 2 and a half years after the CIP was approved – the 2 main affordable housing CIP programs (programs 1 and 2) still had not been opened/offered yet according to the Acting Manager of Policy Planning.

I had to submit a formal request under the Municipal Freedom of Information and Protection of Privacy Act to access the results shown in the table above because the City does not voluntarily or proactively publish information regarding the applications, funding recipients or results of the Community Improvement Program (or most other programs for that matter).

What are Tax Increment Equivalent Rebates?

Creation of new affordable rental unit(s) results in an increase of the property’s assessed value, which increases the owner’s property taxes.

Tax Increment Equivalent Rebates (TIER) refund the owner a portion of their property taxes equal to the increase resulting from the increase in their property value due to the addition of affordable rental units. The municipality does not pay any money to the developer or homeowner, but simply foregoes a portion of their property taxes, reducing municipal revenues.

Under a TIER program, a developer or homeowner may apply for the rebate equal to 100% of the increase in the municipal portion of property tax payments as a result of a reassessment for a period of 10 years.

This allow the costs of the program funding to be recouped over time using the municipal tax revenue earned from the redevelopment or development of the property.

At the end of the 10 year period, the improved property’s taxes will increase – increasing municipal revenues – and the residential unit will enter the supply of market housing in Belleville.

Example

For example, the cost to add 20 affordable units is $400,000. The current annual municipal tax bill for this property is approximately $14,000, but after adding 10 additional, affordable units, the estimated taxes are $25,000.

Using the current tax increment equivalent grant program to fund the eligible costs and incentivize the applicant to remediate and redevelop the property, the City will gain an annual municipal tax increment of approximately $11,000.

There is an expense to recommit part of the initial tax revenue for the property back to the applicant to cover the eligible costs for the project, the increased taxes achieved here may not have been realized without the incentive. The increased taxes achieved here may not have been realized without the incentive.

What is Belleville’s definition of affordable housing?

The City of Belleville’s definition of affordable used for these incentives is rent is at or below the Average Market Rent (AMR) in Belleville as determined by the CMHC’s Rental Market Survey.

What is the Community Improvement Plan (CIP)?

Belleville’s 2021 Final Community Improvement Plan provides financial incentives for development, redevelopment and remediation projects. These projects must meet eligibility criteria which are designed to ensure the financial incentives provided will support projects which work towards achieving the intent and goals of the C.I.P.

The intent of the CIP is to reduce the costs of projects which will:

- Increase the supply of affordable rental units city-wide;

- Increase the supply of rental units downtown;

- Revitalize the downtown building stock; and,

- Remediate and redevelop brownfield sites.

In 2019, Belleville council hosted a “Housing Summit” that involved and resulted in the creation of seven action items, the first of which was to develop an “Affordable Rental Housing Community Improvement Plan (CIP)” which would be combined with updated versions of the existing Brownfields CIP and Downtown CIP.

The purpose of this action item is to provide incentives for affordable rental units. The City has approved an Affordable Rental Housing CIP. The Community Improvement Plan is now available on our Community Improvement Plan page.

How many affordable rental units could be funded?

In 2021, Belleville Council approved $13 million allocated over 10 years as an incentive for new rental developments in the city. The goal is to create 544 new affordable rental units, which fits into a target of having 1,000 new rental units by 2025. Over the course of the plan, the average cost to the city per new housing unit would be about $24,500. Any unused money would go into a reserve fund and be carried over for use in the future.

According to the Staff Recommendation Report to Approve CIP:

Financial analysis by Dillon Consulting found that the CIP could incentivize the creation of 544 new affordable rental units, which will assist Council in reaching its target of 1000 new rental units (both affordable and market rate) by 2025.

The total estimated cost of maximizing the CIP would be $13,470,282.46 over a 19 year commitment period, for an average cost per new housing unit of $24,568.53.

The CIP aligns with existing municipal and regional strategic priorities to promote redevelopment and new development projects that will contribute towards increasing the supply of affordable rental housing across the municipality.

CIP programs

The CIP has 17 programs, split between: Affordable Rental Units, New Rental Units, Facade Improvement and Brownfield Rehabilitation.

| Program | Category | Program Name | Description | Value | Approved/Approved in Principle | Confirmed By |

|---|---|---|---|---|---|---|

| 1 | Affordable Rental Units | Affordable Rental Housing Development Charge Rebate | Affordable rental units in new mid- or high-rise apartment buildings receive 100% rebate of development charges. | Up to $9,000 per unit | Working Committee | Director of Engineering and Development Services |

| 2 | Affordable Rental Units | Affordable Rental Housing Building Permit Fee Rebate | Affordable rental units in new apartment buildings or new second units receive 100% rebate of building permit fees. | Up to $2,000 per unit | Working Committee | Director of Engineering and Development Services |

| 3 | Affordable Rental Units | Affordable Rental Housing T.I.E.R – 100% Municipal Portion | Affordable rental units in new apartment buildings or new second units receive a Tax Increment Equivalent Rebate (T.I.E.R.). | Municipal portion of tax increases which occur as a result of the development of affordable rental unit(s) for 10 years. | Working Committee | City Council |

| 4 | Second Units | Second Units In New Construction Housing Rebate | Market-rate second units included in new homes are eligible to receive a rebate for a fixed amount of construction costs as long as it is used as a rental unit for 5 years and not as a short-stay accommodation (AirBnB). | Up to $2,500 | Director of Engineering and Development Services | N/A |

| 5 | Second Units | Second Units In Existing Housing Rebate | Existing owner occupied dwellings which are renovated to include a new legal second unit are eligible to receive a rebates related to design and construction costs. | Up to $500 for the studies/drawings required for Building Permit AND up to $2,000 of a $30,000 construction project. | Director of Engineering and Development Services | N/A |

| 6 | New Units | Accessibility Top-Up Rebate | New rental units that are designed to be accessible for persons with disabilities are eligible for a rebate. | Up to $2,500 per unit | Working Committee | Director of Engineering and Development Services |

| 7 | New Units | Downtown Residential Above Commercial Building Permit Fee Rebate | New rental units above commercial ground floors. | 100% rebate of building permit fees | Working Committee | Director of Engineering and Development Services |

| 8 | New Units | Downtown Residential Above Commercial T.I.E.R – 100% Municipal Portion | New rental units above commercial ground floors are eligible to receive 100% Tax Increment Equivalent Rebate (T.I.E.R.) | The municipal portion of tax increases which occur as a result of the development of the residential unit(s) above a commercial use, for 10 years. | Working Committee | City Council |

| 9 | Other | Downtown Fire Fire Retrofitting Rebate | Retrofitting existing buildings Downtown to meet the Ontario Fire Code | Up to $1,000 | Working Committee | Director of Engineering and Development Services |

| 10 | Façade | Façade Improvement Design Rebate | Commercial or institutional properties within the Downtown Façade Area which intend to undergo improvements to rehabilitate and improve the façades are eligible to receive a rebate for costs associated with design-related professional fees. | Up to $3,000 | Working Committee | Director of Engineering and Development Services |

| 11 | Façade | Façade Improvement Renovation Rebate | Commercial or institutional properties within the Downtown Façade Area which undergo improvements to rehabilitate and improve the façades are eligible to receive a rebate for costs associated with the renovation. | 50% of the eligible costs with the overall grant value not exceeding $12,000 | Working Committee | Director of Engineering and Development Services |

| 12 | Façade | Façade Improvement Renovation Rebate – Rear Façade | Commercial or institutional properties within the Downtown Façade Area which undergo improvements to rehabilitate and improve the façades which front the Moira River are eligible to receive a rebate for costs associated with the renovation. | 50% of the eligible costs with the overall grant value not exceeding $10,000 | Working Committee | Director of Engineering and Development Services |

| 13 | Brownfield | Brownfield Environmental Site Assessment Rebate | Phase II Environmental Site Assessment and development of a Remediation Action Plan | Up to $25,000 per study or 50% of the cost of the E.S.A., whichever is less | Working Committee | City Council |

| 14 | Brownfield | Brownfield T.I.E.R. – 50% Municipal Portion | Sites remediated within the Brownfield Priority Area | Up to 50% of the municipal portion of the incremental tax increase or total remediation costs, whichever is less | Working Committee | City Council |

| 15 | Brownfield | Brownfield Building Permit Fees Reduction | Sites undergoing redevelopment needing remediation | 50% of the building permit fees associated with the development up to the cost of remediation not exceeding $50,000 | Working Committee | City Council |

| 16 | Brownfield | Brownfield Development Charge Deferral | Sites undergoing redevelopment needing remediation | Deferral of up to 50% of the Development Charge for a period of up to 18 months without interest | Working Committee | City Council |

| 17 | Brownfield | Brownfield Environmental Remediation Tax Cancellation Assistance | Sites remediated within the Brownfield Priority Area | Limited to the increase in property tax over the established “base” tax | Working Committee | City Council |

As of April 2023, the following programs had not been opened/offered yet According to the Acting Manager of Policy Planning, almost 2 and a half years after the CIP was approved:

- 1 Affordable Rental Housing Development Charge Rebate (up to $9,000 per unit)

- 2 Affordable Rental Housing Building Permit Fee Rebate (up to $2,000 per unit)

- 7 Downtown Residential Above Commercial Building Permit Fee Rebate

- Brownfield programs 15, 16, 17

In July 2022, Manager of Policy Planning said rebates for development and building-permit fees were planned but pending sufficient funds in the reserve fund.

All other programs were made available for Spring 2021 with an intake deadline of May 31st.

Application deadlines

- Spring Intake deadline is May 31st

- Fall Intake deadline is September 1st

Program funding and allocations

The annual allocation to the CIP is determined by Council on an annual basis through operating budget.

The financial incentive programs will then be administered by City staff within the budget established by Council. Any unspent funds at year-end may be placed in reserves to be used in subsequent years. Reserve funds are essential to budgeting for long term program costs that extend beyond a budget year.

This amount does not include the annual $50,000 for the Brownfield programs (13 & 14) or the $85,000 for the Facade programs (10, 11, 12).

| Year | Funding allocated | Façade programs (10, 11, 12) | Brownfield programs (13 & 14) |

|---|---|---|---|

| 2019 | $85,000 + $75,000 (reserve fund) | ||

| 2020 | $350,000* | $85,000 | $50,000 |

| 2021 | $500,000 | $85,000 | $50,000 |

| 2022 | $500,000 | $85,000 | $50,000 |

| 2023 | $0** | $35,000*** | $50,000 |

- *Pre-funded reserve fund

- **In 2023, Council originally initially approved the same $500,000, however, the CIP funding was reduced to $0.

- ***For 2023, the Brownfield programs were allocated usual amount, but the Facade programs funding was reduced to $35,000.

- There is $112,000 in Facade reserve funding

Funding for affordable housing cut from 2023 operating budget by city council

During 2023 Budget Meeting on April 5 & 6, 2023 council was informed that the 2023 Operating Budget would result in an increase in property taxes by 7-8%, which was comparable to the inflation in Ontario of 6.8% in 2022.

In response, they went over the 2023 Operating Budget line-by-line to identify areas (see the Issues Summary) they could cut spending in order to reduce the year-over-year increase in residential property tax levies and make the property tax increase more affordable for homeowners in a year when cost of living sharply rose.

Moved by Mayor Ellis, seconded by Councillor Allsop, and carried by council, they approved cutting $300,000 from D7-2 Community Improvement Plan Reduction.

Cutting the remaining $200,000 (D7-26 Community Improvement Program Reduction to $0) was suggested by staff to council after they asked for suggestions of where they could make further cuts. The cut was approved by council the next day, with no on-camera discussion about defunding program from any city councillors, leaving $0 in 2023 funding for the the City’s affordable housing incentives.

2023 vs 2022 Tax Rates

| Rate zone | Before cuts | Annual cost per $250k | After cuts | Annual cost per $250k | Savings/year/250k |

|---|---|---|---|---|---|

| Belleville Urban | 7.02% | $297.99 | 3.15% | $133.83 | $164.16 |

| Belleville Rural | 8.02% | $252.84 | 3.33% | $104.94 | $147.90 |

| Cannifton Urban | 7.44% | $302.51 | 3.17% | $128.77 | $173.74 |

| Cannifton Rural | 7.76% | $288.14 | 3.66% | $135.91 | $152.23 |

Mayor Neil Ellis, who campaigned on a 0% tax increase in the first budget and also acknowledged the need to build housing:

I apologize that we didn’t get to zero. Obviously that’s what I’d like to have done but as we all know with inflation and some other issues that were handed to this council we got through it and I think we got a respectable amount especially to comparable municipalities like Brockville, Quinte West, or the County.

Mayor Neil Ellis

What are Belleville Council’s higher priorities?

- Rejected a $0.50 garbage bag tag price increase (D7-29) – Rejected increasing the price by $0.50 from $3 to $3.50, which could have raised an additional $213,900 in revenues to reduce the tax bill. Councillors said homeowners are already behind the eight ball with higher costs of living.

- Rejected a Quintelicious funding decrease (D6-3) – Rejected decreasing the price by $15,000 from $25,000 to $10,000. Sean Kelly and Thompson said city eateries need support as they emerge from the COVID-19 pandemic.

- Rejected leaf and yard drop off access reduction (D7-27) – Rejected reducing access to leaf and yard waste drop off on Saturdays ($10,000).

- Increased police budget above inflation (D1-2) – 7.67% increase, with plans to hire four new frontline officers and five more dispatchers.

- Reduced, but did not defund the Façade Improvement Programs – Funding available to property and business owners in the Downtown Business Improvement Area to improve the look of storefronts.

$0.50 bag tag price increase a non-starter

One of the most debated issues line items was a a $0.50 increase in the cost of a garbage bag tag from $3 to $3.50 per tag. This would have raised an additional $213,900 in revenues offset property tax increases.

Councillors argued that the increase would be a breaking point for some households, and would lead to more garbage dumping and cost more in the long run to send city by-law out to find out who’s thrown what, where. It could also be due to the recent Capital Budget Survey, which found that respondents were fairly supportive of increasing most fees, with the exception of Bag Tags:

Participants were asked whether they would be in favor of user fees increases, and if so, which specific fees they would support increases to. While nearly 15% of the responses did not support increases to any of the user fees, respondents were fairly supportive of increasing most fees, with the exception of Bag Tags. Apart from Bag Tags and Transit Fares, which received just slightly less support, potential increases to other user fees, including Dog Tags, Pools, and Recreation Programs, were supported by over 30% of respondents. Arenas and Sports Fields were the most supported areas, receiving support from over 40% and 50% of respondents, respectively.

2023 Capital Budget Survey Results

Carr echoed a need shared by his colleagues to pare the budget down even further for the sake of struggling homeowners, especially “age-in place seniors” who are watching every dime as the cost of living spirals amid inflationary times.

How much did other municipalities increase property taxes in 2023?

Compared to Belleville’s 3-3.5% increase, here are some comparator municipalities:

- Quinte West increased taxes by 5.36% ($177/year/$250k assessed value), including contributing $150,000 to the Housing Affordability reserve in support of improving access and supply of affordable housing in Quinte West.

- Peterborough increased taxes by 3.15% ($133/year/$250k assessed value). The initial draft was 4%, but it was trimmed down. “Residents in our community are feeling the costs of inflation and the challenging economic environment in their daily lives” said Coun. Andrew Beamer, council’s finance chairperson.

- Prince Edward County increased taxes by 7.9% (5.8%) ($144.97/year/$250k assessed value) to maintain service levels and invest in high-priority areas such as health care and infrastructure and at the same time, expanded eligibility to their Municipal Financial Relief Program which had been piloted in 2022. Households earning less than $32,240 (single income) or $64,480 (family income) can apply for credits of up to $350 on their water bill and $750 on their property tax account.

Timeline of the Affordable Community Improvement Plan

December 7, 2020 – Staff recommend approving Community Improvement Plan

October 7, 2019 – Dillon Consulting to develop the Affordable Rental Housing Community Improvement Plan

Dillon Consulting will begin work on the City’s CIP program that will:

- Implement the updated policies and schedules of the Official Plan Update and housing requirements identified during the City’s Housing Summit

- Include an ‘Investment-Focussed CIP Ready for the Early-Adopters’ strategy that will help early-adopters get their affordable housing projects organized (e.g., applications complete and approvals-in-principle) and launched as soon as Council makes the funding available.

- Contain an expedited work schedule resulting in a completed CIP by the end of January 2020. This expedited schedule will provide the opportunity for Council to consider budgetary requirements to implement the CIP as part of the 2020 budget process.

April 2-4, 2019 – $50,000 approved in 2019 Operating Budget to develop the plan

March 18 and 19, 2019 – Belleville Housing Summit: provide incentives for affordable rental units

Council passed a number of Resolutions and amendments. A key recommendation approved by Council to encourage the development of affordable housing is the following:

THAT Council direct staff to develop a Terms of Reference for the undertaking of a housing community improvement plan that will provide incentives for affordable rental units in addition to leveraging the opportunities of the existing Brownfields Community Improvement Plan and Downtown Community Improvement Plan.

Prepare an RFP that would prioritize the Affordable Housing CIP that would consider incentives including but not limited to:

- Development Charge Grants

- Planning and Building Fees

- Tax Increment Grant Program

- Incentives to promote mixed use development in alignment with the City’s new intensification policies

- Parking requirement reductions

- Parkland Fee reductions

- Second Unit grants and/or loans for new or retrofits

The RFP also provided for other Core Requirements to be considered including:

- Urban Design and Sustainability

- Social & Cultural Well-Being

- Implementation, Governance, Marketing & Monitoring

- Financial Analysis

Finally, the Main Consultant who is preparing the Affordable Housing CIP and update to the Downtown CIP will also be responsible for providing an overarching piece that connects all CIP programs with the goal of co-ordinating the plans looking at creative methods that the three CIPs can be used in combination to provide increased financial incentives for affordable rental housing.

Sources

- PP-2020-66 Staff Recommendation Report to Approve New Community Improvement Plan (CIP) for the City of Belleville

- Precarious Housing and Risk of Homelessness in Hastings County – Bridge Street United Church

Have your say

What do you think of the City defunding the affordable housing programs? Let us know by leaving a comment below!

Comments

We want to hear from you! Share your opinions below and remember to keep it respectful. Please read our Community Guidelines before participating.