If you want to know who owns a particular property in your municipality, there are a number of ways to request it, the most common is to buy a copy of the Parcel Register for the property from OnLand, Ontario’s virtual Land Registry Office (LRO), which costs around $35.

However, another option is to send a request to the Municipal Clerk of the municipality where the property is located and ask to view the municipality’s Assessment Roll. There is no cost to do this, but you must be there in-person to inspect the Assessment Roll as is only stored as a hard copy.

What is an Assessment Roll?

An Assessment Roll lists all properties in a municipality and according to Section 14 of the Assessment Act, must contain:

Section 14, Assessment Act

- The name and surnames, in full, if they can be ascertained, of all persons who are liable to assessment in the municipality or in the non-municipal territory, as the case may be.

- The amount assessable against each person who is liable to assessment, opposite the person’s name.

- A description of each property sufficient to identify it.

- The number of acres, or other measures showing the extent of the land.

- The current value of the land.

- The value of the land liable to taxation.

- The value of land exempt from taxation.

- The classification of the land.

- Such other information as may be prescribed by the Minister. 2006, c. 33, Sched. A, s. 13 (1).

Assessment roll information is open to the public based on the Assessment Act of Ontario.

You can use them to see who or what was at an address, and learn more about the property and residents.

Every year, the Municipal Property Assessment Corporation (MPAC) determines property assessments for all properties in Ontario and delivers a printed, physical copy of the assessment roll to each municipality and the Province of Ontario, which use it to calculate property and education taxes.

The assessed values (value of a property (lands and buildings) for taxation purposes) are used by municipalities to distribute taxes, not determine them.

Assessment rolls must be available to the public for inspection

Immediately upon receiving the assessment roll for the municipality, the clerk shall make it available for inspection by the public during office hours.

Section 39 (2), Assessment Act

Assessment Rolls are stored as hard copies/microfilm, so you will need to visit the municipality’s archives in-person to see them. To access them, send a request to your municipal clerk asking to inspect the assessment rolls.

Pre-1997 assessment rolls available in the Archives of Ontario

For assessment rolls before 1997, search the Archives of Ontario for the municipality’s name + “assessment” or visit the Archives of Ontario in North York in person.

You’ll need the:

- 15 or 19-digit assessment roll number (not required for records before 1970)

- Address (or lot and concession)

- Name of the municipality at the time

- Name of the owner

To get a copy, contact the Archives with the name of the municipality, the year, the type of records (assessment, collector’s or combined tolls), and the reference code. To get a copy, also include the address (or concession and lot), the name of the owner and (after 1970) the 15 or 19-digit assessment roll number.

How to read an assessment roll?

What is a property’s Roll Number?

A Roll Number is a 19-digit number assigned by the Assessment Commissioner to an assessable property for identification purposes. MPAC assigns a separate assessment roll number for each property. This number appears on all notices issued by MPAC and the Assessment Review Board.

You can look up a roll number using street address in the Assessment Roll, which is typically ordered alphabetically by street name.

For example, 1904-031-200-01100-0000 represents:

- 19 – County or Municipal District

- 04 – City or Town

- 031 – Ward

- 200 – Area Subcenterision

- 01100 – Street Subcenterision

- 0000 – Plate number (formerly used in realty/business assessments)

The next column contains the name and address of the property’s owner or tenant.

- The “OTV” column shows whether the person is the Owner (‘O’), a Tenant (‘T’) or the property is vacant. (‘V’).

- If the owner/tenant is Roman Catholic, the ‘REL’ (religion) column will be marked ‘R’.

- The next column (‘SUP’) is used to indicate the owner/tenant’s school support (‘P’ for public, ‘S’ for separate, ‘B’ for both in cases of split support).

The location and description column provides the address of the assessed property and information on the land, including the frontage ( ‘FR’) and depth (‘D’) of the property, in feet.

The assessed value of the property is found in the ‘Total Valuation Apportionments’ column (third from the right). The letter ‘T’ indicates the total assessment for all portions of the property. If the assessment of the property consists of various portion, they are listed below the total assessment.

How do I find a property’s Roll Number?

Your own Roll Number and Access Key can be found on your Property Assessment Notice sent by your municipality, or you can request it at AboutMyProperty.

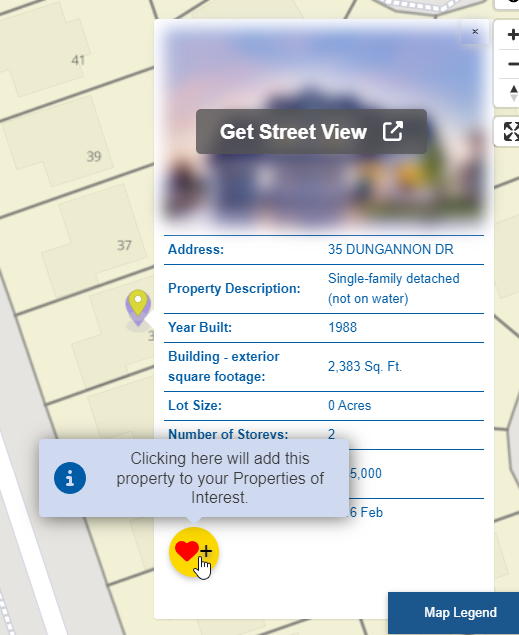

You can also find the Roll Number of residential properties using AboutMyProperty by adding it to your Properties of Interest list:

Favoriting the property:

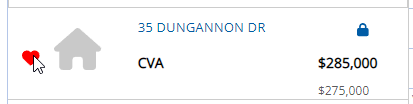

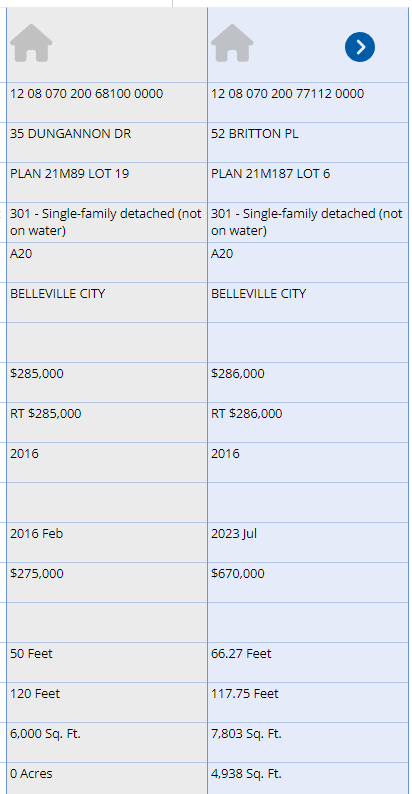

And the Roll Number of the property, assessed value and other details will show up in your favourites list:

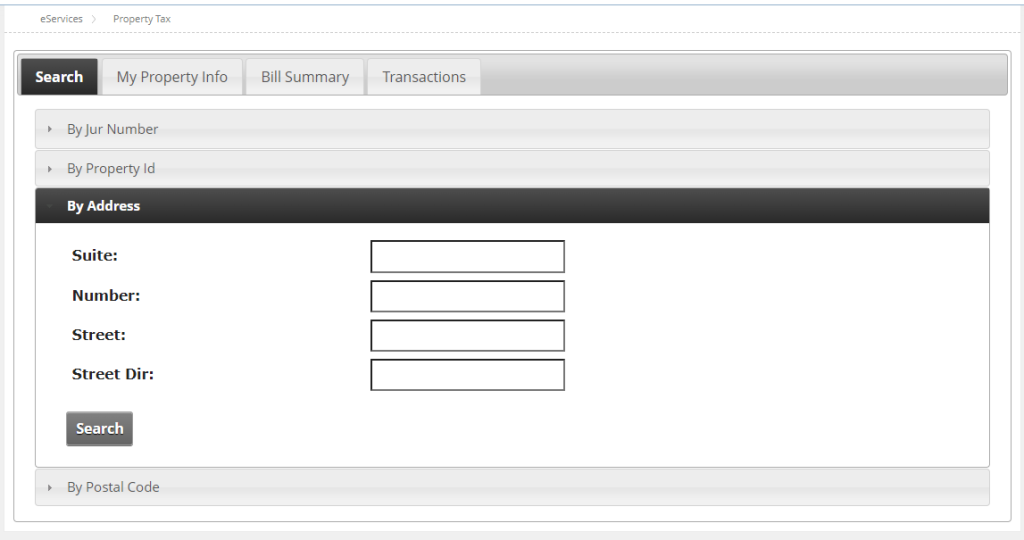

The City of Belleville has a Property Assessment Search Tool which allows you to look up a property Roll Number using an address:

Changes to the Assessment Roll from parcel severances, mergers or consolidation

Changes to assessment roll numbers include:

- Property severances or consent is dividing one property into 2 or more properties.

- Consolidation is combining 2 or more neighbouring properties owned by the same entity.

- Mergers of Title is when 2 or more neighbouring properties merge under one title when they come under a single ownership.

Severance

- Once a property is severed, the property owner is sent a notice of the severance decision by the consent-granting authority, usually a Committee of Adjustment or Land Division Committee.

- MPAC receives notification from the land registry office that a transfer document that implements the severance decision has been registered.

- Upon receiving notice of the transfer document from the land registry office, and depending upon municipal preferences, MPAC assigns a new or updated roll number for the newly severed parcels.

- MPAC informs the relevant municipality, advising it of the changes to the assessment roll numbers as a result of the severance.

- A Property Assessment Notice reflecting the changed roll numbers is mailed to the property owner for the next taxation year.

Consolidation

- MPAC receives notice from the land registry office or other satisfactory documentation that formerly separate abutting properties have merged in title.

- Upon receiving notice from the land registry office or other satisfactory documentation that two or more abutting properties have merged in title, MPAC will retire one or both of the formerly separate roll numbers and update the property information to reflect the merger of title. However, as an Application to Consolidate Parcels does not necessarily mean that two or more parcels have merged in title, MPAC may not combine roll numbers solely on that basis.

- Depending upon municipal preferences, a new or updated roll number will be created for the newly consolidated parcel.

- MPAC informs the relevant municipality, advising it of the changes to the new or updated roll number.

- A Property Assessment Notice reflecting the change is mailed to the property owner for the next taxation year.

How Ontario municipalities handle access to the Tax Assessment Roll

Tiny

Tiny’s Release of Property Assessment & Tax Information Policy states that the assessment roll cannot be photocopied, scanned or photographed:

- The tax status of a property in the Municipality shall not be released by staff without the written consent of the property owner or their legal representative.

- The Tax Assessment Roll for the Municipality shall not be photocopied.

- The Tax Assessment Roll for the Municipality shall not be reproduced by means of a scanner pen.

- The Tax Assessment Roll for the Municipality may not be reproduced by means of a camera.

- Staff are not responsible for the correctness of the Tax Assessment Roll for the Municipality.

- Staff shall not provide any information additional to the Tax Assessment Roll for the Municipality.

- Personal information contained in the Tax Assessment Roll for the Municipality shall not be provided by staff by phone.

Decisions by the Ontario Information and Privacy Commissioner (IPC) regarding access to assessment rolls

MPAC is a not-for-profit corporation established under the Municipal Property Assessment Corporation Act (the MPAC Act) and is the sole provider of assessment services for the Province of Ontario. MPAC sells various property assessment information products to the public in electronic format and this business is their main asset and source of revenue.

In general, according to Order P-984 (1995), in order to request Assessment Roll records through MFIPPA, there needs to be a compelling public interest in disclosure, the information in the record must serve the purpose of informing the citizenry about the activities of their government, adding in some way to the information the public has to make effective use of the means of expressing public opinion or to make political choices.

2014 – Municipalities not required to create records from Assessment Roll

MO-2996 – The IPC denied a request from a resident of the Municipality of Mattawan to create a record containing information from the Assessment Roll, stating it was not reasonable for him to be required to travel a great distance to view the assessment roll during the limited times available.

2011 – Scanning the assessment roll denied

MO-2668 – The IPC denied a request from a resident of the Township of Minden Hills to access the assessment roll for the purposes of scan it using a hand held device, citing section 15(a) of MFIPPA, which states:

A head may refuse to disclose a record if,

(a) the record or the information contained in the record has been published or is currently available to the public

Section 15 (a), MFIPPA

2007 – Journalist denied electronic copy of the Assessment Roll

MO-2248 – The IPC denied a request from a journalist asking for an electronic copy of the Assessment Roll, stating that if they were compelled to release electronic copies of Assessment Roll records en-masse, the loss of this income would in turn be passed on to municipalities and ultimately taxpayers.

2004 – Electronic database exempt from MFIPPA

Divisional Court 2004 CanLii 17632 (Div. Ct.) held that MPAC’s electronic database containing assessment roll information for the province of Ontario was exempt under section 14(1) of MFIPPA, where the records pertained to individual property owners through a regularized system of access such as a public library or a government publications centre. Public availability of paper records for inspection is sufficient to support the application of section 15(a) to assessment roll information.

MPAC stated that “inspection” of the roll means “view only” and does not mean photocopying, scanning, or filming by still or video cameras that might be used to create digital files. MPAC advised the township that only copying by hand or keying the information into a laptop should be permitted.

2003 – Assessment roll for entire province initially approved, but later quashed

MO-1693 – MPAC, then known as Ontario Property Assessment Corporation (OPAC) was ordered to disclose as a copy of the current year’s tax assessment roll for the entire Province of Ontario to the representative of a consulting business.

In making his decision, then Assistant Commissioner Mitchinson held that he was bound by the Ontario Divisional Court’s decision in Gombu v. Ontario (Assistant Information and Privacy Commissioner) (2002), 59 O. R. (3d) 773. In that particular case, a journalist sought access to an electronic database containing the names, addresses and telephone numbers of municipal election campaign contributors. Order MO-1693 was quashed by the Divisional Court in MPAC v IPC. Consequently, MPAC was not required to disclose the record at issue.

Comments

We want to hear from you! Share your opinions below and remember to keep it respectful. Please read our Community Guidelines before participating.