Submit your comments on the 2025 draft budget or budget process to [email protected].

February 20-21, 2025 – Council meeting

January 27, 2025 – Survey #2 Draft Operating Budget

To obtain direct feedback on the preliminary draft Operating budget. The survey results will be included at the Operating Budget meetings for Council’s consideration.

August 8, 2024 – Preliminary Survey Results & staff recommendations

Taxation

When asked about current tax levels, in relation to tax-funded services, the majority (42%) of respondents were in favor of maintaining taxes, even if it means reducing some discretionary tax-funded services. There was a relatively equal split between “increase taxes to an extent that maintains tax-funded services” and “decrease taxes by reducing discretionary tax-funded services” at 22% and 26%, respectively.

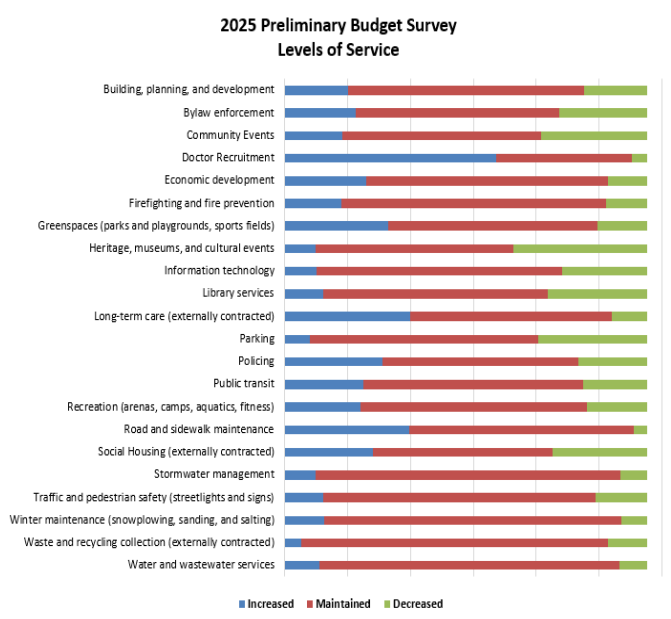

Service Levels

Respondents were provided with specific service types and asked to provide feedback on the current level of service. Overall, it appears most would like to see services maintained at existing levels. There were three services, Doctor Recruitment (58%), Long-Term Care (34%), and Road and Sidewalk Maintenance (34%) that received considerable support for increased levels of service.

User Fees

Participants were asked whether they would be in favor of user fees increases, and if so, which specific fees they would support increases to. While over 17% of the responses did not support increases to any of the user fees, respondents were supportive of increasing most fees, with the exception of Bag Tags. Apart from Bag Tags and Transit Fares, which received just slightly less support, potential increases to other user fees, including Dog Tags, Pools, Sports Fields and Recreation Programs, were supported by over 45% of respondents. Arenas and Museum

Services were the most supported areas, receiving support from over 55% of respondents.

Key Performance Indicators (KPI)

With the development and inclusion of departmental plans as part of the annual operating budget process, respondents were asked to provide feedback on which KPIs were most relevant and beneficial for tracking performance. Efficiency and Community Impact were identified as the top

two KPIs, with a desired focus on Finance.

2025 Operating Budget Guidelines

The draft recommended 2025 Operating Budget Guidelines are as follows:

- That the 2025 Draft Operating Budget be presented with overall residential property tax rate increases not to exceed 5%, excluding any tax rate increases generated from the 2024 Fire Master Plan phase-in approved by Council;

- That the 2025 Draft Operating Budget consider the service areas prioritized through public input received;

- That City Department operating issues presented in the 2025 Draft Operating Budget align with the strategic themes and initiatives outlined in the City’s Strategic Plan and Departmental Operating Plans, with priority given to those categorized as Legislative, Compliance, or Health & Safety and Maintenance of Service Levels, and where any Enhancement of Service Levels are proposed, that they align with public input received; and

- That the 2025 Draft Operating Budget incorporate a moderate increase in its tax-funded contributions to capital projects in alignment with the financial strategy outlined in the 2024 Asset Management Plan.

May 14, 2024 – Survey #1 – 2025 Preliminary Capital & Operating Budget

The survey was available for roughly three weeks from May 14th to June 5th with a total of 781 responses received.

Purpose: engage stakeholders in the early stages of the budget process and allow them to provide their feedback on operational and capital spending priorities, as well as the overall approach to budget development. The results of the survey will be presented to the Finance Committee and Council to assist with the development of guidelines for budget preparation later this year.

Residents can provide feedback on spending priorities and the overall approach to budget development. The results of the survey will be used to develop guidelines for budget preparation.

1. Do you live and/or own a business in Belleville?

- I am a homeowner

- I am a business owner

- I am a tenant

- One or more of the above

- None of the above (please specify)

2. What is your tax billing area?

- Belleville Urban

- Belleville Rural

- Cannifton Urban

- Cannifton Rural

3. How old are you?

- 18-24

- 25-34

- 35-44

- 45-54

- 55-64

- 65+

- Prefer not to answer

4. What is your annual gross household income?

- Less than $50,000

- $50,000 to $100,000

- $100,000 to $150,000

- $150,000 to $250,000

- $250,000+

- Prefer not to answer

5. How familiar are you with how the City develops the annual Capital and Operating Budgets?

- Very familiar

- Somewhat familiar

- Not at all familiar

6. Due to the increased cost of maintaining service levels and supporting infrastructure, the City must balance property taxes with increasing demand for services. The City has a number of options when balancing the budget. Please indicate which of the following statements comes close to capturing your point of view:

- Increase taxes to an extent that maintains tax-funded services.

- Maintain taxes, even if it means reducing some discretionary tax-funded services.

- Decrease taxes by reducing discretionary tax-funded services.

- Increase taxes to expand and/or enhance tax-funded services.

7. For each of services listed below that are directly or indirectly provided by the City, please indicate whether the level of service should be increased, maintained, or decreased.

- Building, planning, and development

- Bylaw enforcement

- Community Events

- Doctor Recruitment

- Economic development

- Firefighting and fire prevention

- Greenspaces (parks and playgrounds, sports fields)

- Heritage, museums, and cultural events

- Information technology

- Library services

- Long-term care (externally contracted)

- Parking

- Policing

- Public transit

- Recreation (arenas, camps, aquatics, fitness)

- Road and sidewalk maintenance

- Social Housing (externally contracted)

- Stormwater management

- Traffic and pedestrian safety (streetlights and signs)

- Winter maintenance (snowplowing, sanding, and salting)

- Waste and recycling collection (externally contracted)

- Water and wastewater services

8. The following services are partially funded user fees.

Please identify which service(s) you would support an increase in user fees to reduce reliance on property taxes (select all that apply)

- Arenas

- Museum & Culture Services

- Recreation Programs

- Pools

- Sports Fields

- Transit (only applicable to Belleville Urban tax billing area)

- Garbage Bag Tags

- Dog Tags/Licenses/Permits

- None of the above

9. The City prepares Annual Departmental Plans each year in conjunction with the Operating budget process.

This document provides a comprehensive overview of past accomplishments, strategic objectives, operational goals, key initiatives, and budget projections for the upcoming year: City of Belleville 2024 Departmental Plans.

For the development of the 2025 Departmental Plans, staff and Council will be developing key performance indicators to be included in these plans.

Please select the types of performance metrics and departmental areas you believe are most relevant and beneficial for tracking performance. (select all that apply)

- Finance

- Fire Services

- Corporate Services

- Human Resources

- Engineering & Development Services

- Transportation & Operations Services

- Community Services

- Environmental Services

- Information Technology

- Economic Development

- Efficiency – expresses the resources used in relation to the number of units of service provided or delivered. Typically, this is expressed in terms of cost per unit of service.

- Customer services – expresses the quality of service delivered relative to service standards or the customer’s needs and expectations.

- Community impact – expresses the outcome, impact, or benefit that the City program has on the community in relation to the intended purpose or societal outcomes expected.

- Activity level – provides an indication of service/activity levels by the number of resources or the volumes of service delivered to ratepayers. Results are often expressed on a common basis, such as, the number of units of service provided per capita.

- Other (please specify)

10. The Capital Budget is the City’s plan for making large investments in infrastructure. Capital expenses include major maintenance to public buildings, construction or purchase of new buildings, purchase of major equipment, significant road resurfacing projects, water and wastewater infrastructure, and more.

In your opinion, how would you rank the following areas of the City’s capital investment?

- Adding to or expanding existing infrastructure to enhance levels of service (e.g., adding a new recreation facility or splash pad to serve existing ratepayers)

- Renewing assets that support existing levels of service (e.g., rehabilitating or reconstructing a road).

- Improving the responsiveness of City services (e.g., improving response time of ratepayer complaints regarding infrastructure).

- Facilitating residential and non-residential growth (e.g., acquiring a new snowplow to service new subdivisions that would generate tax revenue).

- Investing in other key priorities as outlined in the City’s Strategic Plan (e.g., reducing climate change impacts).

11. In accordance with the Asset Management Plan, the City must prioritize Capital projects to develop its 10-year capital plan. In your opinion, select the most important infrastructure areas.

- Transportation (e.g., roads, streetlights, bridges)

- Water (e.g., treatment plant, water pipes)

- Wastewater (e.g., treatment plant, wastewater pipes)

- Stormwater (e.g., culverts, stormwater manholes)

- City Facilities (e.g., community & recreation centres, City Hall)

- Parks (e.g., playgrounds)Fire (e.g., firetrucks, fire stations)

- Police (e.g., patrol vehicles, police station)

- Fleet & Equipment (e.g., snowplows, lawnmowers)

- Information Technology (e.g., servers, computer equipment)

- Library (i.e., facility, books)Parking (i.e., parking lots, meters)

12. Would you like to sign up to receive ongoing updates on the City’s budget?

- Yes

- No

Leave a comment

All comments are reviewed prior to appearing on the site.

Rules: