Political advertisements purchased by third parties during elections are allowed in federal (search federal advertisers), provincial (search Ontario advertisers or see their financial statements) and municipal elections in Ontario.

What is a third party advertiser?

A third party advertiser is an individual, corporation or group that wants to influence an election by persuading or swaying voters to vote a certain way by supporting or opposing a candidate, or “yes” or “no” ballot question.

What entities are allowed?

In municipal elections in Ontario they can be:

- Individuals normally resident in Ontario, including family members or campaign staff of candidates

- Corporations that do business in Ontario

- Trade unions that hold bargaining rights for employees in Ontario

What entities are not allowed?

They cannot be:

- Municipal candidates

- Federal political parties, associations or registered candidates

- Provincial political parties, associations or registered candidates

- The Crown (Canada or Ontario), a municipality or local boards (school board, public library, police services, etc.)

- Groups, associations (professional associations, clubs, neighbourhood groups, non-profits) or non-corporate businesses. The members of these groups may make individual contributions from their personal funds, as long as they are residents of Ontario.

Section 88.6 of the Municipal Elections Act requires all advertisers to register with the Municipal Clerk to be a registered third party for an election.

What is a third party advertisement?

A third party advertisement is an ad or other material that promotes, supports or opposes a candidate, or a “yes” or “no” answer to a question on the ballot. This includes ads on social media, radio and TV as well as brochures, signs and flyers, among others.

Each ad must contain the:

- Name of the registered third party.

- Municipality where the registered third party is registered.

- Telephone number, mailing address or email address of the third party.

Third party advertising must be done independently and without direction from any candidate.

What is not a third party advertisement?

The rules do not apply to the following forms of advertising or promotion by third parties:

Advertising about an issue. For example, signs saying “Support local businesses” or “Keep the waterfront green” do not count as third party ads, even if a candidate has made those issues part of their campaign.

Non-paid advertising. For example, speaking to friends and neighbours, posting on social media or sending emails to a mailing list.

Internal communications. For example an email from an employer to their employees, a report from a corporation to its shareholders, or a memo from a trade union to its members.

Candidate’s ad campaigns. Candidates can hold their own election ad campaigns, following rules including identifying that they are responsible for the ad.

How to find who donated to a third party advertiser?

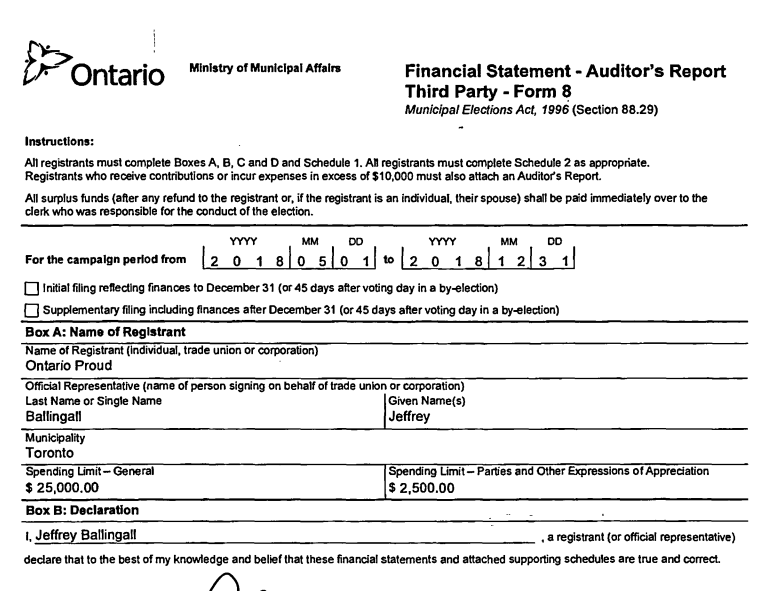

After an election, you can find out who bought political ads about a topic or individual during the election period by searching the municipality’s website for: “Financial Statement – Auditor’s Report Third Party – Form 8“. You can also contact your Municipal Clerk, who handles the registration of third parties to get a copy of the statement.

These statements are publicly available records that disclose the:

- Name of the individual, trade union or corporation acting as a third party advertiser

- Name of their official representative and a list of the names and addresses of individuals who contributed to them

- Income (contributions) amounts and sources

- Expenses (spending) amounts and categories

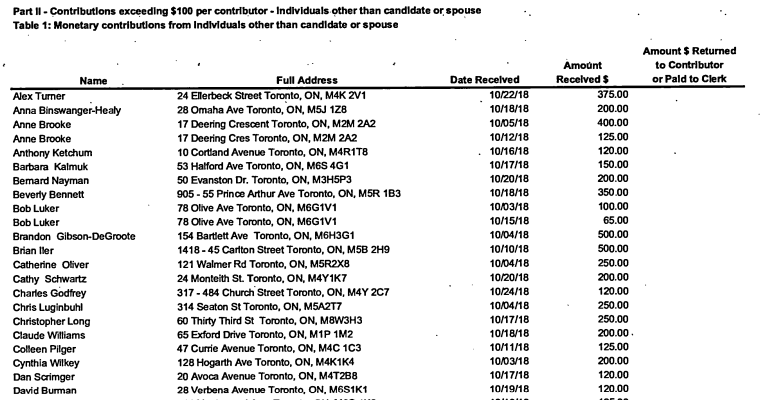

- Names and addresses of all individuals who contributed $100 or more to the third party advertiser, as well as the date of the contribution and amount given.

Third party advertisers are required to track the names and addresses of every contributor who gives more than $100 total to the advertising campaign in their financial statement. For example, an individual who makes a monetary contribution of $60 and a later purchases of a $50 ticket to a fundraiser dinner would be identified as their total contribution is greater than $100 ($110).

Contributions totaling less than $100 do not have to be identified and are recorded as a lump sum, but anonymous contributions over $25 cannot be kept and must be turned over to the clerk.

Here is an example financial statement for Ontario Proud:

And here is an example list of contributors to another organization (NOT Ontario Proud):

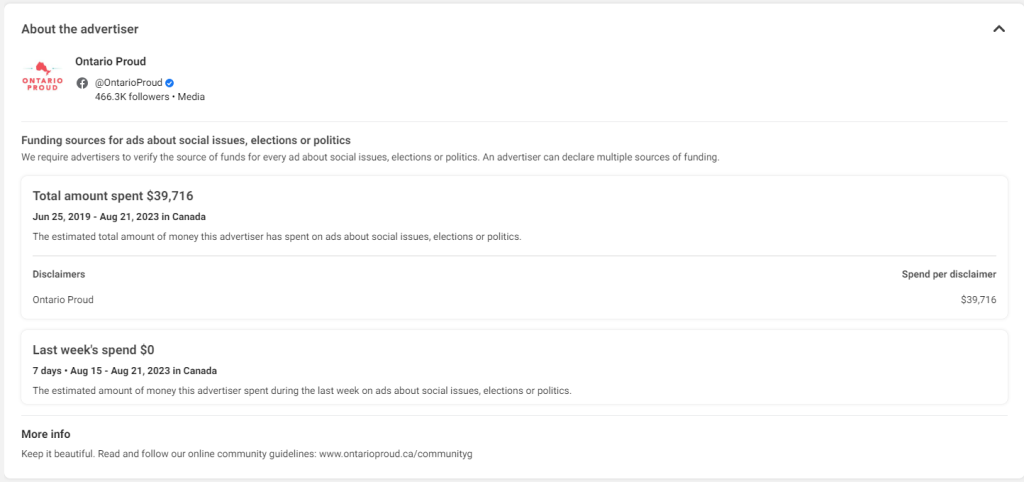

Once you know the names of the advertisers, you can look them up to the see their Facebook ads and their Google Ads.

Here is an example of an ad by registered advertiser “Ontario Proud”:

See their other Facebook ads here.

Why is tracking third party advertisements important?

These statements allow you to “follow the money” and find who is responsible for the third party advertiser, who are their donors and how are their ads trying to sway public opinion and influence the election, allowing you analyze their intentions.

The Strong Mayors Act, 2022 transferred a wide range of powers from municipal councils to the mayors alone, concentrating power to the head of council with the stated purpose of building 1.5 million new homes over the next 10 years. It initially applied to Toronto and Ottawa, but was expanded to 26 municipalities including Ajax, Kingston, Markham and Hamilton in June 2023.

Expanded powers include:

- Veto by-laws that are approved by council and which may interfere with matters of “provincial priority” (the “Veto Power”).

- Greater control over executive hiring

- Appoint chairs and vice-chairs for certain committees and local boards, create new committees, as well as assign certain functions to committees;

- Propose and adopt the municipal budget

These significant changes give corporations and individuals with interests at the municipal level greater incentives to participate in the electoral process – particularly in determining who the mayor is.

Who can contribute to a third party advertiser?

A third party advertiser can accept contributions from:

- any person who is a resident of Ontario

- corporations carrying on business in Ontario

- trade unions that hold bargaining rights for employees in Ontario

If the registered third party advertiser is an individual, and their spouse is not normally resident in Ontario, the spouse can still make contributions to the third party’s advertising campaign. They may not make contributions to any other registered third party advertiser, or to any candidates.

Groups such as clubs, associations or ratepayer’s groups are not eligible to make contributions. The members of these groups may make individual contributions from their personal funds, as long as they are residents of Ontario.

What is the contribution limit?

A contributor shall not make contributions exceeding a total of $1,200 to a registered third party in relation to third party advertisements that appear during an election in a municipality.

A contributor shall not make contributions exceeding a total of $5,000 to two or more registered third parties registered in the same municipality in relation to third party advertisements.

Section 88.13 of the Municipal Elections Act

In Ontario, each entity can contribute up to a total of $1,200 to a third party advertiser, and no more than $5,000 to all third party advertisers registered in the same municipality in a given municipal election. This amount includes the value of any goods or services donated.

There is no limit on how much a registered third party advertiser (and, if the third party advertiser is an individual, their spouse) can contribute to their own advertising campaign and they are allowed to take out a loan from a bank or other recognized lending institution in Ontario, to be paid directly into the campaign account.

Who cannot contribute to a third party advertiser?

The following are not allowed to make contributions to third party advertising campaigns:

- a federal political party, constituency association, or a registered candidate in a federal election

- a provincial political party, constituency association, or a registered candidate or leadership contestant

- a federal or provincial government, a municipality or a school board.

What is a third party advertiser’s spending limit?

The formula to calculate the spending limit for a third party advertiser’s campaign in a municipal election is $5,000 plus $0.05 per eligible elector (individuals eligible to vote), to a maximum of $25,000. For example, an advertiser in a municipality with 100,000 electors would have a spending limit of $10,000.

The municipal clerk provides the spending limit based on the number of electors on the voters’ list for the current election.

Are contributions to third party advertisers tax deductible?

Contribution receipts are not tax receipts. Contributions to third party advertising campaigns cannot be credited against provincial or federal income taxes and are not eligible for reimbursement under Contribution Rebate Programs.

What happens to excess contributions?

Candidates and third party advertisers are not permitted to return unused contributions to contributors.

If the advertising campaign ends with a surplus, the third party advertiser can withdraw the value of contributions that they made to their own campaign. If the third party advertiser is an individual, they can also withdraw the value of contributions made by their spouse. If there is still a surplus once these contributions have been withdrawn, it must be turned over to the clerk.

A third party advertiser cannot refund any other unused contributions.

How to report a third party advertiser?

If an eligible voter believes that a third party advertiser has violated the Municipal Elections Act, they may apply for a compliance audit of the candidate’s election campaign finances by sending a written request to the municipal clerk outlining the reasons that they believe the advertiser did not follow the rules (Section 88.33) within 90 days of the deadline to file the advertising campaign financial statement.

The potential penalties are:

- Individuals: Fine of up to $25,000, up to 6 months in prison and lose their ability to vote, run or be a third party advertiser in the next regular election

- Corporations: Fine of up to $50,000 and lose their third party advertiser status for the next regular election

Comments

We want to hear from you! Share your opinions below and remember to keep it respectful. Please read our Community Guidelines before participating.