A municipality may, by by-law, provide for the payment of rebates to individuals who made contributions to candidates for office on the municipal council.

Section 88.11 of the Municipal Elections Act

What is a contribution rebate program?

Unlike contributions to federal and provincial candidates’ election campaigns, contributions to Ontario municipal election candidates are not eligible for federal or provincial income tax credits.

A contribution rebate program reimburses a portion of the total value of all donations an individual makes to candidates’ election campaigns in the form of a rebate. It is an optional municipal program in Ontario that can act as a stand-in for the lack of tax credits. In general, candidates must opt-in to rebate programs in order for their contributors to receive the rebates.

In general, to be eligible for a rebate contributions must be:

- Compliant with the Municipal Elections Act

- Monetary (not goods and services)

- Made by a method that clearly shows where the funds came from (not cash).

- Received during the candidate’s campaign period

- Not from the candidate, their spouse, or their relatives (siblings, grandparents, parents, children and grandchildren)

- Not from a corporation or any person not permitted to make contributions to candidates

Rebates are issued after the compliant audit period for financial statements has ended (90 days after the candidate’s financial filing deadline), and some municipalities state it can take up to 120 days.

Some such programs have been around for a while – Oakville’s was first used in the 2003 Municipal Election.

What are the benefits of a contribution rebate program?

According to Oakville’s 2021 report on the program, the program has the following goals:

- to enhance the election process and encourage more candidate participation;

- to increase the proportion of candidate contributions sourced from individual electors compared to corporations and other organizations; and

- to create more interest in municipal elections, resulting in higher voter turnout.

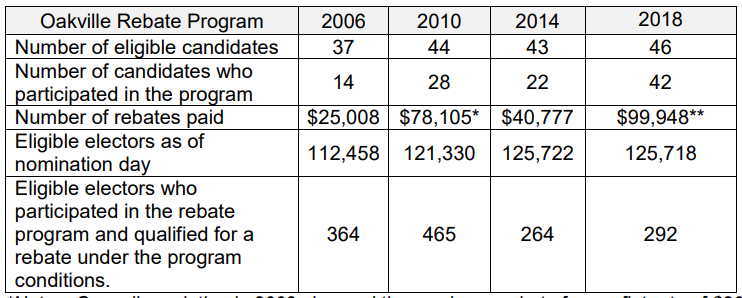

And here is how it has been used in Oakville:

What municipalities have a contribution rebate program in Ontario?

The following municipalities have a program in Ontario:

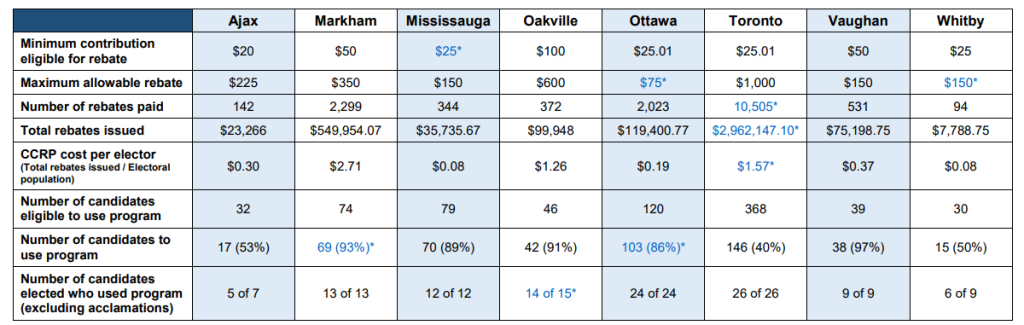

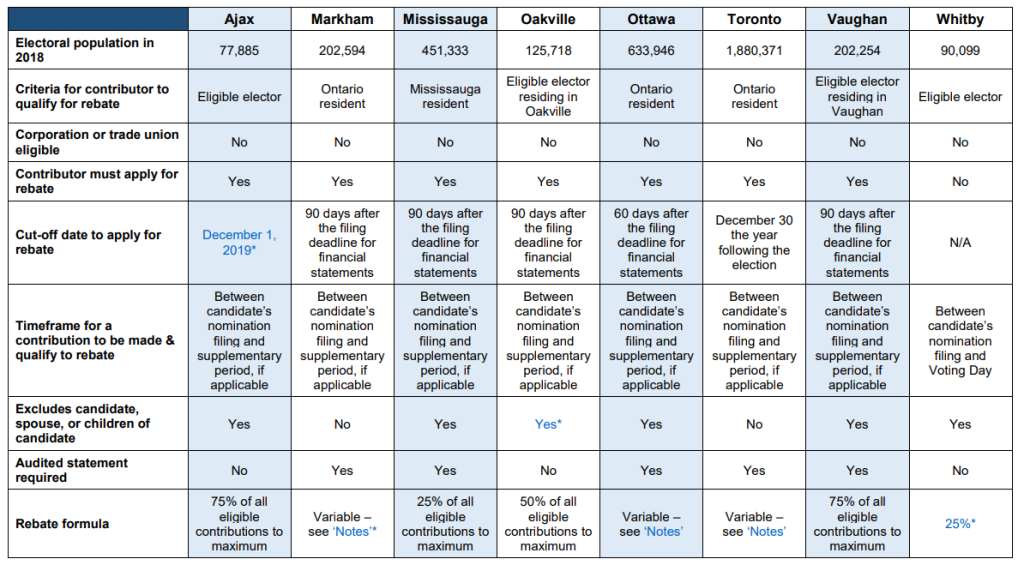

| Municipality | Eligibility | Rebate amount |

|---|---|---|

| Toronto | Individuals who normally reside in Ontario | Min: $25 75% for $25 to $300 50% for $300 to $1,000 33.33% of >$1,000 Max rebate: $1,000 |

| Vaughan | Eligible voter in Vaughan Resident of the city of Vaughan Not the candidate, or the spouse or relative of the candidate, including siblings, grandparents, parents, children and grandchildren | Min: $50 75% of contributions Max rebate: $150 |

| Markham | Eligible voter in Markham Permanent resident living in Markham | $50 minimum 75% of contributions Max rebate: $150 |

| Whitby | Eligible voter in Whitby | Min: $25 75% of first $100 25% of >$100.01 Max rebate: $200 |

| Mississauga | Eligible voter in Mississauga | $100 minimum 75% of first $300 50% of $300 to $1,000 33.33% of >$1,000 Max rebate: $1,500 |

| Oakville | Eligible voter Residing in Oakville | $100 minimum 50% Max rebate: $600 |

| Ottawa | Individuals who normally reside in Ontario | Min: $25.01 50% for $25 to $100 25% for >$100 Max rebate: $75 75% up to a maximum of $900.00 for candidates who withdraw |

What if my municipality doesn’t have a contribution rebate program?

- Contact your Members of Council and ask them to support a contribution rebate program.

Comments

We want to hear from you! Share your opinions below and remember to keep it respectful. Please read our Community Guidelines before participating.